by William Henderson, Vice President / Head of Investments

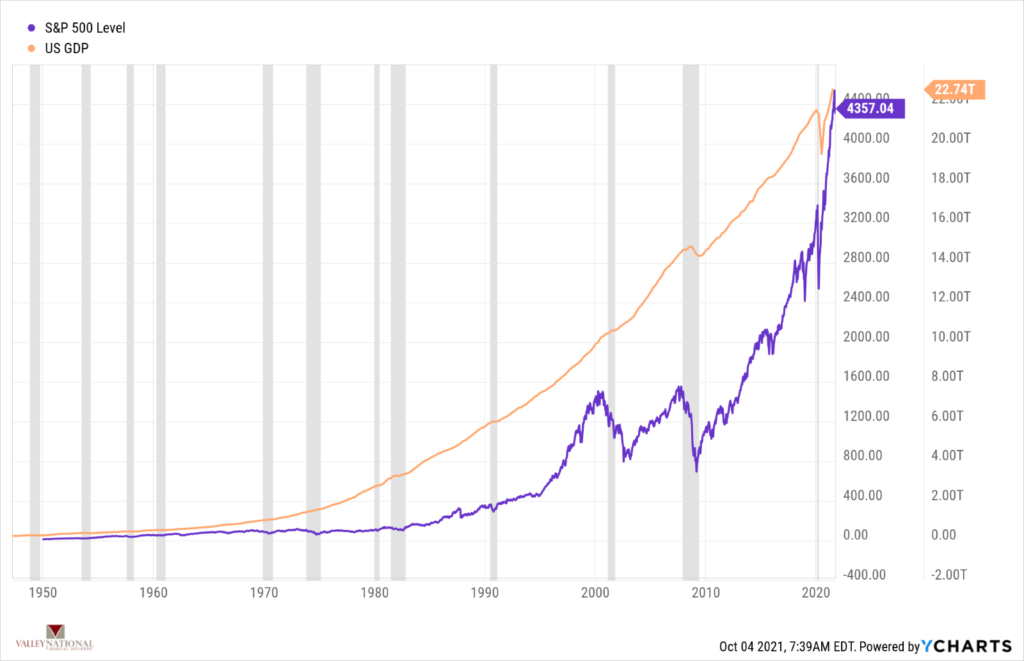

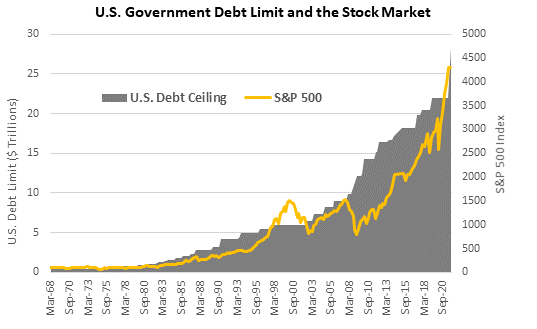

The past week in this newsletter, we talked about long-term trends in the stock market and how that view will pay off much better than trying to time the market by picking highs and lows, and moving money based on those wishful targets. As you know, we are not market timers, we talk about consistent investment plans and consistent investing. These mantras have paid off well and have been, in our opinion, the correct way to invest. The financial news media, which has gained in popularity over the past 20 years needs headlines to attract readers and viewers. “If it bleeds it leads” was the old media trope; with the thinking being grab the viewer’s attention and keep them glued to the channel. Financial media follows this pattern – generally. There’s always the invisible wall of seemingly insurmountable obstacles to the markets doing “better.” We see this today everywhere in the financial headlines – inflation, supply chain disruptions, China, bond tapering, and quadrennial classic – “The Debt Ceiling Debacle.”

Certainly, the issues above are real and deserve attention and to be addressed. Already, Congress passed a magic stop gap bill printing additional billions of dollars to keep the government running. Does anyone remember what happened the last three times the government shut down (one time each during Clinton, Obama, and Trump’s term)? Nothing! Americans went on doing their thing and getting the job done.

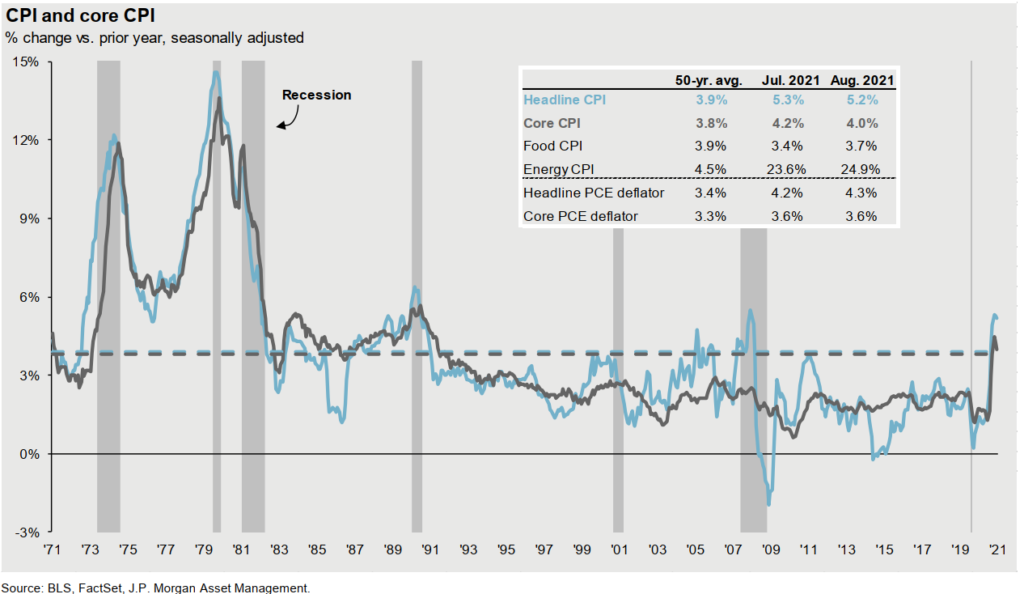

Inflation? Jerome Powell succinctly told everyone he wanted inflation to average 2%. There has been a lot of concerned chatter about inflation lately with everything from food, to energy to commodities costing more; but we have been below 2% for far too many years. (See the chart below from the BLS and JP Morgan, showing CPI and Core CPI since 1971.) Only very recently have we started move above the 2% target, thereby moving the average closer to 2%. The Fed is getting what it designed – inflation will be here until it averages 2% at which point the Fed has said it will raise rates.

