Our remote team took a brief break last week to snap and submit photos of how they relax at home with family (including pets).

Our remote team took a brief break last week to snap and submit photos of how they relax at home with family (including pets).

“Community is much more than belonging to something; it’s about doing something together that makes belonging matter.” – Brian Solis

by Connor Darrell CFA, Assistant Vice President – Head of Investments

U.S. equities (as measured by the S&P 500) continued their bounce from last month’s lows last week with investors seemingly more focused on the spread of COVID-19 than on economic fundamentals (which continue to deteriorate). Further fueling investor optimism was a growing sense that Congress would move toward passing “Phase 3.5” of economic stimulus. In fact, reports emerged Monday morning that the general belief in Washington is that something will be passed by the end of this week. The ideas being proposed include an expansion of the Paycheck Protection Program (PPP), an additional $60 billion allocated to the SBA disaster relief fund, and additional federal funding for hospitals and COVID-19 testing kits.

Q1 earnings season also kicked off last week, with several of the nation’s largest banks providing investors with the first sense of how corporate leaders are assessing the current environment. During investor calls, JPMorgan, Bank of America, and Wells Fargo all provided a rather bleak near-term outlook and cited historically high levels of uncertainty. The extreme uncertainty across markets is also succinctly represented in current S&P return forecasts, where the difference between the most bullish and most bearish wall street estimates stands at its widest level in history. We continue to remind investors that in such an uncertain environment, the importance of discipline and maintaining a focus on long-term objectives cannot be overemphasized. In the near-term, there are a variety of factors that can move markets in either direction, but in the long-term, we can say with a very high degree of confidence that markets will achieve new highs once again.

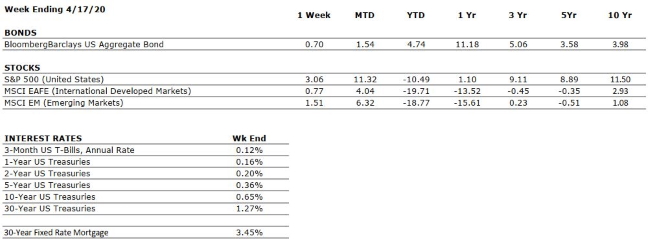

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

VERY NEGATIVE |

The consumer has been the bedrock of the US economy through much of the current expansion. However, we have further reduced our grade to VERY NEGATIVE as a result of the unprecedented social distancing and quarantining efforts currently being employed to fight the spread of COVID-19. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

Coming into the year, analysts were expecting mid to single digit earnings growth, but the spread of COVID-19 is likely to have a substantial impact on near-term earnings forecasts. However, earnings could bounce back quickly once the pandemic has run its course. |

|

EMPLOYMENT |

VERY NEGATIVE |

We expect continued job losses due to the suspension of economic activity in the services industry to combat the spread of COVID-19. |

|

INFLATION |

POSITIVE |

Inflation is often a sign of “tightening” in the economy and can be a signal that growth is peaking. The deflationary environment created by COVID-19 should provide additional room for robust stimulus from both fiscal and monetary policy initiatives. |

|

FISCAL POLICY |

VERY POSITIVE |

The CARES Act provides approximately $2.2 trillion of support for businesses and families that are impacted by the economic fallout of the COVID-19 pandemic. This is by far the largest fiscal stimulus package ever passed, and we anticipate the possibility of additional support once we emerge on the other side of the curve”. |

|

MONETARY POLICY |

VERY POSITIVE |

In response to the threat of COVID-19, the Federal Reserve has implemented two emergency rate cuts and has moved its target interest rate back to zero. Additionally, it has announced its intention to conduct further asset purchases to support markets. We believe that the Fed is doing all it can to support the economy and markets. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

With COVID-19 being declared a global pandemic, our geopolitical risks rating is VERY NEGATIVE. However, we think it is important for investors to disentangle the public health concerns over the near-term from the expectations for markets over the long-term. The pandemic remains a near-term issue at this time. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The economic impacts of the COVID-19 pandemic are likely to be substantial. However, we believe that the eventual economic recovery (which will be aided by historically large economic stimulus) will occur more swiftly than from previous economic shocks. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

COVID SCAMS

Unfortunately, fraud related to the coronavirus pandemic is part of

the new normal as many people are overwhelmed, stressed, scared and in need. We

have collected some links to help you share to recognize and report these

criminals.

CDC – https://www.cdc.gov/media/phishing.html

FBI – https://www.fbi.gov/news/stories/protect-yourself-from-covid-19-scams-040620

Federal Communications Commission – https://www.fcc.gov/covid-scams

U.S. Department of Treasury – https://home.treasury.gov/services/report-fraud-waste-and-abuse/covid-19-scams

Better Business Bureau – https://www.bbb.org/article/news-releases/21989-top-6-coronavirus-scams-bbb

U.S. Small Business Administration – https://www.sba.gov/content/beware-scams

AARP –https://www.aarp.org/money/scams-fraud/info-2020/coronavirus.html

Tune in Wednesday for another new “Your Financial Choices” show on WDIY. Laurie will be recording the show Tuesday to air at the normal time, Wednesday, 6-7 p.m. She will answer questions that have been submitted via yourfinancialchoices.com and discuss: More on the CARES Act.

Live episodes of “Your Financial Choices” are postponed until further notice as Laurie and her guests are working from home in response to guidance around the COVID-19 pandemic. WDIY will continue to broadcast prerecorded local shows as well as available NPR programming. Please continue to support local radio!

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.