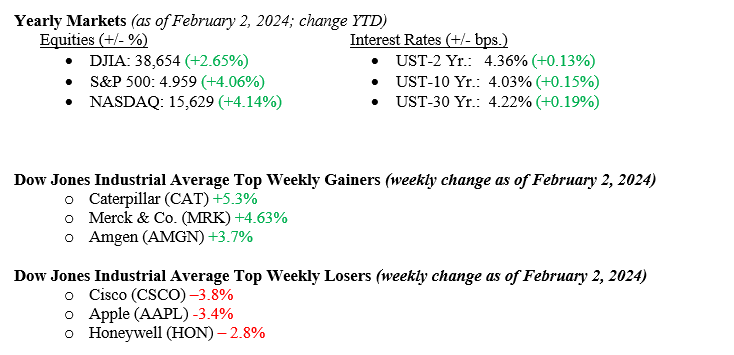

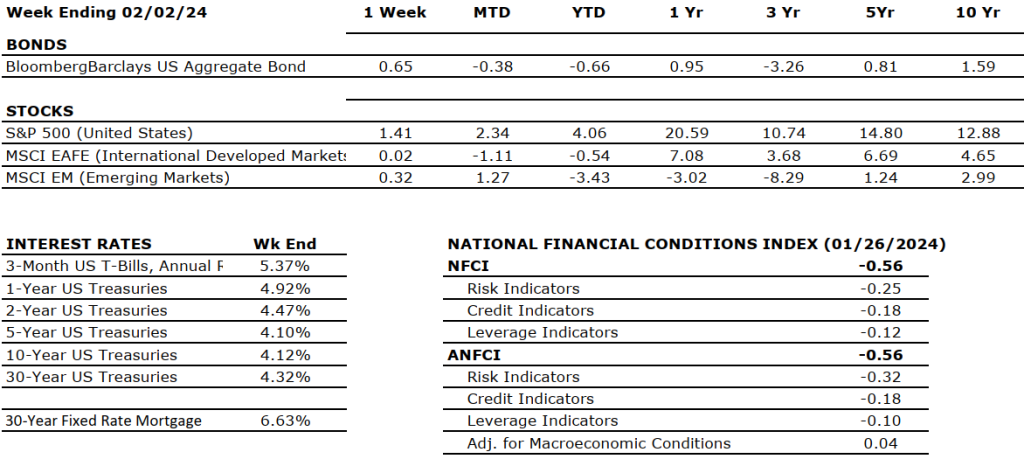

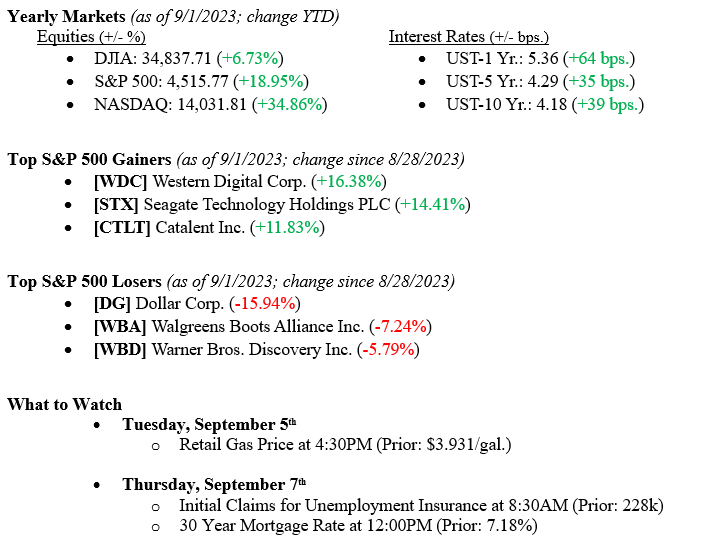

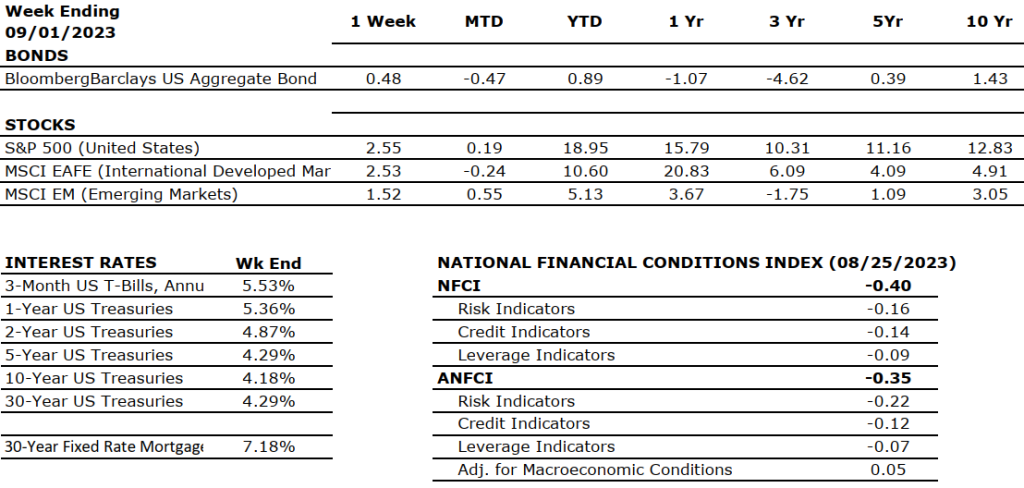

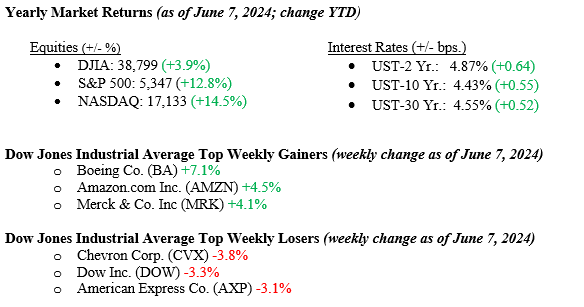

Last week, the markets saw modest rallies in all three major stock market indices. The NASDAQ led the charge, registering a 2.4% increase, while the Dow Jones Industrial Average saw a marginal rise of 0.3%, and the S&P 500 Index recorded a gain of 1.3%. Continued strength in technology, particularly those companies related to artificial intelligence such as Nvidia (NVDA), carried the week. While acknowledging the significance of market leaders such as NVDA and other AI giants, it’s essential to note that favorable returns are evident across all market sectors. This observation comes amidst the backdrop of the U.S. economy maintaining its status as a growth juggernaut. Last week’s new jobs report showed that for May 2024, the U.S. economy added 272,000 new jobs, which was well above economists’ forecasts for only 180,000 new jobs. The solid growth in new jobs and related wage growth leads us to believe that the Fed remains comfortably on the sidelines regarding rate cuts. The 10-year U.S. Treasury closed the week at 4.43%, eight basis points lower than the previous week.

