Given the recent rapid spread of the omicron variant and the addition of potential exposures over the holidays, this week most of our team will be working remotely. Our offices will be open for scheduled appointments and deliveries during normal office hours. Our commitment to keep our team and our client safe continues to be a priority and we thank you for your understanding as we continue masking inside our office spaces in January.

Daily Archives: January 4, 2022

Current Market Observations

by William Henderson, Vice President / Head of Investments

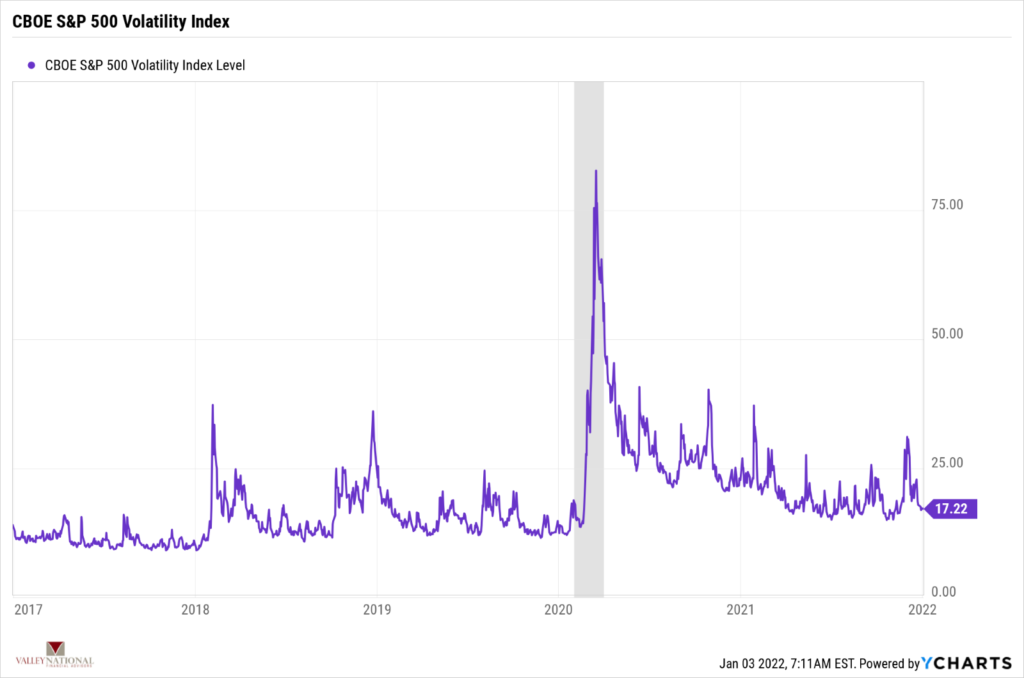

Stocks ended the year on a mixed note with the broader markets posting modest gains while the technology-laden NASDAQ notched a barely noticeable loss. The Dow Jones Industrial Average rose +1.1%, the S&P 500 Index gained +0.9%, and the NASDAQ dropped –0.1%. Massive piles of cash in consumer coffers, corporate earnings hitting new records, and waning but still in place federal monetary and fiscal stimulus propelled markets to new records in 2021 and the patient investor was richly rewarded with double-digit full year 2021 returns in all three major market indexes. Year-to-date 2021, the Dow Jones Industrial Average has returned +21.0%, the S&P 500 Index +28.7% and the NASDAQ +22.2%. What made the returns in equities more palatable was that these returns were garnered with very little volatility. A brief look at the VIX (Chicago Board of Options Exchange S&P 500 Volatility Index), which measure stock market volatility shows that by historic measures the VIX in 2021 was calm. See the chart below from YCharts and Valley National Financial Advisors. There were very few spikes in the VIX above 25, and for most of the year, the index was modestly falling.

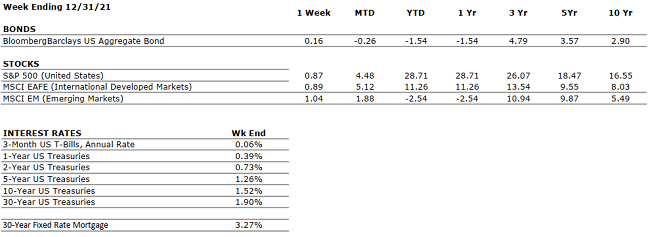

During this record rise in stock prices, fixed-income markets, while selling off early in 2021, regained some composure mid-year and stayed relatively steady into year-end. he 10-year U.S. Treasury opened 2021 at a yield of 0.91%, hit a high of 1.74% in March and then closed the year at 1.51%. While not a year for strong bond returns, for the few occasions in 2021 when risk assets sold off, it was important that smart investors held anchor positions in risk management assets like bonds.

