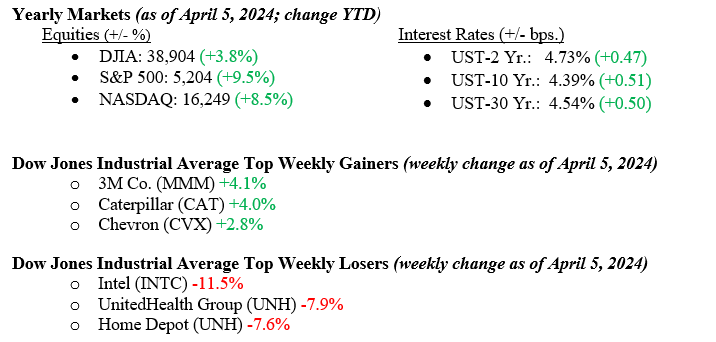

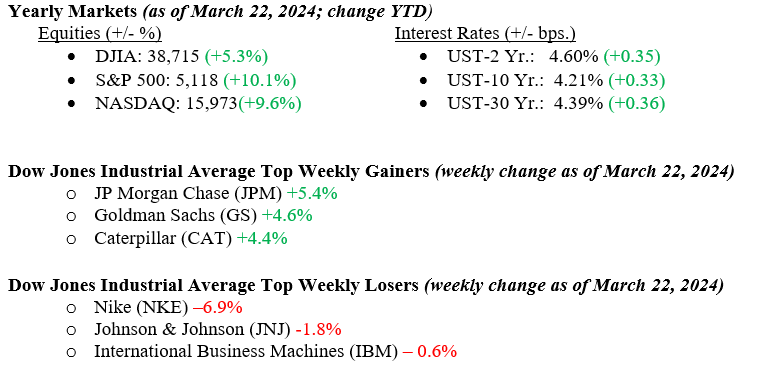

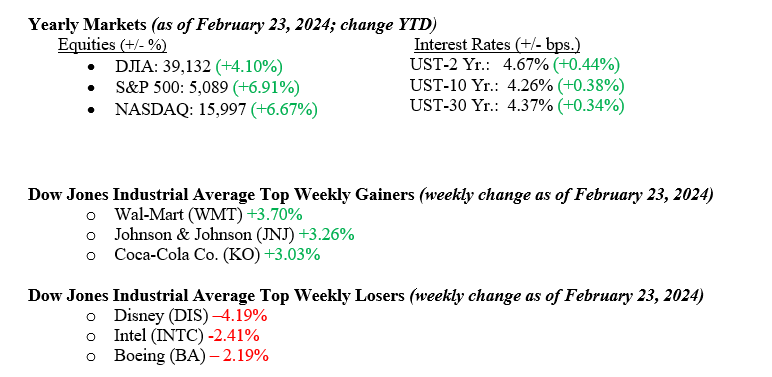

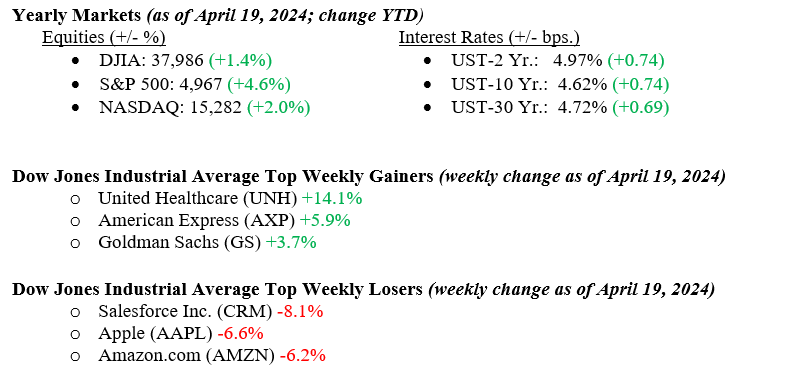

With so much global unrest and uncertainty hanging over the markets and the Fed clearly on hold for a bit longer with rate cuts, risk assets needed a reason to sell off. We got that last week with Israel’s retaliatory strike on Iran. While the strike seemed limited in scope, the risk of further escalation now hangs over the markets. Oddly, U.S. Treasuries, which typically would rally during global unrest, sold off as the Fed’s position on rates outweighed the troubles in the Middle East. The 10-year U.S. Treasury closed the week at 4.62%, 12 basis points lower than the previous week.