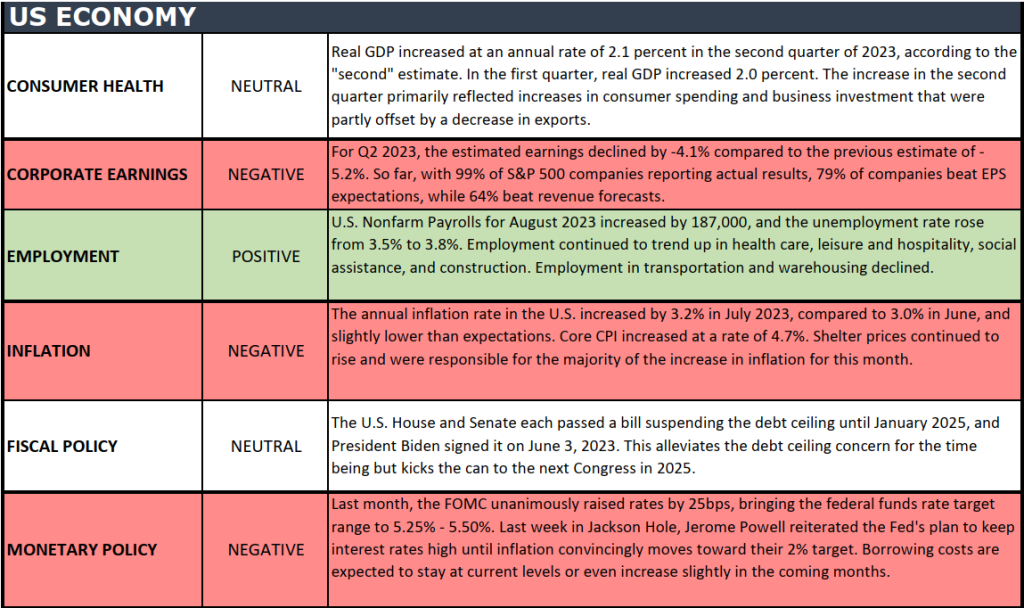

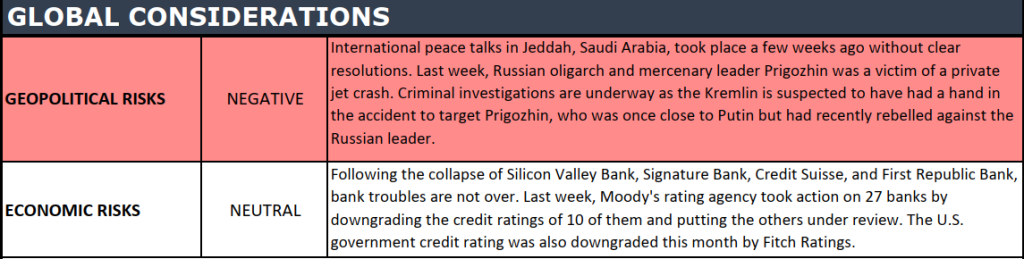

U.S. & Global Economy

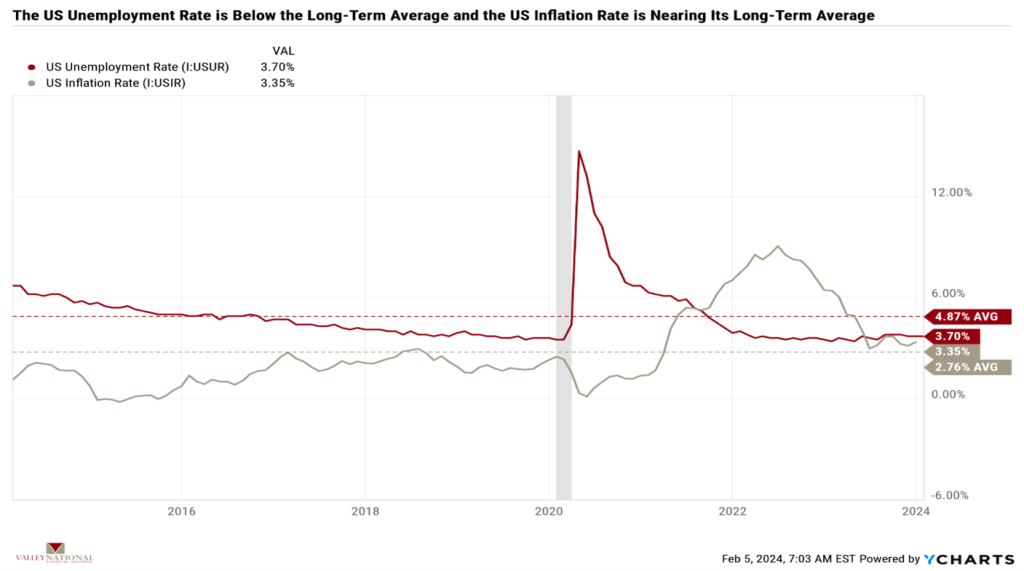

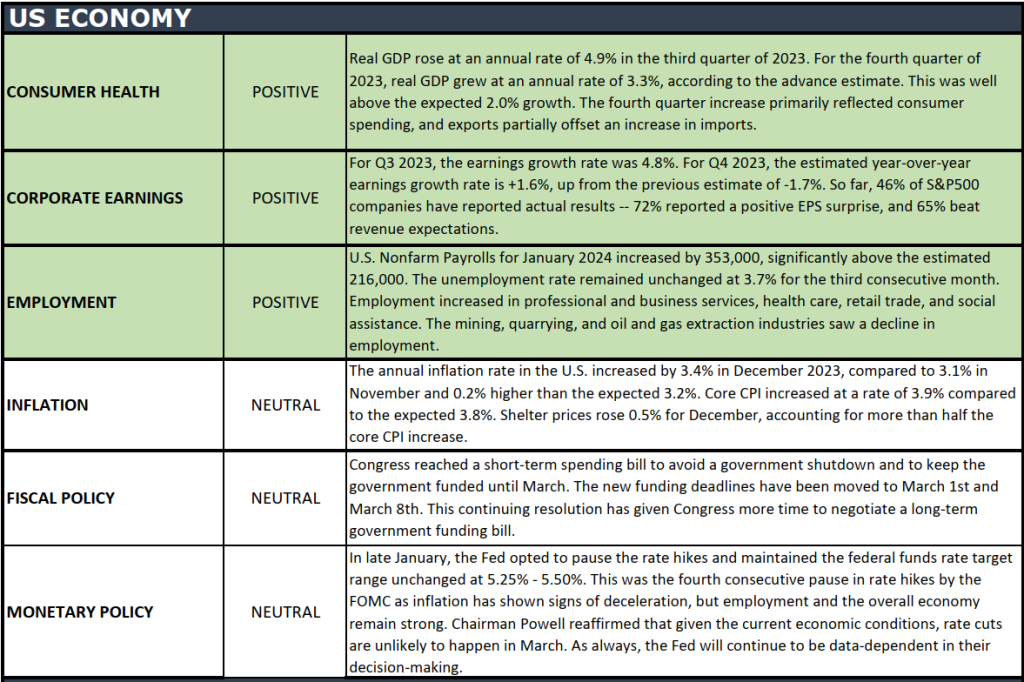

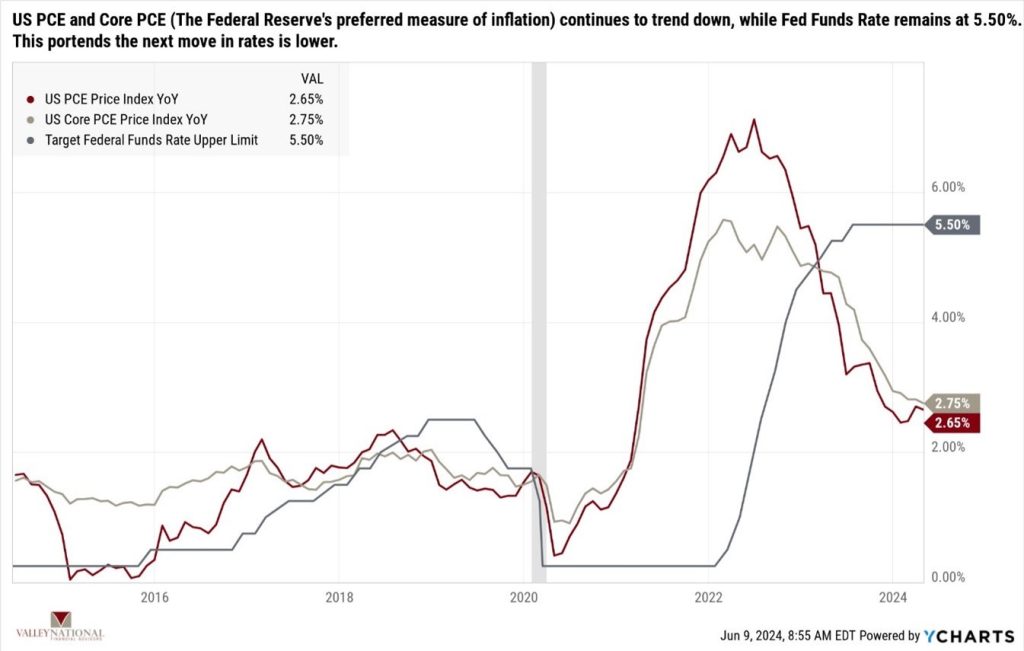

Economic data from last week suggests that the Federal Reserve, convening this week, will likely maintain its current stance on interest rates, opting to stay on the sidelines. We at Valley National Financial Advisors and all major economists agree that the next move by the FOMC will be to lower the Fed Funds Rate. However, not everyone agrees on when this will happen. Last week, we saw an explosive job number, as highlighted above. At the same time, we saw lower levels on the US PCE and Core PCE Index, which are the Federal Reserve’s preferred inflation measures. See Chart 1 below from Valley National Financial Advisors and Y Charts. The economic data released last week shows that the U.S. economy continues to grow and add jobs, and inflation continues to slowly but steadily decrease. The combined impact suggests that Fed Chairman Jay Powell is nearing completion of his goal, alluding to the elusive concept of a soft landing.

