by Connor Darrell CFA, Assistant Vice President – Head of Investments

Global equity markets weakened a bit last week, posting mixed results after news reports suggested that U.S. and Chinese leaders are unlikely to meet before the “trade truce” expires on March 1. Sentiment across markets has remained far more positive than it was at the latter end of 2018, with credit spreads declining to their lowest level since November. Government bonds also fared well as yields continued to decline. The yield on the 10-Year Treasury Note dropped to close the week at 2.63%, down from its high of 3.24% back in November.

How Bond Investing Has Changed Since the Financial Crisis

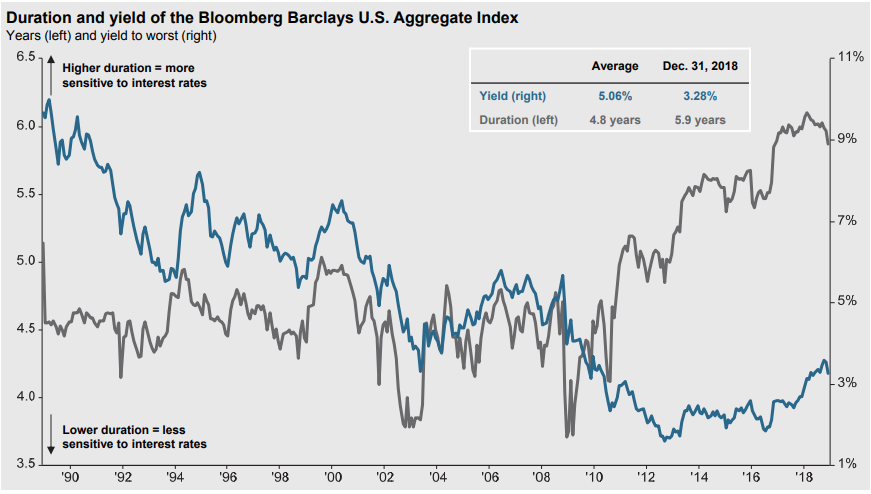

In the world of finance, everything is interconnected, and sometimes it can be incredibly enlightening to take a look at how a change in one area of the economy can have long lasting impacts on global financial markets. The post financial crisis monetary policy environment (marked by artificially low interest rates and high liquidity) has influenced nearly every corner of the economy and the investing world. One major byproduct has been a significant shift in the composition of major bond indices, particularly the Bloomberg Barclays U.S. Aggregate. Over the past 11 years, the yield offered by the average bond in the index has unsurprisingly come down, but the average maturity has also grown longer. Those longer maturities have increased the duration of the index, which is a measure used by bond investors to evaluate how sensitive an investment is to changes in interest rates (see chart provided by JP Morgan Asset Management).

To understand what has transpired, we need to assess the decision making of bond issuers. Low interest rates mean low borrowing costs for corporations, and that provides an incentive for businesses to seek longer term financing (in order to lock in lower rates for a longer period of time). This has changed the mix of securities that make up the index, leading to a higher proportion of longer-term bonds. Passive bond investors should be aware of the changes in the composition of the underlying index being tracked, as the risk/reward outlook for the Bloomberg Barclays Aggregate has become less attractive (lower yields and higher rate sensitivity). In the context of the active vs. passive debate, the proponents of active management may have the strongest argument when it comes to fixed income, where an active manager may be able to manage the tradeoff between yield and duration more effectively.