by William Henderson, Vice President / Head of Investments

With second quarter earnings season well under way, last week saw a slight retreat in all three major indexes as stocks sold off a bit from their previous highs. The Dow Jones Industrial Average fell (-0.5%), the S&P 500 Index lost (-1.0%) and the NASDAQ sold off by (-1.9%). Regardless of last week’s modest sell off, year-to-date returns remain strong across all three indexes. Year-to-date, the Dow Jones Industrial Average has returned +14.5%, the S&P 500 Index +16.1% and the NASDAQ +12.3%; representing a broad rally across industries and sectors. Bonds continued to be torn between inflation-related news and Federal Reserve Chairman Powell’s commitment to keeping rates lower for longer. Confounding bond bears, yield on the 10-Year U.S. Treasury dropped an additional nine basis points last week to close at 1.25%, a full 49 basis points lower than the 1.74% yield level hit in March of this year.

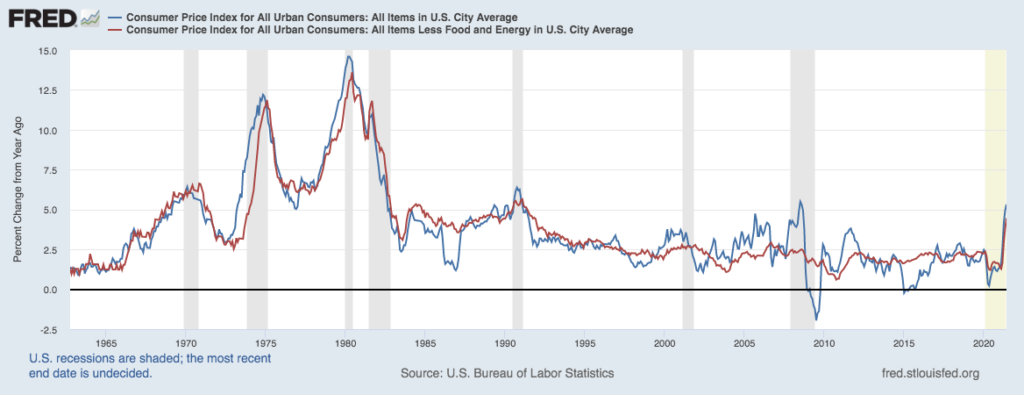

Inflation news was all the rage last week when a monthly measure of U.S. consumer prices rose at the fastest pace since 2008. June’s Consumer Price Index rose 5.4% from the same period a year earlier, which surprised most economists who expected the recent spike in inflation to begin to moderate. (See chart below from the Federal Reserve Bank of St. Louis.)

While the spike in inflation was much larger than expected, breaking down the results revealed that about 1/3 of the increase was due to increases in used-car prices. Inflationary pressures were certainly broadly felt by consumers elsewhere, as food prices increased 0.8% in June and gasoline prices rose by 2.5%. In his report to a U.S. Congressional Panel, Powell repeatedly stated two things: 1) He would not hesitate to raise interest rates if needed to control runaway inflation; and 2) He expects consumer prices to ease later this year. However, Powell firmly believes significant progress in terms of employment and inflation is still needed before short-term interest rates are increased.

Wall Street analysts are expecting strong earnings results from companies focused on technology, materials, and healthcare as final 2Q results are announced. Looking beyond 2Q, companies will have to deal with increases in prices of materials and labor and this could certainly impact earnings, especially in firms where their ability to pass on costs to consumers is limited. Conversely, we have seen some modest price declines in materials like copper and lumber. The overall supply/demand mismatch is abating and these factors will assist companies going forward.

The moves in U.S. Treasury Bond prices as noted above with the 10-year note falling to 1.25% seem to harken back to the early trading patterns when the pandemic first struck in 2020. Surging cases of the new Delta variant of the COVID-19 virus in many parts of the world, including highly vaccinated countries such as the U.K., could be prompting a flight to quality by investors. Lastly, any impediment to a continued re-opening of the global economy will impact future economic growth and concomitant earnings results for equities. Concerns abound and markets are a tricky business. Modest pull backs in equity markets like last weeks and even larger corrections in bull markets are healthy and expected. Equity prices never go straight up, they go up and down and up; generally going from the lower left of a chart to the upper right. Keep focused on long-term trends and a Federal Reserve that is committed to a healthy recovery.