by Connor Darrell CFA, Assistant Vice President – Head of Investments

Equities climbed higher during the holiday shortened week, bolstered by rising optimism surrounding the anticipated “Phase One” trade deal between the U.S. and China. It’s beginning to look as if the proposed agreement will be more comprehensive than many had anticipated, with stronger intellectual property protections being included in the discussions.

The week also brought some encouraging economic news. Data on new home sales came in above analyst expectations and durable goods orders rebounded from recent lows. Additionally, the second estimate of U.S. GDP for the third quarter was revised upward and now stands at 2.1%. Particularly encouraging was that the upward revision was due to a smaller decline in business investment than was initially measured, suggesting that the impacts of the ongoing trade dispute may be starting to wane.

Some Perspective on the National Debt

Aside from the constant calls in the news media for an “impending recession,” there are few issues that seem to worry everyday investors more than the national debt (there’s even a popular website called “U.S. Debt Clock” which keeps a running tally). For many, the rising debt is an albatross that hangs over the markets and threatens the long-term sustainability of economic growth. However, it’s important for us to keep things in perspective, and even more important to keep our concerns as private citizens and taxpayers separate from our convictions as long-term investors.

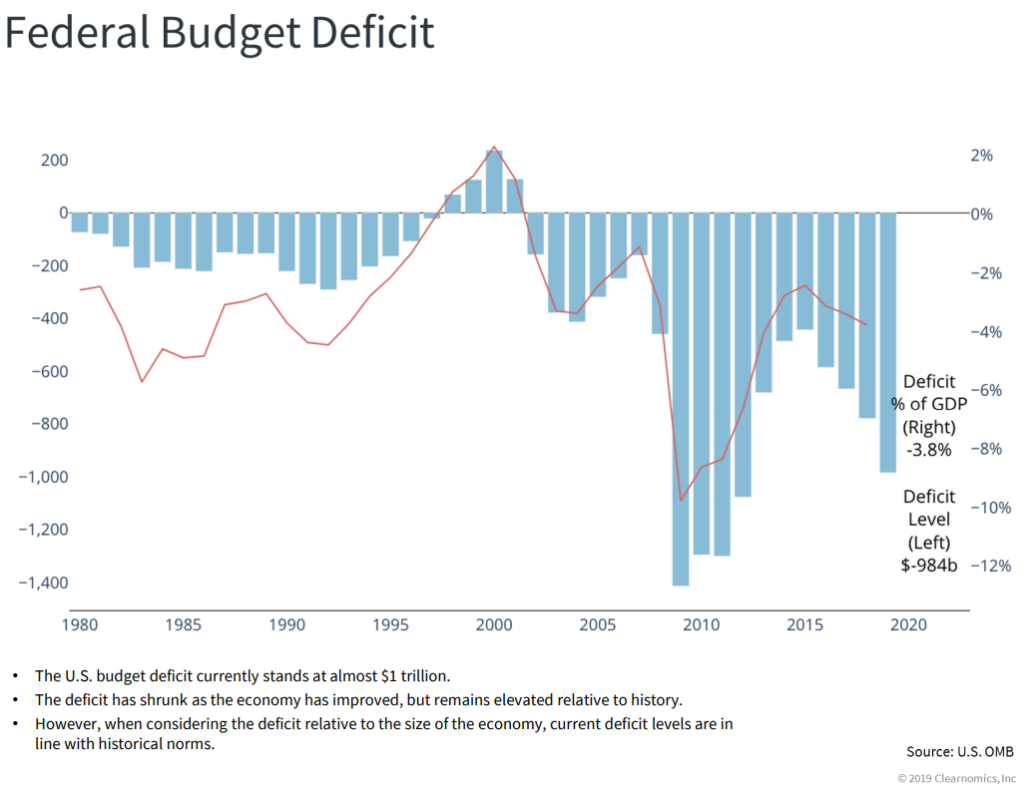

The national debt continues to rise, and with the government currently running at a deficit, that trend is likely to continue well into the future. Looking through recent history, it’s clear that the size of the national debt and the annual budget deficit with which the government operates are, in large part, results of the fiscal decisions made during the 2008 financial crisis. The government responded to the crisis by ramping up spending in order to keep the financial system from collapsing and faced a $1.4 trillion deficit in 2009 as a result. At a little less than $1 trillion, the current deficit is a bit smaller than it was in the depths of the crisis but is still a staggeringly high number. Regardless of the magnitude of the deficit, it’s most likely that investors do not need to live in fear when it comes to their portfolios. When discussing debt levels, it’s not the absolute level of debt or annual deficits that are most important, but rather their size in relation to the overall economy.

With that in mind, while current deficits are inarguably high, they are still within historical norms after considering the size of the U.S. economy has also grown significantly. Even if the current deficit as a percentage of GDP (which currently sits at about 3.8%) were to rise by several percentage points over the next year or two, it will still remain well below the 10% levels observed in 2009 and right on par with where things stood back in the early 80s. In other words, while debt is not something to be ignored, it is unlikely to have a direct impact on the profitability of companies or the yield spreads on bonds. Another important consideration when thinking about the potential impacts of high debt levels is the cost of that debt. With interest rates still very low, the cost of servicing debt is much lower than it has been at most other points in our nation’s history, which makes carrying higher levels of debt more tolerable. For most investors, the current level of national debt should rank low on the list of potential concerns from a portfolio management perspective.