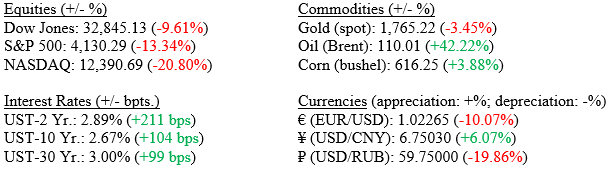

Last week, the markets were torn between the FED’s message on Wednesday, continued inflationary pressures and weak economic growth data, yet for all the uncertainty, Wall Street posted a positive week overall. For the week, the Dow Jones Industrial Average rose +3.0%, the S&P 500 Index increased by +4.3%, and the tech-heavy NASDAQ moved higher by +4.7%. Continuing its month-long rally, the 10-Year U.S. Treasury Bond fell another 10 basis points during the week, to close at 2.67%; quite an unusual feat considering that the FED is technically in a tightening (moving interest rates higher) cycle. The yield curve continued its inverted stance and GDP figures released last week confirmed that we saw two back-to-back quarters (albeit very modest dips) of negative GDP (economic growth).

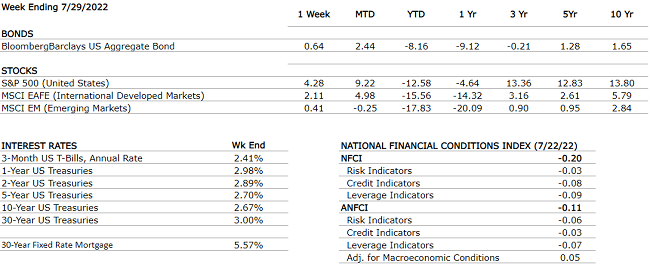

Markets (as of 7/29; change YTD)

Global Economy

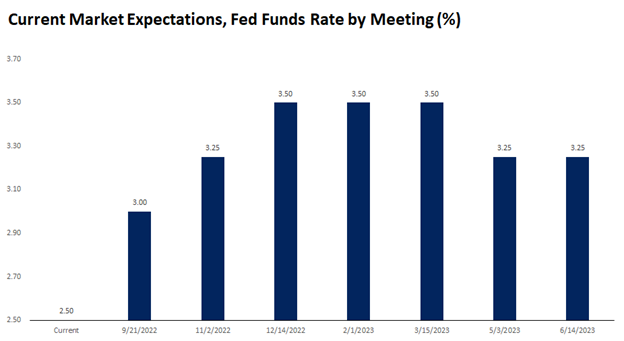

At last week’s FOMC meeting, the Federal Reserve raised rates by 75 basis points (0.75%), bringing the benchmark fed funds rate to 2.50%, the highest level since 2019. Fed Chair Jerome Powell noted in his commentary that the fed funds rate is now close to the Fed’s estimate of a neutral rate, indicating an official end of the post-pandemic easy money policy. Chairman Powell also noted that by the end of the year, fed funds could be at their terminal rate of 3.00% to 3.50%. There may only be one or two more rate hikes this year thereby slowing or ending this tightening cycle. Chart 1 below from FactSet shows the current market expectations by Fed meeting date. Importantly, as early as March 2023, we could see rate cuts as the Fed begins to deal with slowing economy.

As noted above, the markets ended the week, and the month, with strong gains. Clearly, the markets are banking on a Fed pivot (moving from tightening or raising rates, to easing or lowering rates). GDP figures released last week for the second quarter 2022 showed -0.90%, and when combined with the first quarter of 2022 at -1.60%; showed we have a “technical” recession in place – which economists historically cited two back-to-back quarters of negative GDP signaled a recession. The GDP data is accurate and when combined with many recent missed EPS releases by companies such as Intel and Proctor & Gamble certainly point to a slowing economy, which goes into the Fed’s decision to consider a pivot sometime in late 2022-23. A pivot means lower interest rates in the future and that is what the markets are rallying on. Chart 2 (from FactSet) shows the broad performance of several major indexes thus far in the 3rd Quarter 2022. Every sector is higher, led by the NASDAQ.

Policy and Politics

The markets are banking on the Fed doing its job in combating inflation, however we have yet to see any indication that inflation is moderating except in lower commodity prices as we discussed last week. For the markets to continue their recovery, we must see some real impact on the inflationary pressures impacting consumers. Note that gasoline prices are well off their highs of $4.50-5.00/gallon, and this is a commodity that immediately impacts all consumers. Further downward pressure on gasoline could be seen in the months ahead as global economies cool and demand for oil lessens.

What to Watch

- August 4th U.S. Initial Jobless Claims estimate +249,000 vs prior month +256,000

- August 5th U.S. Non-farm payrolls estimate +250,000 vs prior month of +372,000

- August 5th U.S. Unemployment rate estimate 3.6% vs prior rate of 3.6%