by Connor Darrell CFA, Assistant Vice President – Head of Investments

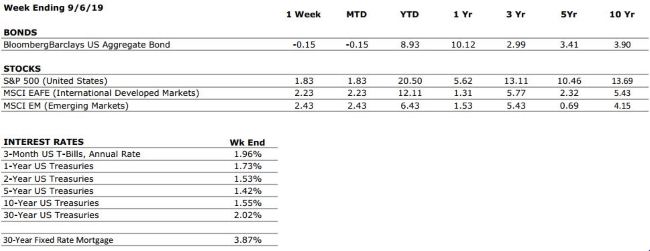

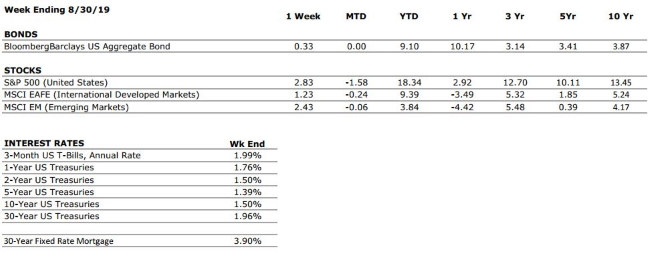

Stocks logged their third consecutive week of healthy gains last week, with outperformance rotating toward small caps and value stocks. The shift into value and small cap stocks represented a meaningful change in investor preferences, which have favored large caps and growth stocks for much of the year. Bond investors saw losses as the yield curve steepened and most interest rates moved higher throughout the week. Bond yields were likely supported by stronger than expected retail sales and inflation data.

As far as economic data goes, there continues to be a disparity between measures of businesses and measures of consumers. Consumer data has remained strong as a result of low unemployment, rising wages, and relatively low inflation. However, trade uncertainties have made global businesses apprehensive to invest heavily in new projects, leading to weakening manufacturing activity and lower capital expenditures. In the absence of a trade deal, the U.S. consumer will likely continue to bear the responsibility of keeping economic momentum intact. However, an eventual deal remains our base-case scenario. In the meantime, we continue to advise against attempting to trade around short-term moves driven by speculation surrounding a trade deal. Investors would be well-served by remaining disciplined and diversified in an increasingly uncertain environment.

Oil Markets Disrupted by Attacks in Saudi

Arabia

Over

the weekend, attacks on Saudi oil assets caused major disruptions to facilities

that produce almost six million barrels of oil per day; approximately 5% of the

world’s daily oil output. Oil prices have moved higher as a result of the attacks,

and U.S. officials have made it clear that they believe Iran to be at fault and

that military action remains on the table. Putting aside the concern these

types of headlines may instill in us as global citizens, there are a few

important things to note from an investment perspective.

First, there is the obvious impact of higher oil prices. Generally speaking, higher oil prices lead to higher costs for everyday consumers. The good news is that global oil production is in a much different place than it was even five or 10 years ago, and the United States now has the ability to make up for shortfalls in global supply. As a result, it is unlikely that oil prices will be able to spike to levels that might lead economists to worry about their impact on economic activity. For perspective, West Texas Intermediate Crude prices were climbing into the low $60s per barrel as of Monday morning, far lower than the $100+ levels observed as recently as 2014.

Secondly, higher oil prices will likely provide some support for U.S. energy stocks, which have struggled year to date. Energy sector earnings have been lackluster since the precipitous drop in oil prices observed in 2015, and that has made it difficult for many energy companies to meet their profit and revenue targets. The extent to which the U.S. energy sector benefits will likely be a product of how long it takes Saudi Arabia to restore its production back to previous levels, but in the meantime, the United States’ recent investments in energy independence are likely to bear fruit.

In general, oil remains one of the most important basic resources for economic production, but the significance of events like this have declined over the past decade or so as a result of changes to the global supply network as well as advances in technology that have reduced the word’s dependence on oil. These types of events certainly require monitoring, but rarely require a change in portfolio strategy for the average investor.