View/Download PDF version of Q4 Commentary (or read text below)

Stocks

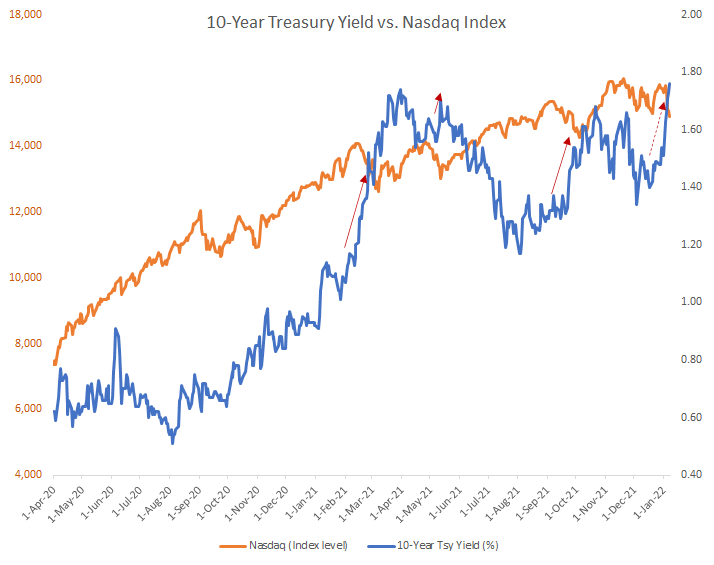

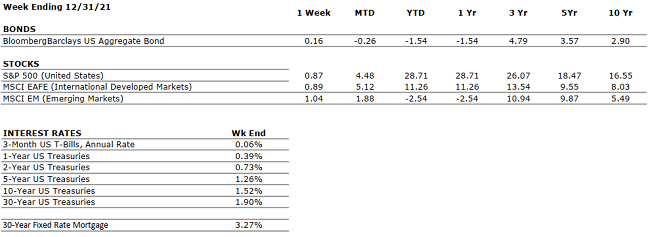

The three major U.S. equity indices – The Dow Jones Industrial Average, the S&P 500 Index and the NASDAQ Composite were each up between 21.0 – 28.7% for the full year of 2021. Continuing the year-long trend of equity industrials and dividend heavyweights outperforming technology, the S&P 500 Index came away as the big gainer for the year notching a stellar return of 28.7%. Regardless of the divergence in returns, the strong performance of all three market indexes shows the strength, depth, and breadth of the current bull market. In fact, the VIX, the standard measure of market volatility, fell throughout the year and provided very few large market pullbacks or sell-offs. Rather, the run up in stock prices in 2021 was slow and steady.

Bonds

During this record rise in stock prices, fixed-income markets, while selling off early in 2021, regained some composure mid-year and stayed relatively steady into year-end. In late November 2021, on the news of the new omicron variant of COVID-19, there was a flight to quality and as a result yields on bonds fell once again. The 10-year U.S. Treasury opened 2021 at a yield of 0.91%, hit a high of 1.74% in March and then closed the year at 1.51%. While not a year for strong bond returns, for the few occasions in 2021 when risk assets sold off, it was important that smart investors held anchor positions in risk management assets like bonds.

Economy and Outlook

The Fed successfully orchestrated a recovery from the pandemic-induced recession of 2020, which gave consumers the confidence to spend on everything from leisure activities to new homes and renovations to existing homes. While inflation became a concern along with supply chains disruptions, labor markets were hot all year and unemployment slowly fell to 4.2% as hiring continued across all sectors of the economy. The omicron variant could have some impact on the future hiring process and worker’s willingness to return to work. However, the strength and virulent activity of this strain has proven weaker than previous variants. Further, it seems logical to assume that as the strains expand and mutate, they get weaker and eventually the pandemic becomes an endemic.

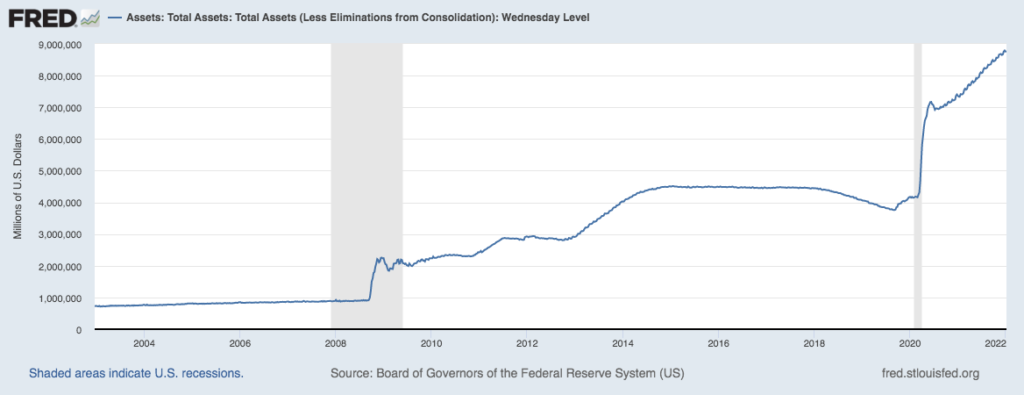

As we look to 2022, there are headwinds and tailwinds to consider. While monetary stimulus will slowly get removed as the Fed reduces its bond buying and then moves to higher interest rates, fiscal stimulus could continue in the form of big policy spending like the Biden-proposed $1.8 trillion Build Back Better Bill. The consumer starts the year in excellent financial shape bolstered by strong increases in savings accounts and limited spending in 2021. Corporate balance sheets are also in excellent shape allowing firms to boost wages and hiring but supply chain disruptions and drastic increases in raw material costs pose dilemmas for corporate CEOs. Wall Street economists are modestly optimistic on 2022 with growth estimates for U.S. GDP averaging +3.0% which certainly provides a solid base that supports the continuation of the bull market.

An issue to keep in perspective is inflation and whether current elevated inflation levels remain in place or prove to be transitory and temporary. The Fed has committed to focus on inflation and will take the relatively high inflation numbers seriously as they consider future monetary policy. Recall that the Fed operates under a dual mandate of price stability and full employment. We are clearly in the camp that the U.S. economy and corporate America will continue to recover as we move into the post-pandemic period. The omicron variant worries us, but its impact seems less so that previous strains. Overall, the economy and the markets are headed in the correct direction, but we are moving into a period where fiscal and monetary stimulus will be waning, and markets will take some time to digest that significant change.