Our team, led by our CEO as Honorary Chair, is pleased to support the Volunteer Center of the Lehigh Valley Spirit of Volunteerism Awards.

Save the Date!

Nominate. Donate.

https://www.volunteerlv.org/spirit-of-volunteerism

Our team, led by our CEO as Honorary Chair, is pleased to support the Volunteer Center of the Lehigh Valley Spirit of Volunteerism Awards.

Save the Date!

Nominate. Donate.

https://www.volunteerlv.org/spirit-of-volunteerism

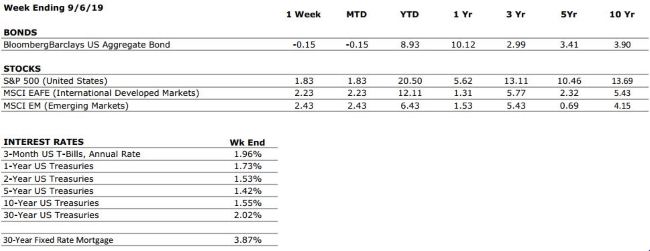

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A. Surveys of US consumers continue to indicate that the consumer is in a strong position, and recent GDP data provided further evidence of healthy consumer spending. |

|

FED POLICIES |

B+ |

Our Fed Policies grade remains a B+ after the Federal Reserve opted to cut its interest rate target by 25 bps following last month’s meeting. The cut was widely anticipated by markets, and if history is any representation, it is unlikely to be the last. |

|

BUSINESS PROFITABILITY |

B- |

With most S&P 500 companies having reported Q2 earnings, the EPS growth rate for the second quarter is close to zero. Despite the weak growth rate, almost 75% of companies have beaten consensus estimates this quarter. |

|

EMPLOYMENT |

A |

The US economy added 130,000 new jobs in August, below the consensus expectations of analysts. However, despite the lower than expected job creation, there was evidence of an acceleration of wage growth. The labor market continues to look quite healthy. |

|

INFLATION |

A |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. Despite a tight labor market, we continue to see no signs of an increase in inflation. This bodes well for the extension of the economic cycle. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

Following a re-escalation of the US/China trade dispute, we have raised our “international risks” metric back to a 7. Other key areas of focus for markets include the ongoing Brexit negotiations, rising economic nationalism around the globe, and escalating tensions in the Middle East. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

“Price is what you pay. Value is what you get. ”– Warren Buffett

by Connor Darrell CFA, Assistant Vice President – Head of Investments

Markets pushed higher last week despite a weaker than expected August jobs report which revealed a slowdown in hiring but an acceleration in wage growth. Combined, these two trends would suggest that fewer people were put to work during the month, but those that were received higher wages. Manufacturing data also released during the week suggested that U.S. manufacturing activity dropped into contraction for the first time in seven years, likely as a result of the ongoing uncertainty being created by the U.S.-China trade war. Manufacturing activity around the globe has been negatively impacted by trade policy, and it seemed only a matter of time before the U.S. manufacturing sector began to feel those same effects. None of the above news came as a major surprise to investors however, and markets were not significantly impacted. Instead, the confirmation from Chinese negotiators that the U.S. and China were scheduled to hold “serious” talks during October seemed to support investor optimism.

Divergence in the “Soft” Data

Economists often classify economic data into two different categories. Hard data refers to real numbers that are directly measurable, such as GDP growth. Soft data refers to measurements that are derived from survey data, such as consumer confidence. Lately, economists have observed a divergence in the soft data coming from businesses and consumers. For businesses, confidence has been declining as a result of the weakening global growth rates and the uncertainty over the impacts of disruptions to global trade. However, consumers have remained rather optimistic as a result of low unemployment, rising wage growth, and low inflation. Economic demand in the U.S. is driven by both businesses and consumers, but consumers make up a larger component (about 70%). As such, the consumer is in a better position to support the economy moving forward, and the resiliency of consumer confidence remains a key factor in keeping the economic expansion intact.

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie will discuss: “Year-end tax planning, before year end.”

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.