U.S. Economy

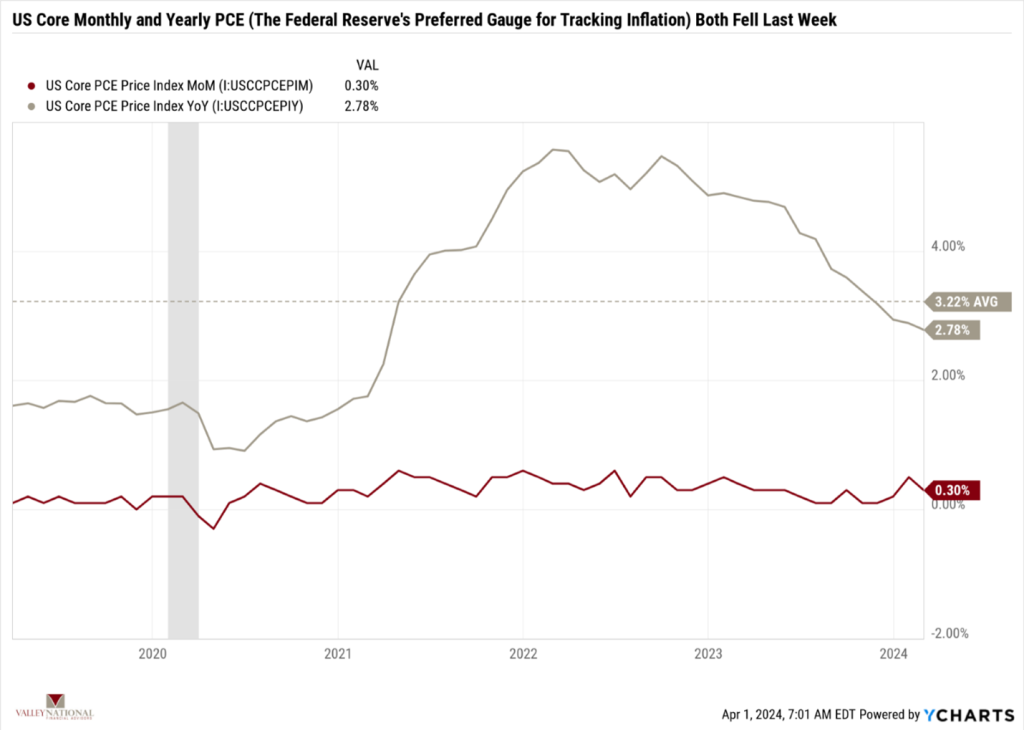

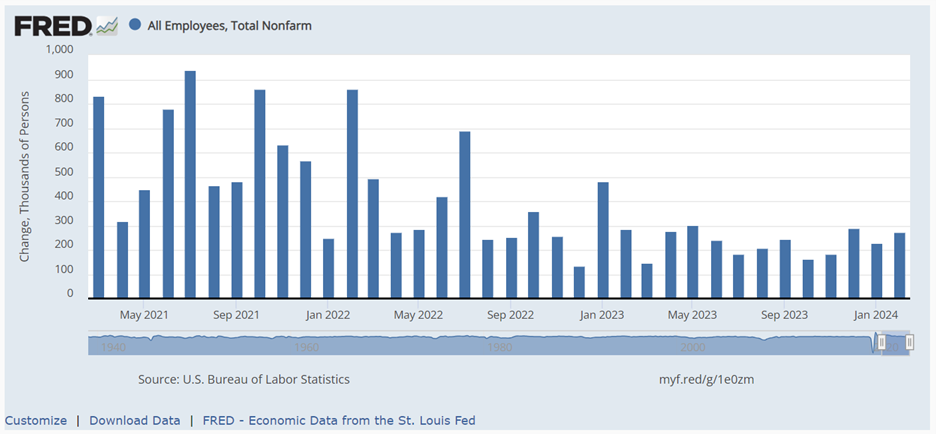

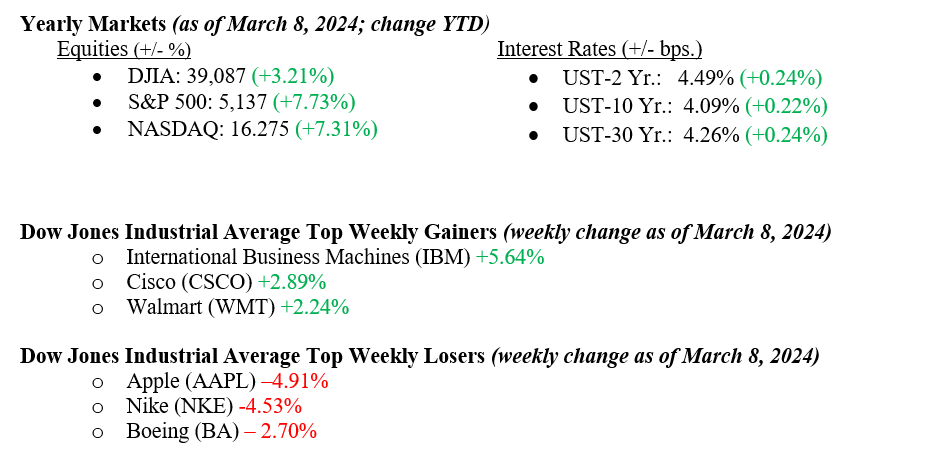

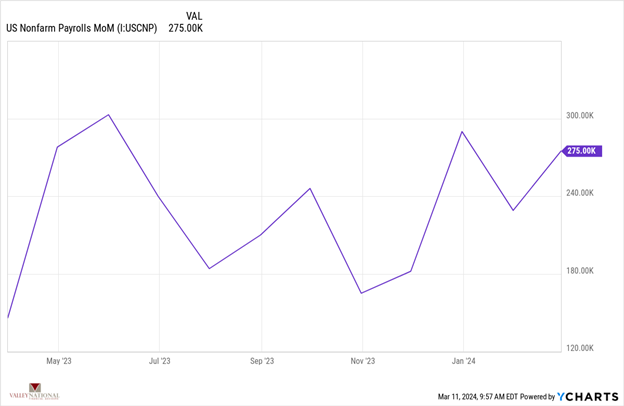

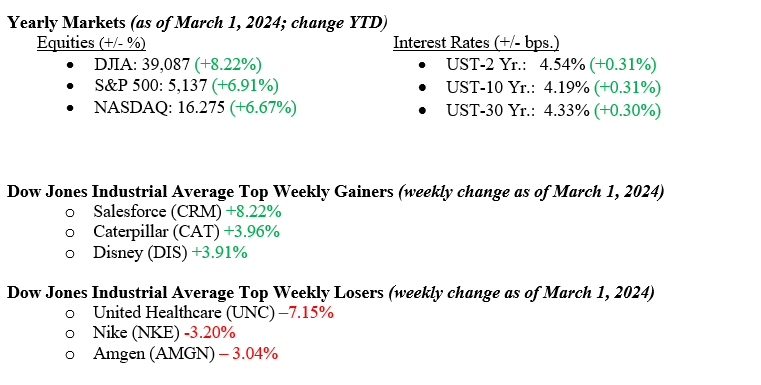

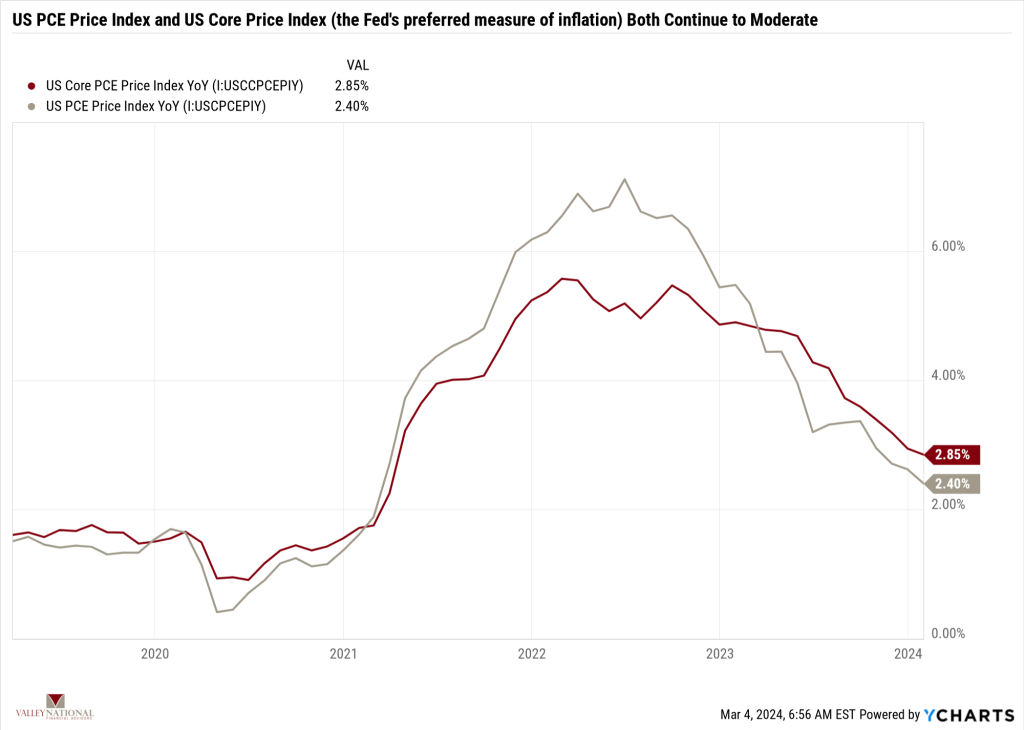

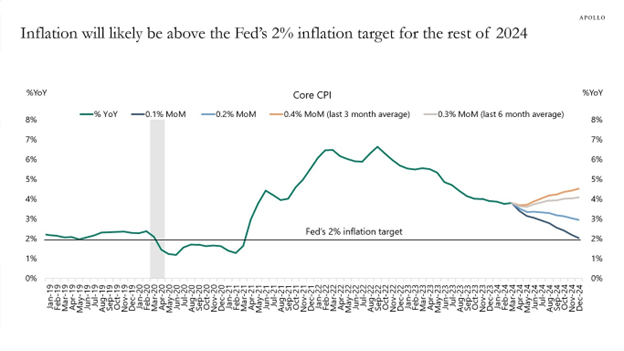

Interest rates continue to rise as they have all year, and we believe the current elevated rates will remain at this level for quite some time for three simple reasons. First, the economy continues to surprise on the upside with steady growth and expansion. Second, the labor market remains strong, with an unemployment rate near a 50-year low of 3.8% (BLS – Bureau of Labor Statistics). Third, inflation has not reached the Fed’s 2% target and, conversely, could remain above their target for 2024. See Chart 1 below from Apollo showing potential paths for inflation into year-end 2024.

Policy and Politics

As the latest escalation settles down, we expect markets to follow suit and settle down as well, but further retaliation from either side would force a flight to safety and quality, and we would expect U.S. Treasuries to rally and yields to fall as a result, so stay tuned!

In nationwide polls, President Biden and former President Trump are neck and neck. Still, Biden lags by approximately three percentage points in the crucial swing states that could determine the electoral victory. According to Prediction Markets, there is a 55% probability of a Democratic triumph.

Economic Numbers to Watch This Week

- U.S. Durable Goods New Orders MoM for March 2024, prior 1.37%

- U.S. Real GDP (Gross Domestic Product) for 1st Quarter 2024, prior 3.4%

- U.S. claims for Unemployment Insurance for the week of April 20, 2024, prior to 212,000

- U.S. Core PCE (Personal Consumption Expenditures) Price Index YoY for March 2024, prior 2.78%

