Labor Day Holiday Closure

Our offices will be closed on Monday next week – September 2 – in observance of the Labor Day holiday.

Daily Archives: August 27, 2019

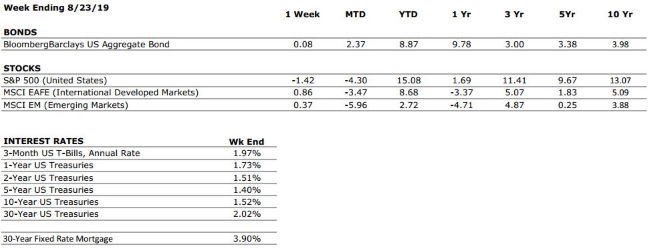

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A. Surveys of U.S. consumers continue to indicate that the consumer is in a strong position, and recent GDP data provided further evidence of healthy consumer spending. |

|

FED POLICIES |

B+ |

Our Fed Policies grade remains a B+ after the Federal Reserve opted to cut its interest rate target by 25 bps following last month’s meeting. The cut was widely anticipated by markets, and if history is any representation, it is unlikely to be the last. |

|

BUSINESS PROFITABILITY |

B- |

With most S&P 500 companies having reported Q2 earnings, the EPS growth rate for the second quarter is close to zero. Despite the weak growth rate, almost 75% of companies have beaten consensus estimates this quarter. |

|

EMPLOYMENT |

A |

The U.S. economy added 164,000 new jobs in July, right on target with consensus expectations. July’s report also showed that the size of the labor force (defined as those who are either working or actively seeking employment) grew to its highest level ever. The labor market remains one of the strongest components of the U.S. economy. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but as the economic cycle continues to mature, this metric will deserve our ongoing attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

Following a re-escalation of the U.S./China trade dispute, we have raised our “international risks” metric back to a 7. Other key areas of focus for markets include the ongoing Brexit negotiations, rising economic nationalism around the globe, and escalating tensions in the Middle East. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

From the Pros… VIDEO

The Value of a Diverse Portfolio

Associate Financial Advisor Mike Warch reviews some considerations and questions to ask about your investment portfolio, in order to reduce risk and reach your long-term financial goals. WATCH NOW

Quote of the Week

“Instead of wondering when your next vacation is, maybe you should set up a life you don’t need to escape from.” – Seth Godin

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

After four days of relative stability in equity markets, President Donald Trump took to Twitter on Friday morning to suggest that U.S. companies should “immediately start looking for an alternative to China.” Markets reacted negatively to the President’s tweet, and the S&P 500 ended the day down more than 2.5%, marking the fourth consecutive week of market declines. Elsewhere, Fed Chairman Jerome Powell spoke at an annual gathering of central bankers in Jackson Hole, Wyoming and discussed the challenge posed to fed policymakers by the uncertainty created by the administration’s strained relationship with China. Powell lamented that there is no playbook that bankers can consult in addressing the impacts of trade uncertainty on the macroeconomic environment.

Stocks Have Remained Resilient in Difficult Environment

The stock market has had a lot thrown at it over the past several months, including a continued escalation in the U.S.-China trade war, a yield curve inversion, Great Britain inching closer to a no deal Brexit, and weakening global economic growth. Yet despite all of this, U.S. stocks have remained very resilient and currently sit just five or so percent off of their all-time highs. Part of this may have to do with the shape of the yield curve and the lack of yield available in long-term bonds. On Friday, the yield on the 10-Year Treasury closed the trading day at 1.52%. Factoring in the current inflation rate of over 2%, a buyer of a 10-Year Treasury is likely locking in a negative real return unless we see a significant and prolonged collapse in the inflation rate over the next 10 years. This leaves investors with less options for long-term return generation, and the logical place to turn is to the stock market. All of this creates a challenging environment for investors. The risks that seem to be surfacing in the global economy cannot be ignored and suggest a defensive posturing. However, the lack of yield available in global bond markets and the active suppression of interest rates by central bankers has made traditional defensive assets such as cash and fixed income increasingly unattractive. With that said, we continue to believe that the U.S. economy remains strong enough that a recession is not the base case scenario. Much of this is based upon the fact that there is considerable reason to believe that some of the softening in the global economy has been driven by geopolitical issues such as trade friction. The U.S. consumer, (which accounts for more than two thirds of GDP growth) remains very healthy at this point in time, and a reversal in trade policy would likely ease some pressure on economic growth rates.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie will discuss: “Financial Decisions – understanding the tax implications of your investments decisions.”

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org. Listen to a recent conversation with our own Tim Roof, CFP® on the topic of Market Volatility.