Policy and Politics

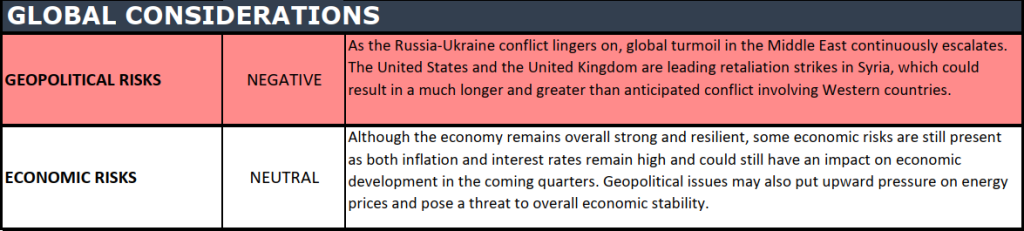

Despite ongoing global unrest, with conflicts in Ukraine and Israel persisting, there’s also notable progress in the expansion of democracies. Major leadership elections in Mexico saw Claudia Sheinbaum elected as the country’s first female president, while in India, over 652 million people voted, reaffirming their support for Prime Minister Narendra Modi. While unrest and suffering persist globally, it’s important not to overlook the positive developments. Often, these movements garner more attention from markets and worldwide economies than the prevailing negatives.

Economic Numbers to Watch This Week

- U.S. Consumer Price Index YoY for May 2024, prior 3.36%.

- U.S. Core Consumer Price Index YoY for May 2024, prior 3.62%.

- U.S. Inflation Rate for May 2024, prior, 3.36%.

- U.S. Target Fed Funds Rate as of May 2, 2024, current rate 5:50%.

- U.S. Producer Price Index YoY for May 2024, prior 2.17%.

- U.S. Core Producer Price Index YoY for May 2024, prior 2.37%.

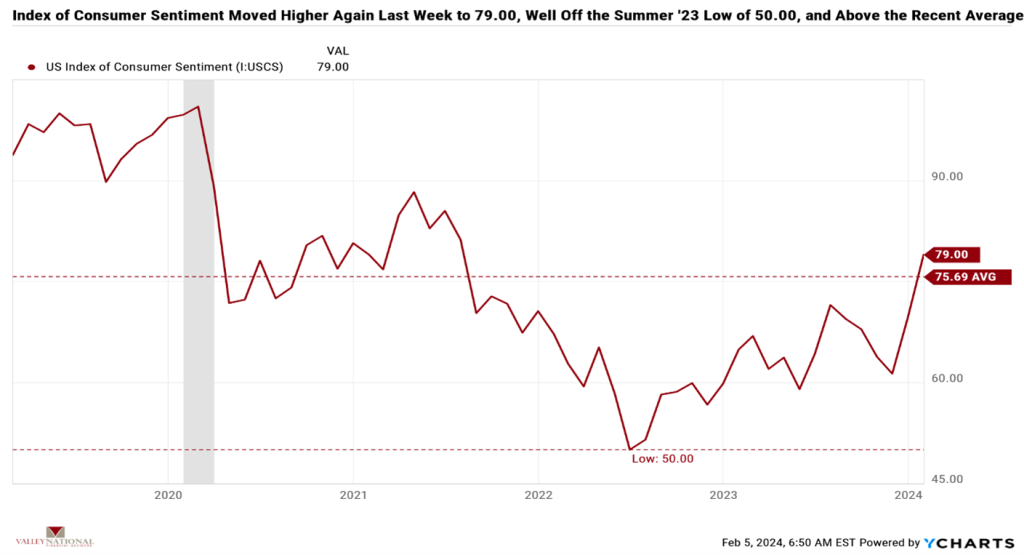

- U.S Index of Consumer Sentiment for June 2024, prior 69.10.

Last week, economic reports showed a growing economy (strong new job creation) with inflation retreating (PCE falling). This week, investors will get a fresh set of data, including Core CPI, the week’s FOMC meeting results, and the consumer sentiment index on Friday. Just understand and appreciate that the markets are more efficient than investors. If you look at where all the major stock market indexes have gone in the past year (hint: higher), you will see why investors should pay attention to long-term trends and only invest for the long term. Please contact your advisor at Valley National Financial Advisors with any questions.