Please note that our physical office locations remain closed, except for delivery and pick up by appointment. Call 610-868-9000 to scheduled. In accordance with our safety protocols, ‘walk-ins’ will not be granted entry. Clients working directly with our New Jersey office should call 908-454-1000 for mailing/delivery instructions.

Daily Archives: January 19, 2021

Did You Know…?

Our website has updated articles related to tax planning and tax return filing. https://valleynationalgroup.com/news-and-insights/articles/ Filter by Tax Planning or visit valleynationalgroup.com/tax and scroll down for a list of the most recent posts.

Current Market Observations

by William Henderson, Vice President / Head of Investments

All three broader market indices showed negative returns for the week as portfolio rebalancing reallocating took place. The Dow Jones Industrial Average returned (-.91%), the S&P 500 Index (-1.48%) and the NASDAQ (1.54%). Market average for the full year 2021 remain in positive territory with year-to-date figures at +0.73 for the Dow Jones Industrial Average, +0.39% for the S&P 500 Index and +0.87% for the NASDAQ. Washington was relatively calm, and the markets are looking at a Martin Luther King Jr. holiday shortened week punctuated by the inauguration of President Biden and a peaceful transition of government.

The market will begin a laser-like focus on President Biden and his immediate actions as the new Commander in Chief. Already, President-elect Biden has announced his plans on a flurry of executive orders after his inauguration. Some will roll back Trump administration orders like immigration restrictions and others will be forward actions such as rejoining the Paris climate agreement, a mandate on mask wearing during travel and an extension on the pause on student loan payments. A clear focus on the distribution of the COVID-19 vaccine will remain and attention will be paid to the seemingly slower than expected rollout and distribution of vaccines that has thus far taken place. To be sure, mass vaccination, herd immunity and a roughly 75% vaccination rate is the catalyst the economy needs to continue its recovery.

President-elect Biden also announced the proposal of an additional $1.9 trillion stimulus package early in 2021. Even with a full Democrat-controlled Congress, another $1.9 trillion on top of December’s $900 billion stimulus may be a bit of a pipe dream for Biden and could have difficulty getting approved. All the fiscal and monetary stimulus aside, experts agree that the key to releasing the $20 trillion of cash in money market funds, savings accounts and commercial bank accounts into the economy remains solely focused on the distribution of the COVID-19 vaccine. Each positive indicator of a rebounding economy; whether it be record December e-commerce sales or strong foot traffic at U.S. ski resorts, runs smack into the pandemic and its needed vaccine.

The market will continue to take its cues from further government intervention in the form of fiscal stimulus, fourth-quarter and year-end corporate earnings releases and developments and improvements in the distribution of the COVID-19 vaccine. We believe the Biden administration will focus on the vaccine, an additional stimulus package and “green” initiatives that a loosely unified government will be able to get behind and move forward. Patience, diversification and a sound financial plan will be critical in 2021.

The Numbers & “Heat Map”

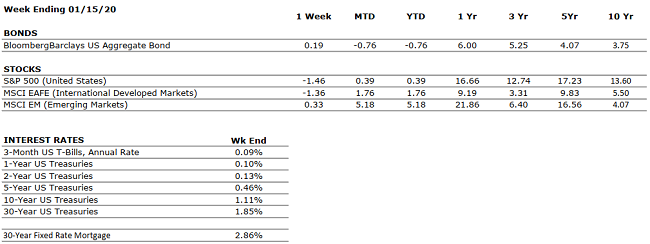

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Retail sales declined by 0.7% in December, the third consecutive month during which the metric was negative. Economic activity is expected to remain muted over the next few months, until a meaningful percentage of the population has been vaccinated. |

|

CORPORATE EARNINGS |

NEUTRAL |

Q4 earnings season kicked off last week as several major banks reported results. According to FactSet, S&P 500 earnings are expected to decline by roughly 7%, year-over-year. |

|

EMPLOYMENT |

NEGATIVE |

The unemployment rate was stagnant in December at 6.7%. This is the first month since April in which the unemployment rate did not improve. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

President Biden unveiled a $1.9 trillion stimulus package last week. Should the bill pass through Congress, the U.S. economy will have received a total of approximately $4 trillion in stimulus over the trailing eleven months. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve supported asset markets with unprecedented speed and magnitude in response to COVID-19. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

Although economic activity mostly remains below 2019’s levels, improvement has occurred across nearly every measure since the April nadir. With multiple vaccines in distribution, a second fiscal package in place, and interest rates low, 2021 is positioning to be a strong economic year. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Grudges are for those who insist that they are owed something; forgiveness, however, is for those who are substantial enough to move on.” – Criss Jami

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM: Updates on Tax Filing – past and present, including stimulus payments.

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.