As we usher in 2019, our team reflects on the people who matter so much to us – our clients. Without you, we would not have the pleasure of living our purpose to help others. We thank you for your continuing trust in us.

Daily Archives: January 1, 2019

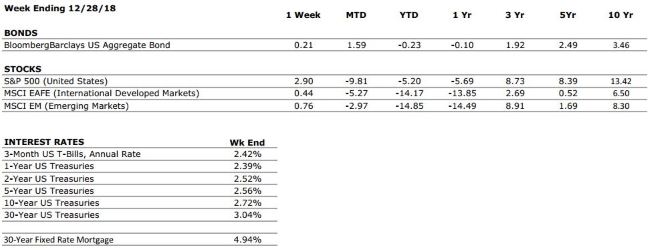

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer confidence is near all time highs with recent tax reform providing further support. The holiday shopping season was one of the strongest on record. |

|

FED POLICIES |

C- |

The Federal Reserve implemented its fourth interest rate hike of the year in December. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

B+ |

Corporate earnings remain strong, but we anticipate earnings growth will taper off in 2019. We are also beginning to see a higher number of companies reducing forward earnings guidance, a sign that earnings growth may have reached its peak in 2018. |

|

EMPLOYMENT |

A+ |

The US economy added 155,000 new jobs in November, which was below estimates. However, the unemployment rate remained at 3.7% and the data suggests that there have been more job openings available in the economy than there are unemployed workers to fill them for 6 consecutive months. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

FROM THE PROS… VIDEO

Matthew Petrozelli, CEO, reflects on the state of the markets moving into 2019. WATCH NOW

Did You Know…?

NJ Tax Amnesty Expires on January 15

For those taxpayers who have received a New Jersey Tax Amnesty notice, please be aware that the program ends January 15, 2019. The program offers a waiver of most penalties and reduced interest charges for those who have met the eligibility requirements. READ MORE at the State of New Jersey Department of Treasury website: nj.gov/treasury

Quote of the Week

“New Year – a new chapter, new verse, or just the same old story? Ultimately we write it. The choices is ours.” – Alex Morritt

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

It was another wild ride for investors despite the holiday-shortened week. Markets were sent tumbling throughout Monday’s abbreviated trading session after Treasury Secretary Steve Mnuchin released a curiously timed statement via Twitter, informing markets that he had spoken with executives from the nation’s six largest banks and had been assured that each were suffering from no liquidity issues. The statement was confounding to market participants as it seemed aimed at addressing a concern that had not been apparent to investors prior to its release.

After the holiday, markets seemed to conclude that this was nothing more than a poorly executed attempt by the White House to stabilize markets, and Wednesday’s trading session was one of the strongest in a decade. By the end of the week, U.S. equities managed to climb out of bear market territory to generate a gain of 2.90% (as measured by the S&P 500). Bonds have continued to play their traditional role as safe haven, generating positive returns as well.

Happy New Year from VNFA

Markets have been volatile in 2018, but as we have communicated previously, we do not believe that there is a need for drastic measures to be taken in portfolios at this time. CLICK HERE to access our recent market note (which summarizes our current thinking on markets).

We encourage investors to enjoy their New Year’s celebrations with friends and family and wish all TWC readers a happy and prosperous 2019!

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie will discuss Milestone ages – birth to 70 ½ and what that means.

Laurie will take your questions live on the air at 610-758-8810 or online through yourfinancialchoices.com. Recordings of past shows are also available to listen or download at both yourfinancialchoices.com and wdiy.org.