We are pleased to announce that our Head of Invesments, Connor Darrell, has obtained his Chartered Financial Analyst® (CFA) designation, and has been promoted to Assistant Vice President.

We are pleased to announce that our Head of Invesments, Connor Darrell, has obtained his Chartered Financial Analyst® (CFA) designation, and has been promoted to Assistant Vice President.

The CFA is regarded by most to be the highest distinction for investment professionals, especially in the areas of research and portfolio management. The CFA program consists of three exams encompassing a “candidate body of knowledge” (CBOK) that the CFA Institute believes is necessary for those in the investment profession. In addition to passing these tests in succession, CFA candidates must accrue four years of professional experience.

“Obtaining the CFA designation is a huge investment in time – with candidates spending upward of 300 hours a year for a period of three to four years,” says Valley National’s CEO, Matthew Petrozelli. “Connor’s commitment to this intensive endeavor while continuing to excel in his full-time work for our team and our clients makes all of us extremely proud.”

Connor joined Valley National Financial Advisors in 2014 as an Associate through the firm’s Entry-Level Professional (ELP) program. He is originally from Cream Ridge, New Jersey, and moved to Bethlehem after he graduated from Gettysburg College with a degree in Economics.

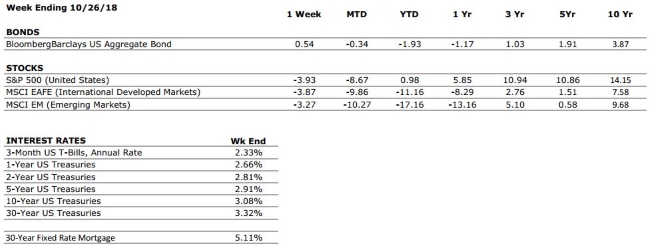

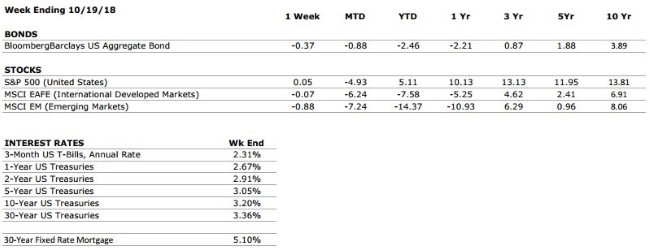

As Assistant Vice President, Head of Investments Connor will continue to provide investment analysis and assist VNFA’s advisory teams with portfolio strategy and asset allocation. in addition to contributing market analysis and insights to The Weekly Commentary e-mail newsletter.