In observance of the Labor Day holiday, our offices will be closed on Monday, September 4. The remainder of the week will operate at normal business hours. All of us at Valley National wish you a safe and enjoyable weekend.

In observance of the Labor Day holiday, our offices will be closed on Monday, September 4. The remainder of the week will operate at normal business hours. All of us at Valley National wish you a safe and enjoyable weekend.

Monthly Archives: August 2018

What We’re Reading

A collection of links to articles and ideas our VNFA staff found interesting and informative recently.

Good News and Bad News on Retirement Savings (ThinkAdvisor.com)

75 Must-Know Statistics About Long-Term Care: 2018 Edition (Morningstar.com)

Visualizing the Longest Bull Markets of the Modern Era (VisualCapitalist.com)

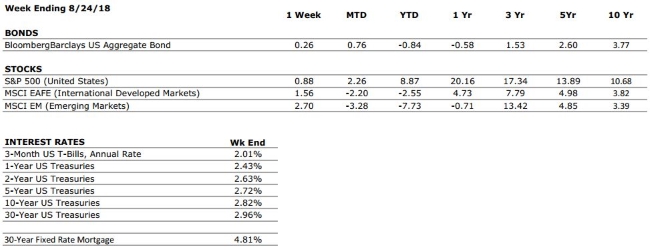

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer spending is expected to remain healthy as individuals with lower tax rates spend their windfalls. |

|

FED POLICIES |

C- |

The Federal Reserve held pat following its most recent meeting, but it remains probable that two more rate hikes will be implemented before year-end. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

A |

Factset is reporting a blended earnings growth rate of 24.6% YoY for the 2nd quarter of 2018. Tax reform has played a major role, but the strength of the US consumer is boosting corporate profits as well. |

|

EMPLOYMENT |

A+ |

The US economy added 157,000 new jobs in July, and the unemployment rate dropped back below 4%. The job market remains very healthy. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

Tax returns that were extended for partnership and S-Corps are due on September 15 and for individuals on October 15.

The first income tax in America was created in 1861 during the Civil War as a mechanism to finance the war effort. It was repealed 10 years later. In 1913, Wyoming ratified the 16th Amendment, providing the three-quarter majority of states necessary to amend the Constitution. The 16th Amendment gave Congress the authority to enact an income tax. In 1914 The Bureau of Internal Revenue (know as the IRS today) released the first Form 1040.

Valley National Services was incorporated on October 27, 1988 – 30 years ago – adding to the one-stop suite of services you know today as Valley National Financial Advisors.

Quote of the Week

“The difference between school and life? In school, you’re taught a lesson and then given a test. In life, you’re given a test that teaches you a lesson.” – Tom Bodett

The Markets This Week

by Connor Darrell, Head of Investments

The stock market continued to brush off the ever-growing list of political headlines on its way to another positive week. The S&P 500 climbed 0.88%, while international stocks bounced back from a turbulent month, posting strong gains as well. Last week also brought further flattening of the yield curve, with the yield on the 30-Year Treasury dropping below 3%.

On Wednesday 8/22, the current bull market officially became the longest on record, which prompted a litany of columns and conversations dedicated to trying to hypothesize when it will finally come to an end. However, the age of a bull market really has no predictive value in determining whether or not it can endure, and we continue to instruct clients to focus on the core foundations of the economy (including the “heat map”), which continue to suggest that a general aura of optimism is justified.

It Still Makes Sense to be Globally Diversified

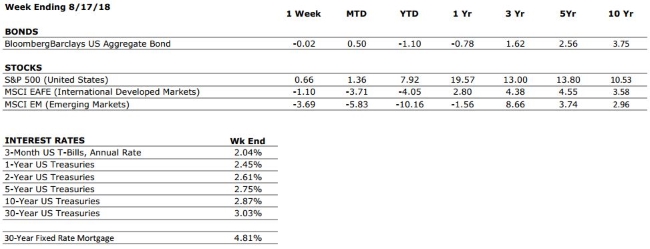

It is no secret that international equities have underperformed their U.S. counterparts in 2018, and the volatility has caused some investors to question the merits of holding a globally diversified equity portfolio. While much of the uncertainty has been due to a weakening macro backdrop in Europe (as well as the currency crisis in Turkey), it should be noted that sector concentrations have also played a part.  The S&P 500 has been bolstered by the performance of fast growing technology stocks, which have outperformed by a substantial margin in comparison to the overall market. The MSCI EAFE (a commonly followed benchmark of international stocks) on the other hand, has not benefitted from the same tailwinds due to its different sector/industry weightings (see chart right).

