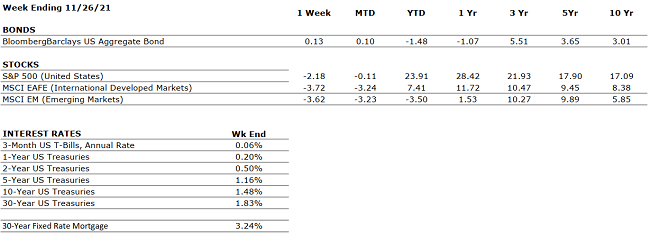

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. GDP growth decelerated to a 2% annualized pace in Q3. The slowdown was driven primarily by supply chain constraints. Economists expect a modest acceleration in Q4. |

|

CORPORATE EARNINGS |

POSITIVE |

With 95% of S&P 500 companies having reported Q3 results, sales and earnings are up 17.5% and 39%, respectively. However, company commentary suggests that the supply chain has been and will continue to be problematic in the coming quarters. |

|

EMPLOYMENT |

POSITIVE |

The unemployment rate is down to 4.6%, as of October. The labor market is very tight at present as many employers, particularly in the Leisure and Logistics sectors, are struggling to fully staff because the labor participation rate remains below pre-COVID levels. The labor shortage is one of the causes of the global supply chain glut. |

|

INFLATION |

NEUTRAL |

CPI rose 6.2% year-over-year in October, the highest increase since 1990, driven by the global supply chain backlog. Will inflation be transitory or permanent? |

|

FISCAL POLICY |

POSITIVE |

A $1.2 trillion infrastructure bill was passed by Congress. A $1.75 trillion spending bill passed by Congress also went to Senate for revisions. |

|

MONETARY POLICY |

POSITIVE |

The Fed will begin bond tapering by November’s end. By mid-2022, all Fed bond purchases will halt. The Fed’s bond buying program works to keep interest rates low. Inflation concerns are persisting, and some are calling for faster tapering and high rates. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

A new COVID-19 variant, omicron, was discovered in South Africa and countries around the world immediately reacted by closing borders to foreigners. While still new and unknown, this needs to be closely watch for potential long-term impact globally and risks of new “lockdowns,” which could severely impact economic recoveries. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions are hampering the economy; however, demand remains very strong. While global logistics are operating far below normal efficacy, it appears the supply chain is slowly improving and may reach normalcy by mid-to-late-2022. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.