by Connor Darrell CFA, Assistant

Vice President – Head of Investments

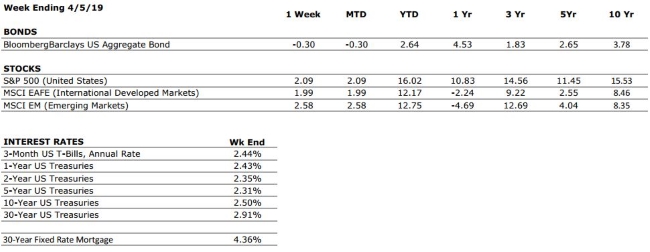

Global

equity markets inched higher in the holiday shortened week (markets were closed

on Friday in observance of Good Friday) amid a slew of economic data that

surprised to the upside. March retail sales figures came in stronger than

expected and showed a strong bounce back from a weaker than expected February. Additionally,

jobless claims fell to their lowest level since 1969. Bond yields crept higher throughout the week,

with the 10-Year Treasury yield touching its highest level in over a

month. The move was likely fueled in

part by the positive economic data triggering some optimism for economic

growth.

As of the end of the week, about 15% of S&P 500 companies had reported Q1 earnings results, with 78% of them reporting positive EPS surprise. Even so, according to data collected by Factset, the blended earnings growth rate for those companies that have reported is -3.9%. The high incidence of positive surprise combined with the relatively uninspiring growth rate reflects how low expectations were coming into Q1 earnings season. We will continue watching as more companies report results and we get a fuller picture of corporate profitability during the beginning of 2019.

2019: The Year of the IPO

2019 is set up to be a particularly active year in the IPO (initial public offering) market. Before year’s end, disruptive companies like Uber, Airbnb, and WeWork are expected to join Lyft, Pinterest, and Zoom on the list of large tech firms making their public trading debuts this year (Pinterest and Zoom both debuted last week and Lyft completed its IPO back in March). Many investors have been clamoring to get into these trendy names, but others have been quick to point out that the flurry of activity may be a sign of overexuberance in markets. In any case, as with any investment, the general rule of thumb for investors interested in buying shares of a stock that recently debuted on an exchange is to do your research. The power of FOMO (fear of missing out) can be particularly fierce when it comes to high profile companies, especially as the financial news outlets are perpetuating stories of huge gains for early investors. But that’s just the thing, those huge gains that pundits like to talk about were available to only the earliest investors and have already been realized. Any new investment needs to be evaluated through the lens of the current price, as the price you pay for an investment is the single most important factor in determining success.