Did you know that every year Valley National Financial Advisors is ranked by Financial Advisor Magazine? We are proud to be continually growing and improving in step with the top firms in our industry across the U.S. So, what does it mean to be an RIA (Registered Investment Advisor)? Learn more about the fiduciary standards at https://www.findyourindependentadvisor.com/

Daily Archives: July 23, 2019

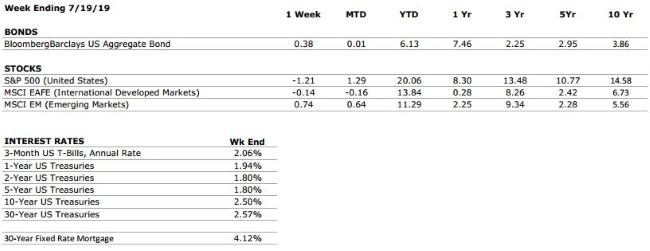

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A. Surveys of US consumers continue to indicate that the consumer is in a strong position. |

|

FED POLICIES |

B+ |

We have increased our Fed Policies grade to a B+ after Jerome Powell commented that “a number” of Fed decision makers believe that the case for a rate cut in the near future has strengthened. |

|

BUSINESS PROFITABILITY |

B- |

As was anticipated, first quarter earnings revealed a tapering of growth. Expectations for Q2 earnings are also relatively low. However, this is largely a result of the fact that YoY comparisons are made relative to a historically strong 2018. |

|

EMPLOYMENT |

A |

The US economy added 224,000 new jobs in June, beating consensus estimates by a wide margin. We continue to view the jobs market as very healthy. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but as the economic cycle continues to mature, this metric will deserve our ongoing attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

6 |

We have adjusted our international risks rating down one notch to a 6 following a recent cooling of rhetoric in the US/China trade negotiations. While new developments are still likely to create short-term volatility in markets, both sides have an incentive to reach a deal. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Values are like fingerprints. Nobody’s are the same, but you leave ‘em all over everything you do.” – Elvis Presley

The Markets This Week

by Connor Darrell CFA, Assistant

Vice President – Head of Investments

Global

equities shed some of their recent gains last week as lukewarm economic and

earnings data combined with increasing geopolitical tensions to put some

pressure on stocks. Bonds generated positive returns following comments from

multiple Federal Reserve policymakers which seemed to lend support for

potentially larger rate cuts in the realm of 50 basis points.

There was little to report on from a conference call held last week between U.S. and Chinese trade representatives. The two sides continue to appear far apart on certain key issues. In comments made last week, President Trump stated that there is still a long way to go before a final deal can be reached and left the door open to the possibility of additional tariffs on $325 billion of Chinese exports.

Earnings Update

With 15% of S&P 500 companies having reported Q2 earnings, the blended earnings growth rate is -1.9% on a one-year basis. The relatively weak results so far were largely expected by the analyst community as the initial accounting boost from 2017’s tax reform begins to wane. The good news is that while corporate earnings have been somewhat disappointing on an absolute basis, they have actually largely exceeded consensus estimates. According to data from Factset, the percentage of companies reporting earnings above consensus estimates has been close to 80%; well above the historical average. Often times, market performance is driven by the difference between expectations and reality, and Q2 earnings season has thus far brought an above average level of positive surprises. Furthermore, the beginning of earnings season has seen a large number of companies from the financial services sector report, and many of these companies’ earnings have been hindered by the decline in interest rates that has played out over much of the first half of 2019.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie will discuss: “Mid-Year Financial Review.”

Questions can be submitted live on air by calling 610-755-8810 or sent in online anytime. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

LISTEN to Timothy G. Roof, CFP® and Connor Darrell, CFA discuss the “2nd Quarter Market Review” with Laurie in the recording from July 10.