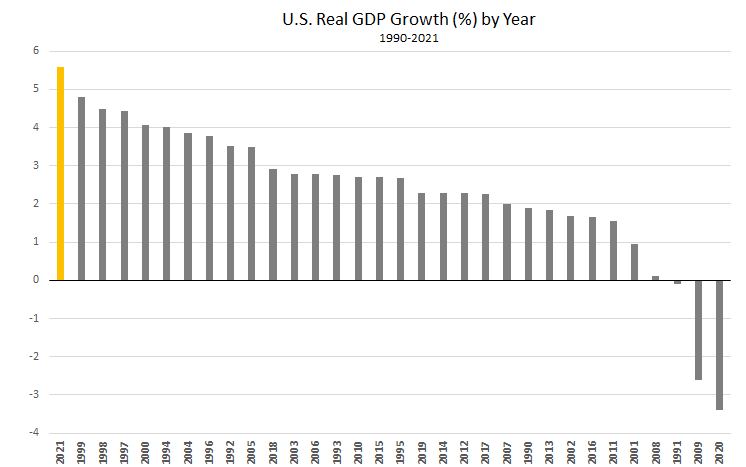

As mentioned, corporate earnings were strong, reflecting economic growth that was the strongest since 1984. (See the chart below from Factset.)

The Fed successfully orchestrated a recovery from the pandemic-induced recession of 2020, which gave consumers the confidence to spend on everything from leisure activities to new homes and renovations to existing homes. While inflation became a concern along with supply chains disruptions, labor markets were hot all year and unemployment slowly fell to 4.2% as hiring continued across all sectors of the economy.

As we look to 2022, there are headwinds and tailwinds to consider. While monetary stimulus will slowly get removed as the Fed reduces its bond buying and then moves to higher interest rates, fiscal stimulus could continue in the form of big policy spending like the Biden-proposed $1.8 trillion Build Back Better Bill. The consumer starts the year in excellent financial shape bolstered by strong increases in savings accounts and limited spending in 2021. Corporate balance sheets are also in excellent shape allowing firms to boost wages and hiring but supply chain disruptions and drastic increases in raw material costs pose dilemmas for corporate CEOs. Wall Street economists are modestly optimistic on 2022 with growth estimates for U.S. GDP averaging +3.0% which certainly provides a solid base that supports the continuation of the bull market. Stay focused on the tailwinds while being aware of the headwinds and keep a long-term perspective on your investments and your financial plan.

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. GDP growth decelerated to a 2% annualized pace in Q3. The slowdown was driven primarily by supply chain constraints. Economists expect a modest acceleration in Q4. Early high-frequency data (shopping, travel, movie ticket sales) is showing some slowing. Holiday retails sales numbers will be important to gauge consumer behavior. |

|

CORPORATE EARNINGS |

POSITIVE |

Fourth quarter wrapped up and earnings are likely to be impacted by labor, supply shortages, price increases and wage inflation. As EPS estimates are ironed out each of these items will play a role, some greater than others. Watch for increases but at a muted pace. |

|

EMPLOYMENT |

POSITIVE |

The unemployment rate is down to 4.2%, as of November. The labor market is very tight at present as many employers, particularly in the Leisure and Logistics sectors, are struggling to fully staff because the labor participation rate remains below pre-COVID levels. The labor shortage is one of the causes of the global supply chain glut. |

|

INFLATION |

NEGATIVE |

CPI rose 6.8% year-over-year in November, the highest increase since 1982, driven by the global supply chain backlog and continued consumer pent up demand. Will inflation be transitory or permanent? Powell may remove “transitory” from his testimony this week. |

|

FISCAL POLICY |

NEUTRAL |

The Build Back Better Bill has been pushed into 2022 in a scaled back $1.8 trillion version as Senator Manchin continues to hold back support. The economy seems to be digesting a new world where fiscal policy is no longer considered an economic stimulus. |

|

MONETARY POLICY |

POSITIVE |

By early 2022, all Fed bond purchases will halt. The Fed’s bond buying program works to keep interest rates low. Once tapering ends, rate hikes follow. Mid-June or sooner for rate hike? |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

The new omicron COVID-19 variant has shown up in many parts of the world. This strain seems less virulent and more reactive to boosters so its impact it still yet to be calculated. A rebound in travel and leisure now seems unsure. Important to watch the Russia/Ukraine situation. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions are hampering the economy; however, demand remains very strong. While global logistics are operating far below normal efficacy, it appears the supply chain is slowly improving and may reach normalcy by mid-to-late-2022. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Tax Corner

Get ready to file your 2021 income tax return by planning ahead. The IRS has resources at irs.gov like “Steps to Take Now to Get a Jump on Your Taxes.”

Changes to VNFA Tax Process

Our Tax Department continues to roll out efficiencies to make the tax preparation process easier for our clients. New this year, we will be sending tax preparation clients a combined packet with engagement, questionnaire, and personalized organizers with document checklists. These will be distributed later in January and should be used as a guide when collecting tax source documents. The combined packet should be complete and returned with your tax source documents, and not before. We look forward to sharing more innovative updates with you as 2022 unfolds.

Quote of the Week

“There’s no sense talking about priorities. Priorities reveal themselves. We’re all transparent against the face of the clock.” – Eric Zorn

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” with Laurie Siebert on WDIY 88.1FM. Laurie will discuss: Planning opportunities for the year ahead.

Laurie can address questions on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.