“If you believe it will work out, you’ll see opportunities. If you believe it won’t, you’ll see obstacles.”– Wayne Dyer

Current Market Observations

By: Chief Investment Officer, William Henderson

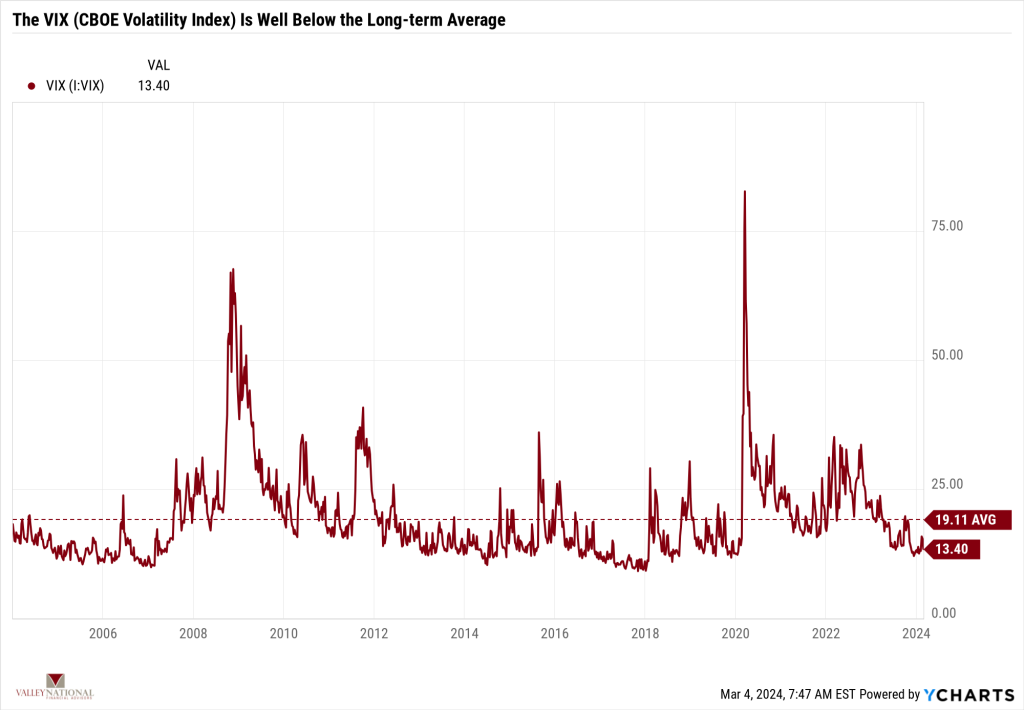

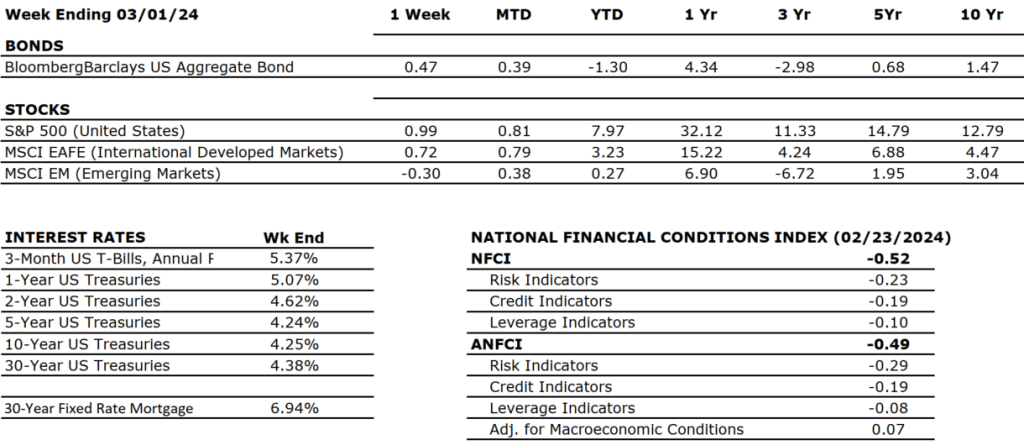

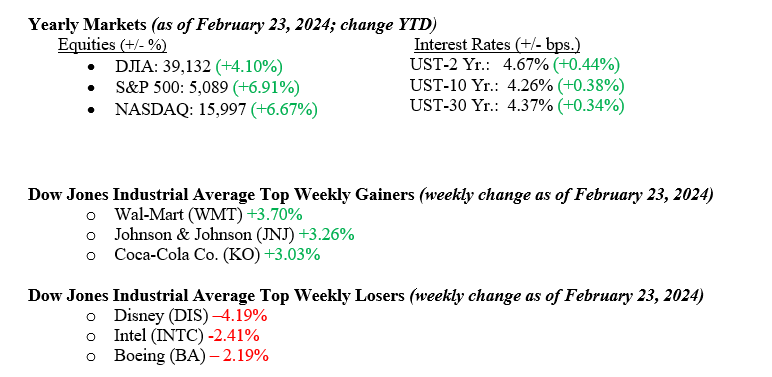

Equity markets were mixed last week, with two of the three major indexes reporting positive results and only the Dow Jones Industrial Average falling for the week. The S&P 500 Index rose +0.95%, the NASDAQ rose +1.74%, while the Dow Jones Industrial Average fell –0.11%. Critically important to a needed broadening in equity returns, the Russell 2000 Index of Small Capitalization stocks rose +3.00%. We do not typically report on the Russell 2000, but this week’s move higher has put some breadth into the market rather than keeping returns concentrated in the “Magnificent 7.” Concentrated markets tend to rise and fall quickly and are usually based on a small piece of information rather than sound fundamentals. Fixed-income markets were quiet last week as traders and markets have accepted that interest rate cuts by the Federal Reserve are further off than previously thought. The 10-year U.S. Treasury bond yield fell seven basis points to close the week at 4.19%.

U.S. Economy

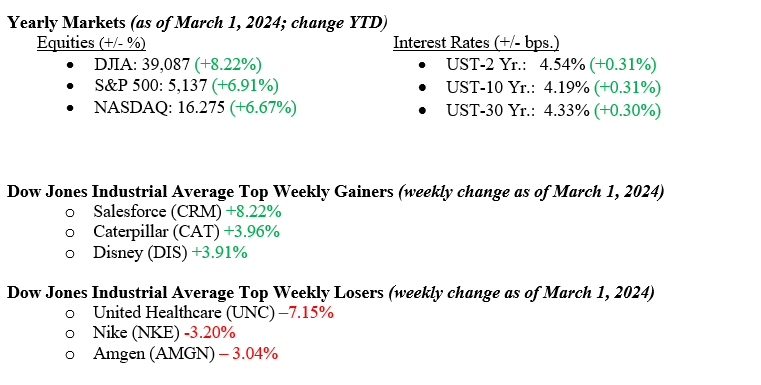

Last week’s inflation data showed that prices on consumer goods continue to fall. See Chart 1 from Valley National Financial Advisors and Y Charts showing U.S. Core PCE (Personal Consumption Expenditures) and US PCE YoY. The recent U.S. Core reading is at 2.85%, compared with 2.94% last month and 4.90% last year. This recent reading is lower than the long-term average of 3.24%. While the U.S. Inflation Rate is currently at 3.09%, below the Fed’s target of 2.00%, Fed Chairman Jay Powell has stated that interest