by William Henderson, Vice President / Head of Investments The equity markets reacted negatively to the discovery of a new highly transmissible COVID-19 variant in South Africa. The announcement of a new strain, dubbed omicron by the World Health Organization, shocked markets and impacted most major sectors. The Dow Jones Industrial Average dropped by -2.7%, the S&P 500 Index fell by -2.3% and the NASDAQ dropped by -3.1%. However, all three major indexes remain in positive territory for the year. Year-to-date, the Dow Jones Industrial Average has returned +15.9%, the S&P 500 Index +23.9% and the NASDAQ +20.9%. The U.S. Treasury market reacted as expected to bad news, with prices rising on bonds, reminding investors why bonds remain an anchor in most portfolios – providing the needed risk management tool while risk assets are selling off. Last Friday, the 10-year U.S. Treasury briefly dipped below 1.50%, before settling in over the weekend at 1.53%, four basis points lower than last week and well below the 1.74% level reached in March of this year.

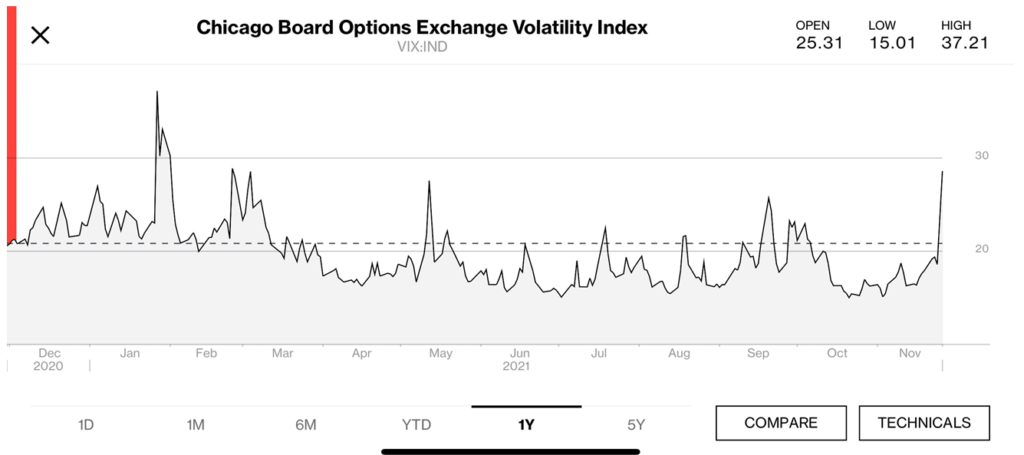

Last week, we talked about the VIX (CBOE Volatility Index – or measure of the market’s risk level) and how “calm” the VIX had been thus far in 2021. Well, add in an omicron variant, and the VIX spikes to a 10-month high. See the chart below from Bloomberg.

As of the writing of this article, the markets are already rebounding nicely, and many market prognosticators are calling it a “buying opportunity.” We often get that question: “Is this a buying opportunity?” Our answer is always the same: “YES!” If you are a long-term investor, with appropriate risk levels applied to your portfolio, every day is a buying opportunity as time generally smooths out peaks and valleys in the markets.

Certainly, this new COVID-19 variant puts the unknown element back into the markets, but we have seen this before with the delta variant and the pharmaceutical firms are already touting the need for another booster shot to deal with the omicron variant. Further, FED policy markets are well aware of the issue and resultant market and economic implications. This means that their announced monetary policy tightening, and bond purchase tapering could at any time be adjusted. In fact, trading markets are already pushing out their expectations of the first rate hike to July 2022 from June 2022.

Lastly, there seems to be an overall consensus gathering in Washington and Wall Street that the pandemic is becoming endemic and will be with us in some form or another for quite a long time. For each sector negatively impacted by lockdowns and new COVID strains such as travel & leisure, there are sectors that are positively impacted such as technology and bio-tech. There are a lot of economic indicators being released this week including data around retail sales, home prices and the labor markets. This information will give us needed information about the future of the economy, the direction of Fed policy and the sentiment and strength of the consumer. Inflation continues to be a concern and the question remains about which parts of inflation will be transitory vs. permanent.

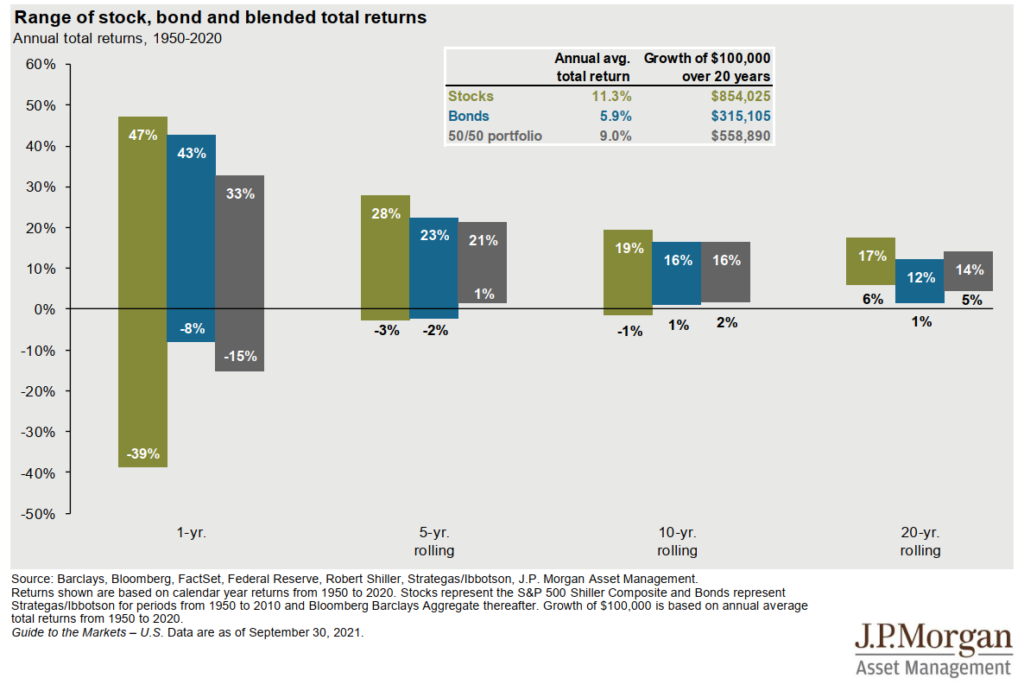

Certainly, last week was a sell-off in all market sectors but we have talked about sell-offs occurring in every major bull market – so this is generally typical market behavior. However, over long periods of time, sell-offs are simply blended into long-term returns. See the chart below from JP Morgan showing performance of portfolios over time.

In any given single year, equities alone can produce a return of –39% and a blended portfolio of –15%. Looking out 20 years, both portfolios are in positive territory. Simply put – investing is a long-term activity.