The supply chain disruptions are real, and it is going to take a long time to unravel. There are something like 110 cargo ships anchored or drifting off the coast of California. Each of those ships carries about 1,000 containers. That is 110,000 truckloads of goods that need to be offloaded, loaded onto ground transportation, and moved across America. During the mandated COVID-19 lockdown, truck driver training schools shut down, which has led to a dreadful shortage of trained truckers. If you are waiting for your new dishwasher or shipment of semiconductor chips; they are likely floating off the coast of California.

China is going to continue to be in the headlines – as you would expect for the world’s second largest economy. China is a country struggling to be a serious world power – a communist capitalist country – yet one where their President Xi Jinping is working to get reelected to a record fourth term next year. China’s actions and reactions certainly impact the global economy.

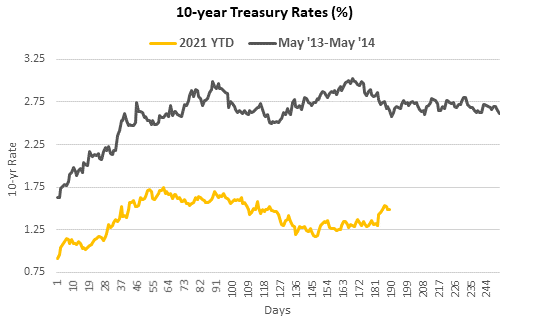

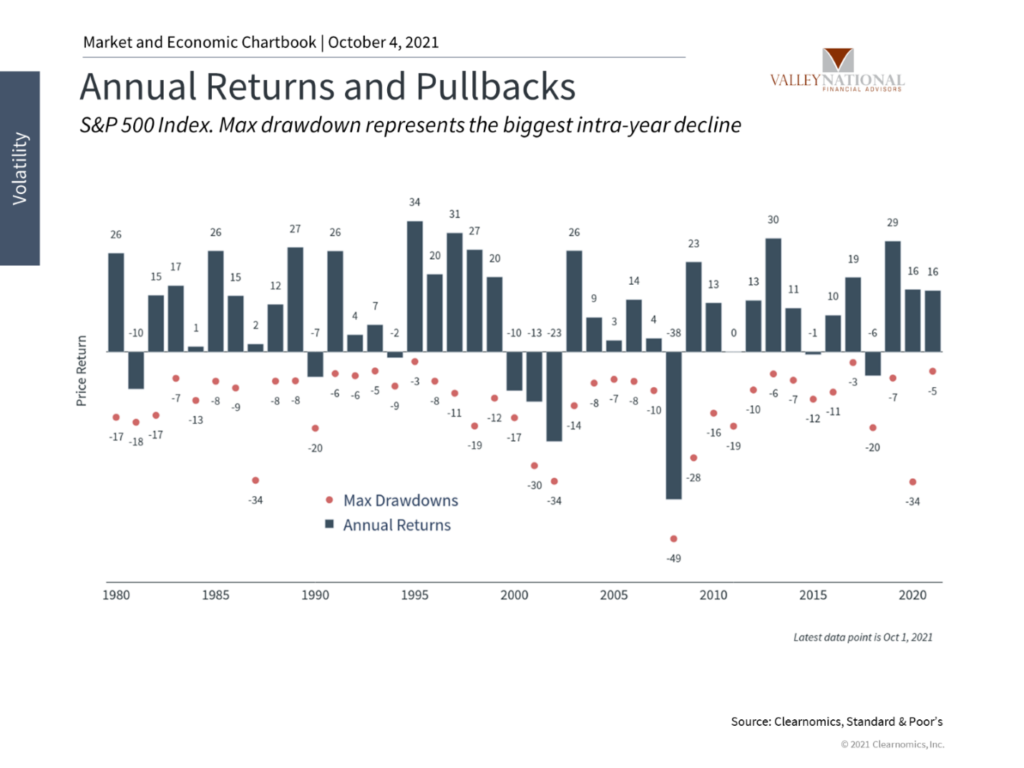

Each of the above issues are surmountable; and the market has proven time and time again that it will move past headline grabbing events. In the short run they are common and normal pullbacks. It took nearly a full year, but the S&P 500 finally had its first 5% pullback of 2021 last week, thus ending hopes of 2021 joining 1954, 1958, 1964, 1993, 1995, and 2017 as the only to go a full calendar year without a 5% move lower. (See the chart below from Clearnomics and Valley National).

The markets and the economy are facing short-term obstacles that deserve attention. The Fed is giving us sustained monetary policy and Congress continues to dribble fiscal stimulus, albeit with a high degree of infighting and backroom brawling. The COVID-19 variants are waning, while vaccine distribution continues to expand globally. Supply chain disruptions are impacting inflation and energy prices are spiking right in front of winter. Thankfully, the consumer has a healthy balance sheet alongside banks and Fortune 500 Corporations. The market is adjusting itself and reacting accordingly and efficiently.

NOTE: The Numbers & “Heat Map” will return to The Weekly Commentary next week, October 19, 2021.