rates could move before the inflation rate reaches their target. A Fed pivot (moving from raising rates to cutting rates) will help broaden out equity returns beyond the “Magnificent 7” because small-cap and mid-cap U.S. companies tend to be more interest rate sensitive than large-cap companies.

Corporate profits continue to be strong, and forward-looking estimates suggest we will see profit growth over the next year. Thus far, 90% of S&P 500 Index companies have reported 4th quarter earnings, and according to Bloomberg, revenue growth was +3.8%, while earnings growth was a healthy +7.5%. While much of the growth was attributable to the “Magnificent 7,” if the Fed does eventually pivot on interest rates (we expect not until the second half of 2024), cyclical sectors of the economy will benefit. Thus, economic growth will continue at a robust pace.

Policy and Politics

March 5th is Super Tuesday, with 15 U.S. states holding primaries on the same day. We expect that the 2024 U.S. presidential primary race will be determined after this date, and whether we have Trump v Biden or Haley v Biden, the next 8+ months will be chock full of the nonsense that sadly surrounds major U.S. elections these days. In the meantime, lawmakers have reached a tentative agreement (to be voted on this week) to fund the government, thereby avoiding another embarrassing shutdown.

We continue to watch the saga playing out with New York Community Bank, where last week they restated their previous earnings results and disclosed potential “weaknesses in internal accounting practices” (emphasis ours!). Banks can be fragile places because confidence in management means confidence in where one places their money for safekeeping. We are confident that the Federal Reserve Bank, the FDIC, and the Treasury know NYCB’s problems and will provide needed guidance and assistance.