The S&P 500 has been bolstered by the performance of fast growing technology stocks, which have outperformed by a substantial margin in comparison to the overall market. The MSCI EAFE (a commonly followed benchmark of international stocks) on the other hand, has not benefitted from the same tailwinds due to its different sector/industry weightings (see chart right).

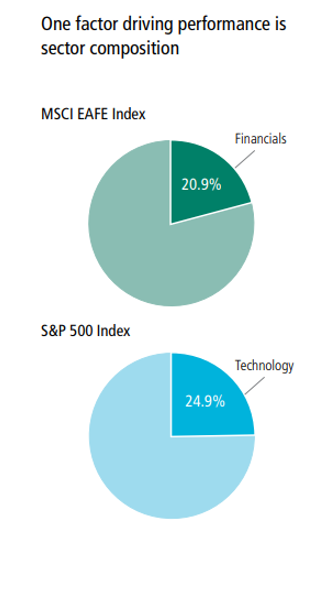

As this has played out over the past several years, the valuation “gap” between U.S. and international equities has expanded to its widest margin in more than 15 years (see chart below).

Valuations are a notoriously ineffective market timing mechanism but have been historically very helpful in predicting long-term variations in relative performance across markets. It will be interesting to watch this dynamic moving forward, as the U.S. inches closer and closer to the theoretical “inflection point”, where monetary policy tightens enough to become a meaningful headwind to market expansion. Internationally, Central Banks are significantly behind in their tightening cycles, and are only just beginning to contemplate adjusting the “easy money” policies of the last decade.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®. This week Laurie will discuss: “Finding Money,” unclaimed property, missed tax credits, discounts and other ways people can overlook money.

Laurie will take your calls on this or other topics at 610-758-8810 during the live show, or via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer spending is expected to remain healthy as individuals with lower tax rates spend their windfalls. |

|

FED POLICIES |

C- |

The Federal Reserve held pat following its most recent meeting, but it remains probable that two more rate hikes will be implemented before year-end. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

A |

Factset is reporting a blended earnings growth rate of 24.6% YoY for the 2nd quarter of 2018. Tax reform has played a major role, but the strength of the US consumer is boosting corporate profits as well. |

|

EMPLOYMENT |

A+ |

The US economy added 157,000 new jobs in July, and the unemployment rate dropped back below 4%. The job market remains very healthy. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

The Markets This Week

by Connor Darrell, Head of Investments

Despite a bumpy ride mid-week, U.S. stocks managed to push higher on the heels of a strong Thursday rally. Globally, markets remained jumpy amid a softening economic growth outlook and lingering concerns over instability in the Turkish financial system.

While foreign economies have struggled to gain momentum, the U.S. has been able to break the barrier and establish a more sustained period of economic strength. With two solid quarters of GDP growth behind us, many investors are looking for insights into whether that growth momentum can be carried further; and for how long. One potential window was opened last week with reports of strong retail sales growth (+0.5%), which was further demonstrated in Walmart’s quarterly earnings release. The country’s largest “brick and mortar” retailer posted its best sales growth in over a decade, suggesting that the U.S. consumer is still in a strong position to help keep the momentum going.

Strong Momentum Can Shift Expectations

While the strength of the U.S. economy should help to alleviate any concerns that the next recession will occur in the near future, it doesn’t preclude us from experiencing periods of market weakness in the meantime. We have discussed in the past that the global investment landscape looks quite a bit different now than it did a year or so ago, and that there are more risks that threaten to bubble up and cause disruption in markets. The currency crisis in Turkey is but one example of the types of obstacles markets may face as they continue to scrape higher.

But another potential “obstacle” is the shifting of investor expectations. Markets are naturally forward-looking instruments, in that the price of any given security is determined by the aggregate of investors’ expectations of its future growth opportunities. As companies continue to post strong profit numbers and investors keep hearing about how great the economy is, the natural result will be for them to raise their expectations of future performance. And it is at the point where expectations meet reality that markets can become a little unstable. Often, markets react more to relative changes than to whether something is “good” or “bad” on a standalone basis. In other words, the U.S. economy may remain “strong” but if it fails to keep pace with rising expectations, the market may not react as positively as might be expected. As the U.S. economy keeps humming along, investors may run the risk of setting their expectations too high and would be well advised to maintain a more balanced, pragmatic approach to portfolio construction.

Valley National News

We are so pleased to share that our team has been voted Best Financial Planner by the readers of Lehigh Valley Magazine for the seventh time – 2010, 2011, 2012, 2013, 2014, 2017, 2018!

We are so pleased to share that our team has been voted Best Financial Planner by the readers of Lehigh Valley Magazine for the seventh time – 2010, 2011, 2012, 2013, 2014, 2017, 2018!

Thank you for your continued confidence in our services and for letting others know about the value we bring to our clients and community.