by Maurice (Mo) Spolan, Investment Research Analyst

The S&P 500 and Dow Jones Industrial Average were both up modestly last week, 1.6% and 1.4% respectively, while the tech-heavy Nasdaq 100 was flat and International and Emerging Market equities trended lower. Bond prices rose as interest rates declined slightly; interest rates have risen quite a bit in 2021 but remain very low from a historical perspective. The 10-year U.S. Treasury note ended the week at 1.66%.

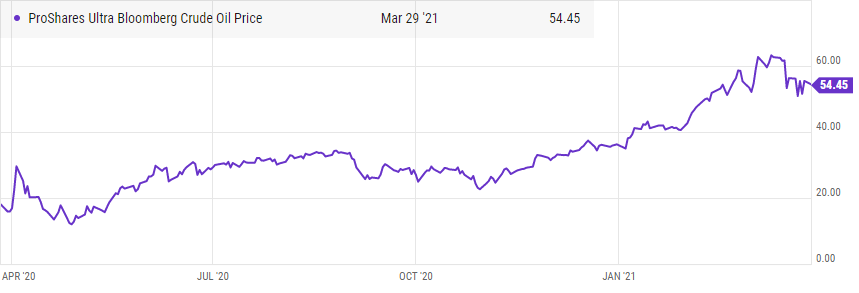

The blockage in the Suez Canal is disrupting as much as 12% of global trade. This supply constraint has also facilitated a rise in the price of oil, which is now above $61. Oil prices have recovered considerably since the pandemic’s outset and may settle at this higher level as demand for travel accelerates upon reopening throughout 2021. The giant container ship bocking the Suez Canal seems to have finally been cleared but the impact to the global supply chain is unclear.

President Biden is increasing his vaccination target, up to 200 million doses administered in his first 100 days in office, from an initial goal of 100 million. Estimates show that 14% of Americans are fully inoculated and 26% of residents have received at least one dose.

The economic outlook remains extremely favorable as both monetary and fiscal stimulus are highly accommodative, and the vaccine roll-out accelerates. As pent-up demand is unleashed, 2021 may end up being one of the most lucrative years in American economic history.