by William Henderson, Chief Investment Officer

A visible slowdown in soaring inflation did little to quell uneasiness in the markets. Consumer sentiment (confidence) fell, and we saw a modest flight to quality as U.S. Treasury Bond prices rallied during the week.

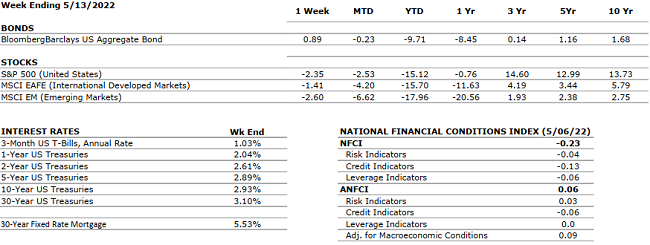

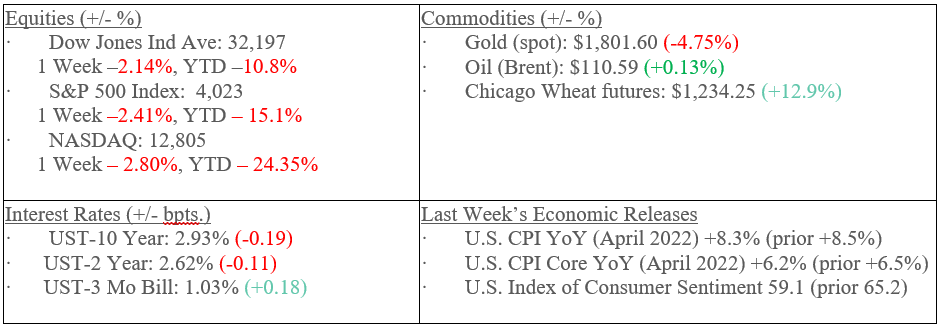

Markets (as of May 13, 2022; 1 week Returns, Year-to-date Returns)

U.S. Consumer Price Index (CPI) fell modestly in April to +8.3% from +8.5% in the March. Further, Core CPI (excluding food & energy) also fell to +6.2% in April from +6.5% in March. Certainly, these numbers are still well above the Fed’s +2% inflation target, we expect the recent strong inflation data to continue to abate showing that the Fed’s efforts to slow inflation and temper the economy are working. Higher interest rates along with a notable drop in the federal deficit, a record high trade deficit fueling overseas demand, and higher mortgage rates cooling the housing market, will naturally slow the economy and thereby inflation over the remainder of 2022. Slowing economic growth is not typically a good thing but with inflation running so high, it is necessary to slow the economy to combat inflation. Most economists are expecting economic growth to slow sharply in 2022 compared to 2021.

A slowing economy will allow supply chains to improve and shortages of certain goods to ease a bit giving consumers needed relief and finally allowing visible labor shortages to moderate. These factors will gradually allow the Fed to temper its hawkish tone which in turn could add needed relief to the equity markets. Last week, even as equity markets fell again, bond markets showed signs of life with the 10-Year U.S. Treasury bond falling 19 basis points to 2.93% from previous week’s 3.12% level. This bond rally provided investors with some surely needed support given the battering the fixed-income market has endured in 2022.

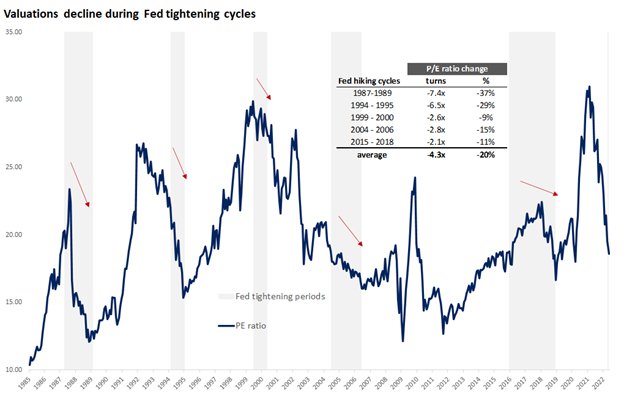

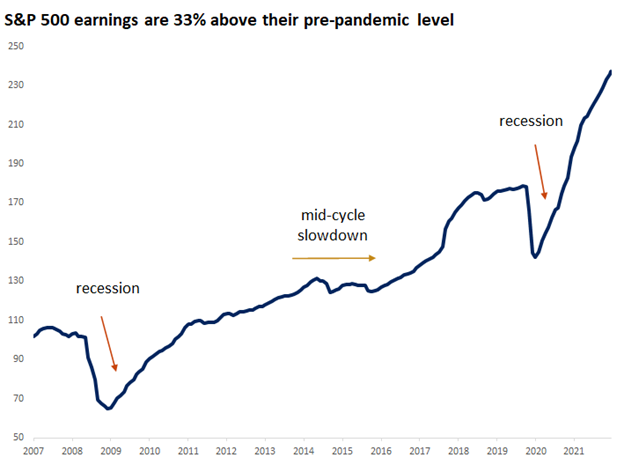

The two charts below (both from FactSet) show why we believe the equity markets will show life before year end and provide long-term investors with needed returns. First, valuations (P/E ratios) typically decline during Fed-tightening cycles, and we are seeing that today. Declining valuations offer investors buying opportunities as prices for equities offer “sale-levels.” Second, S&P 500 earnings are above recession levels and well above pre-pandemic levels, showing that corporations are easily weathering higher prices and supply chain issues resulting in increased earnings.

Another item giving us hope for the equity markets is the continued massive stock buybacks that we continue to see in S&P 500 companies. For the 12-month period ending March 31, 2022, companies in the S&P 500 repurchased $953 billion of their own stock, setting a record for such purchases. Stock buybacks, while often seen as short-term relief, typically result in higher equity prices as they reduce the number of shares outstanding and show that the company feels their cash is best used by reinvesting in their own shares.

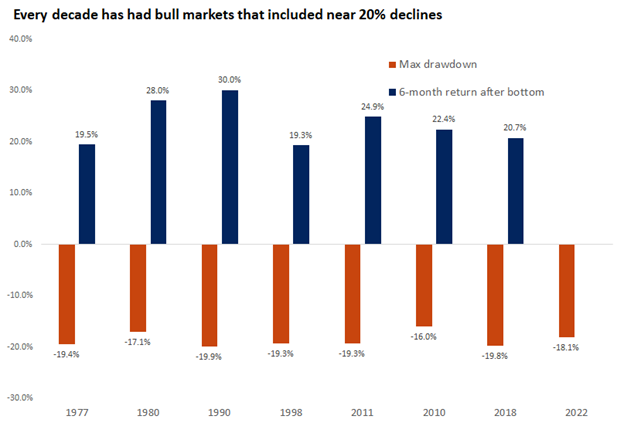

Lastly, each week we talk about long-term investing and sticking to a plan. 2022 has been a painful year for both equity and fixed income investors with both markets down precipitously year-to-date (see returns above). That said, it is worth understanding and considering previous decades of investing. The chart below from Valley National Financial Advisors shows every decade of investing since 1977 and the resultant “bear-market” pullback during the respective bull markets. Each decade had a near 20% drop in equity prices and this decade has been no different. It is times like today that time and history must be considered and sticking with your investment strategy is always the best plan.