by Connor Darrell, Head of Investments

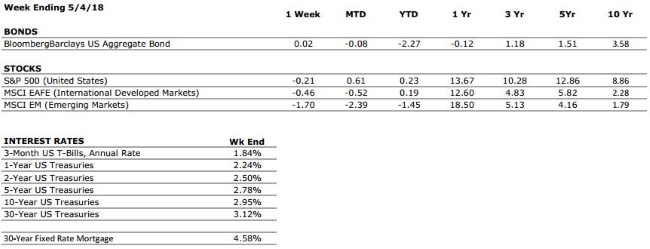

Both stock and bond markets trended downward last week, until Friday’s jobs report sparked a stock market rally. The Department of Labor reported that employers added 164,000 new jobs in April, and that the unemployment rate currently stands at 3.9%. This was the first unemployment reading below 4% since 2000.

Additionally, there are more than six million unfilled job openings throughout the economy; close to an all-time record. However, despite the continued imbalance in the supply and demand for labor, wage growth has remained slightly below expectations. Wage growth is one of the last pieces of the puzzle, and because of its potential connection to inflation, will be watched closely by the Fed as it steadies its march toward normalization.

A Wacky Earnings Season

Active traders often try to take advantage of earnings calls as an opportunity to buy or sell a stock ahead of its earnings report. It’s a risky proposition, and one that we do not recommend in the current environment. Per Factset, 81% of S&P 500 companies have reported Q1 earnings in excess of consensus estimates, and overall earnings growth has been over 24%; the highest rate in seven and a half years. Even so, we have witnessed dozens of companies report earnings beats, only to sell off meaningfully during the following trading session. It seems the market has lofty expectations for further growth, and companies that do not raise their forward guidance to meet those expectations are being punished. As we continue to progress deeper into the economic cycle, the heavy emphasis on forward guidance rather than past results is likely to persist.

According to research from Wells Fargo, earnings growth for Q1 would be closer to 7% in the absence of tax reform, and once we reach 2019, year-over-year comparisons will not benefit from the tax reform boost. Add this reality to the confluence of risks that the market has begun to acknowledge rather than ignore, and it becomes a little bit easier to understand why markets aren’t quite ready to break out the champagne to celebrate a successful earnings season.

As the market continues to trend sideways with higher levels of volatility, asset allocation and diversification become even more important. Periods like these are the reason we diversify in the first place.