In observance of

the Independence Day holiday and related market closures, our offices will be

closed starting at 1 p.m. on Wednesday, July 3 through July 4. We will be open

and available Friday, July 5. All of us at Valley National Financial Advisors

wish you a safe and happy Fourth of July!

In observance of

the Independence Day holiday and related market closures, our offices will be

closed starting at 1 p.m. on Wednesday, July 3 through July 4. We will be open

and available Friday, July 5. All of us at Valley National Financial Advisors

wish you a safe and happy Fourth of July!

Daily Archives: July 2, 2019

Valley National News

VNFA Named to 2019 Financial Times 300 Top RIAs

Valley National Financial Advisors is pleased to announce it has been named to the 2019 edition of the Financial Times 300 Top Registered Investment Advisers. The list recognizes top independent RIA firms from across the U.S. READ MORE

Valley National Financial Advisors is pleased to announce it has been named to the 2019 edition of the Financial Times 300 Top Registered Investment Advisers. The list recognizes top independent RIA firms from across the U.S. READ MORE

FT 300 list: the top US registered investment advisers in 2019

Message from Our CEO

Matthew Petrozelli, CEO, discusses the 2019 FT Top 300 honor and what it means for our firm.

“Our team is so proud to be recognized nationally as a top firm in our industry,” says Matt Petrozelli, CEO. “In order to best serve our clients, we know that VNFA must continue to innovate and grow while maintaining our core values and mission to help our clients make the right financial choices. This ranking is a validation for us and our clients that we are achieving the standards to be considered among the best financial services firms in the nation.” WATCH NOW

Quarterly Commentary – Q2 2019

Equities:

Performance across individual companies and sectors was a bit choppy during the second quarter as investors wrestled with the shroud of uncertainty created by the tenuous trade relationship between the United States and China. Nevertheless, the U.S. equity market (as measured by the S&P 500) rode a strong June rally to new all-time highs, with optimism being fueled by rising confidence that central banks will provide the juice needed to stave off a global economic slowdown. That sentiment was felt worldwide, with international equities in both developed and emerging markets taking advantage of strong June rallies to end the quarter in positive territory.

At present, equity markets are painting a very positive picture of the future; one where central banks can continue to keep the current expansion on target even as it faces its stiffest competition yet in the form of slowing global trade, declining manufacturing activity, and rising geopolitical tensions. Whether that optimism will prove justified remains to be seen, but one only needs to go back to the 1990s to find an example where equity markets extended the rally for an additional five years after the final Fed rate hike.

Bonds:

With equity markets playing the role of Pollyanna, bonds are casting a far more pessimistic tone. Treasury rates continued their precipitous decline throughout the second quarter, with the yield on the 10-Year Note falling to its lowest level since 2017. The futures market is now pricing in more than 100 bps (1%) of rate cuts by the end of 2020. For reference, this would mean the complete reversal of four previous rate increases. Of course, when interest rates decline, bond prices rise, meaning that bonds joined equities in generating healthy returns for investors during the first half of the year.

Whether explicitly part of the policy agenda or not, the Federal Reserve has at the very least, shown that it is keenly aware of market expectations and sensitive to bouts of market volatility that may have been caused by its actions. There have been multiple examples over the past several months of Fed representatives providing what might be construed as strategically timed comments that seemed to help sooth markets during bouts of volatility. Thus, current market expectations may have wedged the Fed between a rock and a hard place, where it risks disappointing markets and tightening lending conditions if it keeps interest rates above what the market is calling for. While we continue to believe that the fundamentals of the economy remain strong enough that a recession is not on the near-term horizon, the Fed may ultimately conclude that with inflation still in check, a preventative “insurance cut” (as it has come to be referred to in financial circles) may be its best course of action for keeping the economic expansion on the path of least resistance.

