This week we are hosting a webinar:

Tax FAQ with Team VNFA: An update on 2019 filings and 2020 planning

REGISTER HERE

Tax FAQ with Team VNFA: An update on 2019 filings and 2020 planning

REGISTER HERE

by Connor Darrell CFA, Assistant Vice President – Head of Investments

Most global equity markets pushed higher last week as more economies continued to take steps toward reopening. Optimism that a vaccine could become available sooner than many anticipated has also helped to boost market sentiment. Markets have remained quite stable over the past several weeks, even as some economic data has begun to paint a very bleak picture. But financial markets are forward-looking entities and are far more focused on the future than the past. In recent weeks, we have seen a significant rebound in the price of oil as air and road travel have both shown signs of recovery. In the U.S., all 50 states have now taken at least some small steps toward reopening their local economies, suggesting that the worst of the economic pain may now be behind us. However, it will be a long and slow recovery, and it will likely take quite some time before economic activity returns to pre COVID-19 levels.

There are also likely to be a variety of lasting issues that persist as we emerge from this crisis, including higher debt levels, poorly balanced state budgets, and an eroded relationship with China. Total authorized spending related to COVID-19 relief has reached about 12% of U.S. GDP, and it is likely that more spending will be required in the near future as many relief programs have now been fully exhausted. Additionally, lower tax revenues and vastly increased unemployment spending has put some states in a very difficult position with respect to maintaining a properly balanced budget, and it is possible that federal aid may be required, placing further strain on the federal budget deficit. Lastly, the relationship between the U.S. and China has taken a clear step backwards as a result of growing speculation surrounding China’s handling of the virus. While China has continued to emphasize its intention to follow through on its end of the Phase 1 trade deal, the rising friction between the two countries is likely to make it even more difficult for a Phase 2 agreement to be reached anytime soon.

Some student loan borrowers have seen their credit reports damaged due to CARES Act forbearance. Read the latest updates to this story, including what to do about inaccurate negative credit reporting. (Forbes.com)

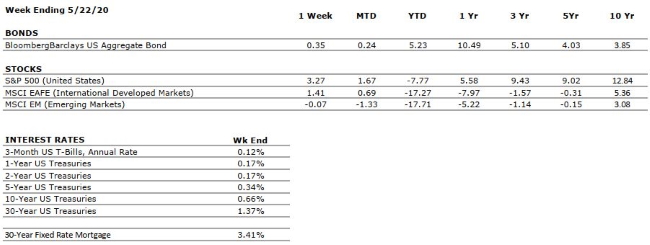

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

VERY NEGATIVE |

The consumer was the bedrock of the US economy through much of the previous decade. However, our Consumer Health grade remains VERY NEGATIVE as a result of the unprecedented social distancing and quarantining efforts currently being employed to fight the spread of COVID-19. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

Coming into the year, analysts were expecting mid to single digit earnings growth, but the spread of COVID-19 is likely to have a substantial impact on near-term earnings forecasts. However, earnings could bounce back quickly once the pandemic has run its course. |

|

MPLOYMENT |

VERY NEGATIVE |

April’s non-farm payrolls report was historically ugly. We expect continued stress in the labor market due to the suppression of economic activity necessary to combat the spread of COVID-19. |

|

INFLATION |

POSITIVE |

The deflationary environment created by COVID-19 should provide additional room for robust stimulus from both fiscal and monetary policy initiatives. However, we will be watching closely in the intermediate term for second and third order effects leading to a return of inflationary pressure. |

|

FISCAL POLICY |

VERY POSITIVE |

The US Government has passed a series of fiscal measures to combat the economic impacts of the COVID-19 pandemic. The largest of these measures, known as the CARES Act, provides approximately $2.2 trillion of support for businesses and families that are impacted by business closures and unemployment. |

|

MONETARY POLICY |

VERY POSITIVE |

In response to the threat of COVID-19, the Federal Reserve has implemented two emergency rate cuts and has moved its target interest rate back to zero. Additionally, it has announced its intention to conduct further asset purchases to support markets. We believe that the Fed is doing all it can to support the economy and markets. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

With COVID-19 being declared a global pandemic, our geopolitical risks rating is VERY NEGATIVE. However, we think it is important for investors to disentangle the public health concerns over the near-term from the expectations for markets over the long-term. The pandemic will ultimately prove to be transitory in nature. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The economic impacts of the COVID-19 pandemic are likely to be substantial. However, we believe that the eventual economic recovery (which will be aided by historically large economic stimulus) may occur more swiftly than from previous economic shocks. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

“I am still learning.” – Michelangelo, age 87

Tune in Wednesday for another new “Your Financial Choices” show on WDIY – 2020 – the year of the ROTH IRA and ROTH Conversion

Laurie will be recording the show Tuesday to air at the normal time, Wednesday, 6-7 p.m. She will answer questions that have been submitted via yourfinancialchoices.com

Live episodes of “Your Financial Choices” are postponed until further notice as Laurie and her guests are working from home in response to guidance around the COVID-19 pandemic. WDIY will continue to broadcast prerecorded local shows as well as available NPR programming. Please continue to support local radio!

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.