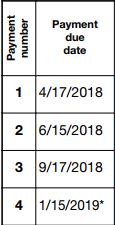

CLIENT REMINDER: Quarterly estimated tax payments are due on June 15, 2018.

CLIENT REMINDER: Quarterly estimated tax payments are due on June 15, 2018.

You can write a check or use a secure service provided by the IRS to pay electronically, called IRS Direct Pay. Please note: You will need information from previous tax returns in order to use the IRS Direct Pay service. We suggest you have a copy of your 2012 through 2016 tax returns accessible for verification purposes.

If you mail your estimated tax payment and the date of the U.S. postmark is on or before the due date, the IRS will generally consider the payment to be on time. If you use IRS Direct Pay, you can make payments up to 8 p.m. Eastern time on the due date. If you use a credit or a debit card, you can make payments up to midnight on the due date.

If you have questions or need another copy of your voucher(s), please contact our office.