Outlook:

With equities and bonds seemingly at odds with one another, there are some interesting and challenging implications for portfolio construction. In the current backdrop, the only way that both the stock and bond markets can be proven right is if the bond market has correctly predicted that the Fed’s concern over economic growth will push it into an aggressive mode of monetary easing (i.e. significant rate cuts), and that this monetary easing will be impactful enough to enable equities to charge onward. There is little in the last 10 years of economic history to suggest that this isn’t a plausible scenario (central bank intervention in the United States has been quite effective since the financial crisis), but the next several months will go a long way in helping us learn whether the bull can be tamed. At this point in time, we remain cautiously optimistic and continue to recommend a balanced, neutral approach to portfolio positioning.

VIDEO: Q2 2019 Market Commentary – Connor Darrell CFA, Head of Investments, shares Valley National Financial Advisors’ review of the second quarter, and an outlook into the second half of 2019. WATCH NOW

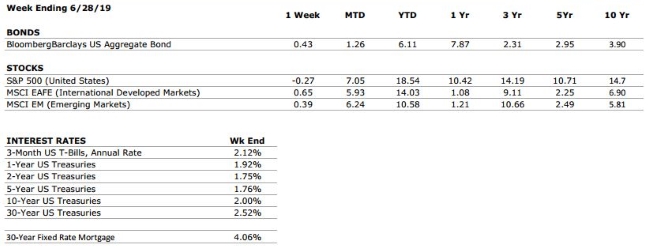

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A. Surveys of US consumers continue to indicate that the consumer is in a strong position. |

|

FED POLICIES |

B+ |

We have increased our Fed Policies grade to a B+ after Jerome Powell commented that “a number” of Fed decision makers believe that the case for a rate cut in the near future has strengthened. |

|

BUSINESS PROFITABILITY |

B- |

As was anticipated, first quarter earnings revealed a tapering of growth. According to Facset, the blended earnings decline for Q1 2019 is -0.4% (with 98% of S&P 500 companies having reported). However, more than 75% of these companies have reported earnings that were higher than consensus estimates. |

|

EMPLOYMENT |

A |

The US economy added just 75,000 new jobs in May, well below the consensus estimates as well as recent trends. However, monthly jobs data tends to be volatile, and it is certainly possible that there is a significant rebound in June (as there was between February and March). We continue to view the jobs market as very healthy. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but as the economic cycle continues to mature, this metric will deserve our ongoing attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

We have raised our international risks rating to a 7 as a result of rising tensions between the US and Iran, as well as the recent decision by the Trump administration to impose a sales ban on Chinese tech company Huawei. The ban is representative of the risks associated with the growing technology rivalry between the US and China. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

FROM THE PROS… VIDEO

Executive Compensation Series – Restricted Stock

Our ExecutiveEdge financial advisors, Rod Young and Jackie Cornelius, discuss Restricted Stock awards – what they are, how they vest and an overview of the tax consequences when they are granted and at the time they are vested.

WATCH NOW

RELATED CONTENT: Executive Compensation Series – Introduction

Quote of the Week

“We must be free not because we claim freedom, but because we practice it.” – William Faulkner

The Markets This Week

by Connor Darrell

CFA, Assistant Vice President – Head of Investments

A

quarter where trade tensions and geopolitics led to choppy returns ended on an

optimistic note as the U.S. and China agreed (once again) to hold off on

implementing additional tariffs in an effort to resurrect the ongoing trade negotiations.

U.S. equities finished the week largely unchanged, but capped off a strong

month of June which saw stock prices rise by over 7%.

As the second half of the year kicks off, investors will begin turning their attention toward Q2 earnings. Analysts are forecasting a second straight quarter of declining S&P 500 earnings, with the weakest growth expected among companies with large, complex global supply chains; another by-product of the ongoing uncertainty surrounding the future of global trade.

Q2 Commentary Now Available – valleynationalgroup.com/Q22019

Equities and bonds have both started the year at a torrid pace, but returns have been driven by very different underlying tones. We explore the conflicting signals that returns in the stock and bond markets are sending in our latest quarterly commentary.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie will not be live on the air. Tune in at the same time for a recorded YFC show.

Questions submitted online at yourfinancialchoices.com/contact-laurie will be addressed during the next live broadcast.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.