- U.S. PCE Price Index YoY for March 2024, prior 2.45%

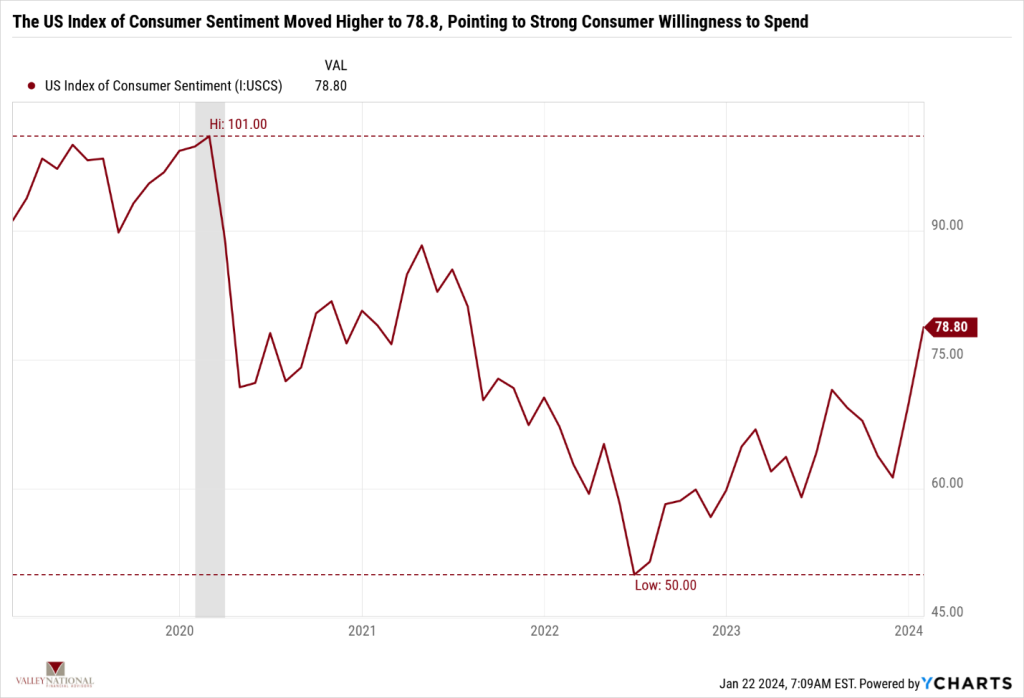

- U.S. Index of Consumer Sentiment for April 2024, prior 77.90

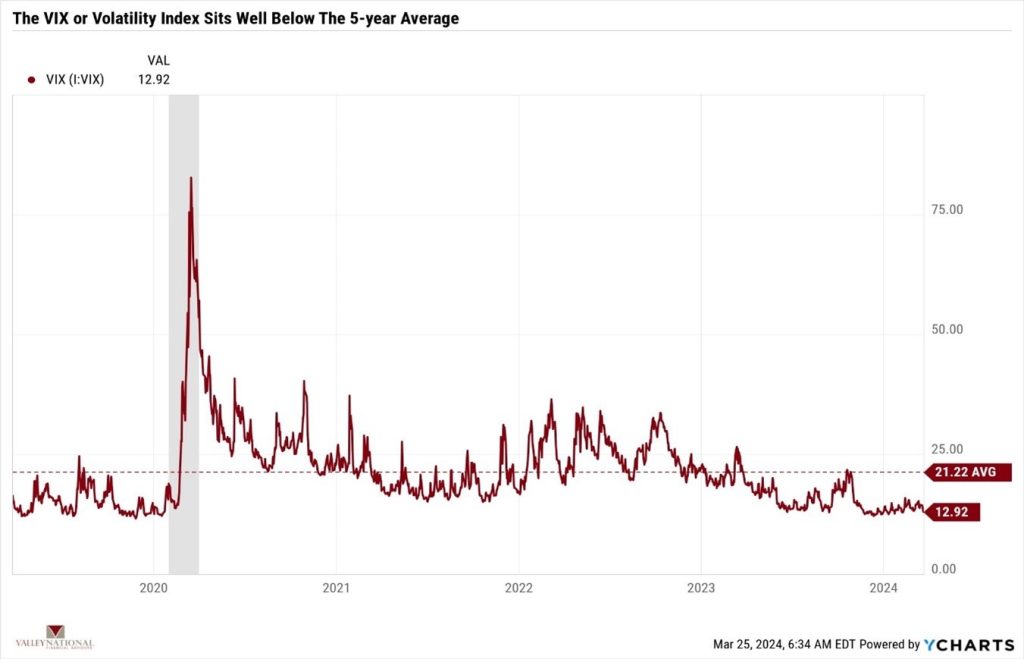

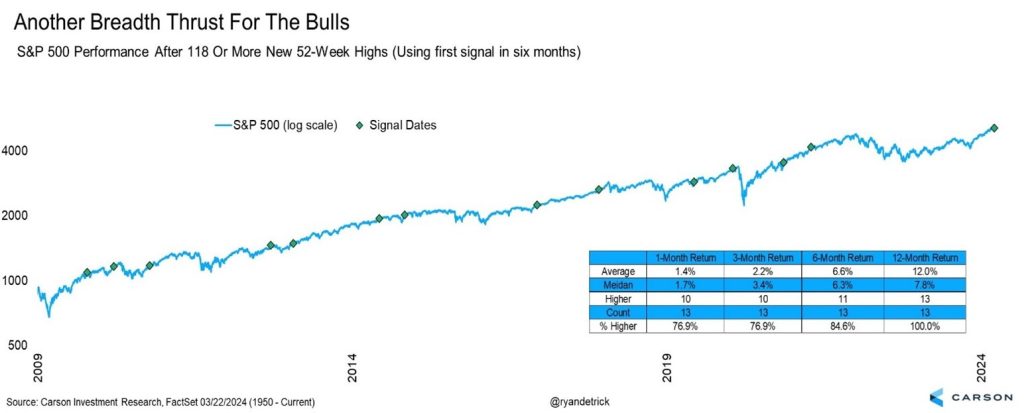

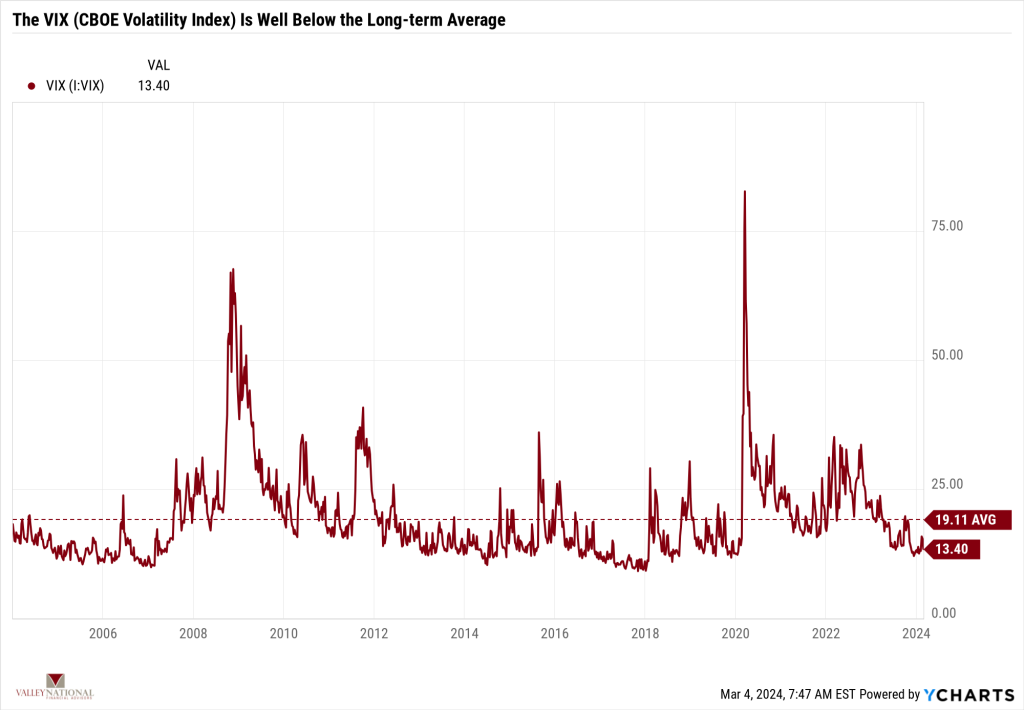

Following a strong stock market rally over the last six months, recent weeks have seen a softening trend. Market corrections are typical, and three main drivers of recent volatility have emerged: a reevaluation of Fed rate cut expectations, escalating geopolitical tensions, and ongoing first-quarter earnings season concerns. Despite market adjustments, the extent of the pullback has been contained against a still healthy macroeconomic picture and corporate earnings growth. We remain optimistic as CEO confidence is on the rise, indicating a greater willingness among firms to allocate more capital this year compared to last year. This confidence typically translates into increased hiring and investment in capital expenditures. Please reach out to your advisor at Valley National Financial Advisors with any questions.