by Connor Darrell

CFA, Assistant Vice President – Head of Investments

Market’s

climbed higher for the third consecutive week as investors shrugged off the

lingering uncertainty related to the government shutdown, which has now

stretched to the longest in U.S. history. Many economists agree that the

shutdown will have an increasing impact on the economy over time, but the

impact so far has been negligible (though the hundreds of thousands of federal

workers who are no longer receiving paychecks would argue to the contrary). For

now, the gridlock in Washington remains more of a distraction than a material

concern for financial markets.

Bond yields ticked up slightly as the rotation to fixed income tapered off a bit due to the stabilization in equity markets. Minutes released from the Fed’s December meeting highlighted that recent modest inflation numbers and rising concern over downside risks in financial markets has given policymakers more flexibility to evaluate the current path of monetary tightening, suggesting that a pause in rate hikes may be upon us.

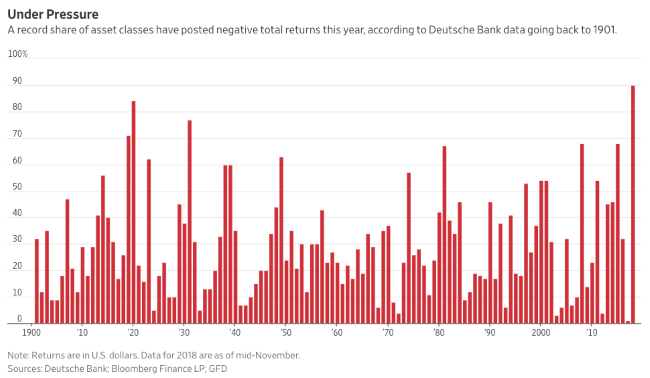

2017 & 2018: Unique in their Own Right

Towards the end of 2018, Deutsche Bank released a very interesting chart (see below) which showed the percentage of asset classes posting negative returns in each year since 1901. It will immediately jump out to readers that 2018 had the highest percentage of asset classes producing negative returns in more than 117 years. But perhaps less obvious in the chart is that 2017 had the lowest percentage. For many investors, the volatility in 2018 felt particularly jarring, and perhaps that is due at least in part to the fact that it represented such an extreme reversal from the 12 months prior. In any case, it is simply astounding that in a 118-year sample of returns history, the two most “extreme” years (as measured by the percentage of asset classes posting negative returns) happened back-to-back. Our takeaway is that the merits of diversification (of which there are many) have been less evident over the past two years because assets have tended to move in the same direction. We view this as somewhat of an anomaly, and caution investors from making significant portfolio adjustments based on experiences during two “outlier” years.