by Thomas M. Riddle, CPA, CFP®, Founder & Chairman of the Board

CLICK HERE TO GET TO KNOW TOM

The next three decades hold extraordinary promise. Breakthroughs in robotics, healthcare & biomedical, 3D print manufacturing, artificial intelligence, and many other fields collectively hold the potential to spectacularly raise U.S. living standards. But, and there is a “but” unfortunately, the U.S. faces a significant obstacle to achieving this promise. That obstacle is high and quickly escalating U.S. debt levels and the annual interest payments on it.

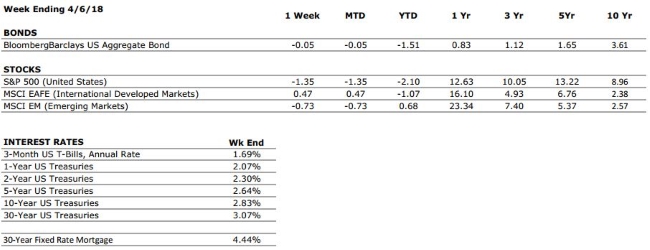

Within 5 years the U.S. may enter a vicious spiral when debt is growing, interest payments are growing even faster and Treasury debt holders start to doubt our government’s ability to repay. At such a time interest rates could rise to compensate Treasury debt investors for taking the risk. Higher interest costs will be financed by even more debt – and the spiral continues.

When the spiral starts, Washington will face difficult choices to attempt to fix the problem: cut expenses (including Entitlements) or raise taxes. Based upon my 45 years of work experience, including 3 years with the U.S. Treasury Department, I believe it is highly likely Washington will raise taxes. The tax increase will have to be substantial to stop the spiral.

What will result when the U.S. dramatically raises taxes? Wealth, and the breakthroughs funded by it, may move to other countries with lower tax burden. You do not have to too look far to find examples of this phenomena on a local level. What caused the many corporate high rises in Conshohocken and City Line Avenue to be built instead of the highly taxed Philadelphia? Same for the incredible number of commercial buildings in Northampton and Lehigh counties instead of the higher taxed state of New Jersey. Or, southern Wisconsin instead of Illinois/Chicago. Or, Nevada instead of California. The bottom line is the debt spiral will probably continue.

In the near future we will report on the signs to look for when investors lose confidence in a country’s ability to repay its debts – history is full of examples.

We are hiring Associates through our Entry Level Professional (ELP) Program.

We are hiring Associates through our Entry Level Professional (ELP) Program.