What to Watch This Week

- U.S. Job Openings: Total Nonfarm, released 3/6/24, prior 9.026M

- U.S. Initial Claims for Unemployment Ins. for the week of 3/2/24, released 3/7/24, prior 215.000.

- U.S. Labor Force Participation Rate for Feb 2024, released 3/8/24, prior 62.5%

- U.S. Unemployment Rate for Feb 2024, released 3/8/24, prior 3.7%

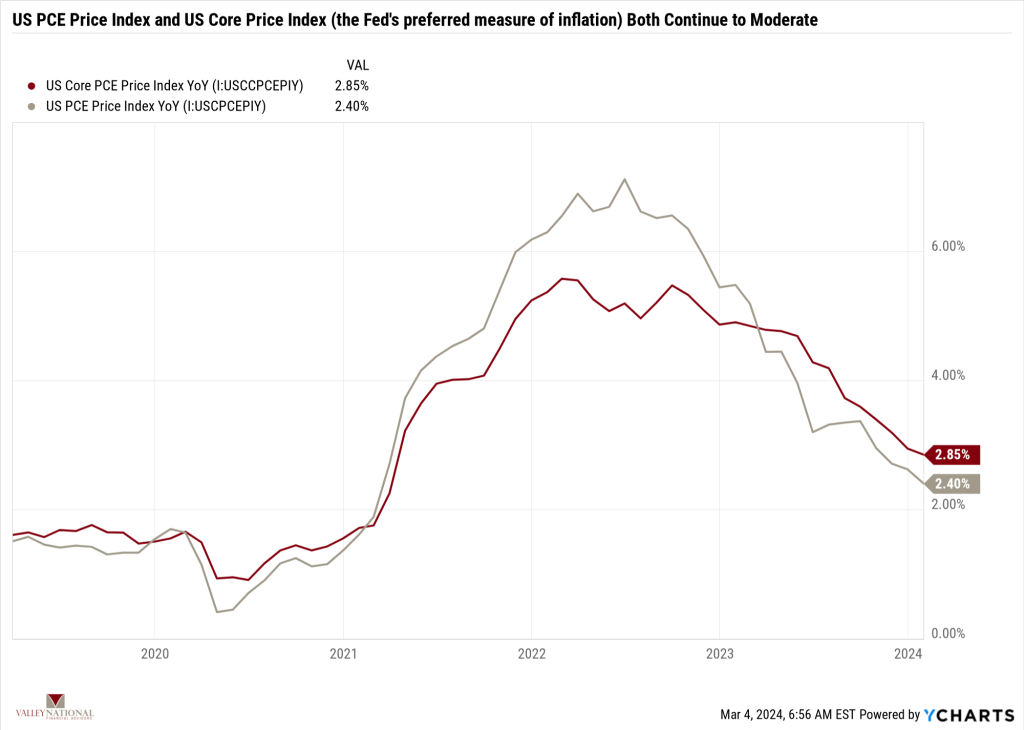

Market volatility remains sanguine, and other than the potential for a government shutdown, news from Washington DC has been muted. Global turmoil exists with Israel/Hamas and Ukraine/Russia, but true market volatility is muted. See Chart 2 below from Valley National Financial Advisors and Y Charts showing the VIX or Volatility Index. The VIX is at 13.40, well below the long-term average of 19.11. Our view on this data point is that true risks to the market, like higher interest rates and a major U.S. economic slowdown or disruption, remain on the sidelines, allowing markets to trade on their own merits.

Among the noise and news, markets continue to set new all-time highs as they efficiently filter out the noise. Low volatility, remaining fiscal stimulus from previous years’ bills (CHIPs Act or Inflation Reduction Act), and growing corporate earnings create real tailwinds for equities. If we get a Fed pivot on interest rates in the second half of 2024, further tailwinds will emerge. It is hard to find unwelcome news these days, but we will keep looking! Reach out to your advisor at Valley National Financial Advisors for help or questions.

“Your Financial Choices” Radio

Tune in Wednesday, 6 PM, “Your Financial Choices” on WDIY 88.1 FM. Laurie will be discussing: 2024 Tax Planning Now.

Questions can be submitted to yourfinancialchoices.com before the live show. Recordings of past shows are available to listen to or download at yourfinancialchoices.com and wdiy.org.

Did you miss the last show: Avoiding Estate Planning Mistakes with Attorney Peter Iorio? Listen Here

The Numbers & “Heat Map”

MARKET HEAT MAP

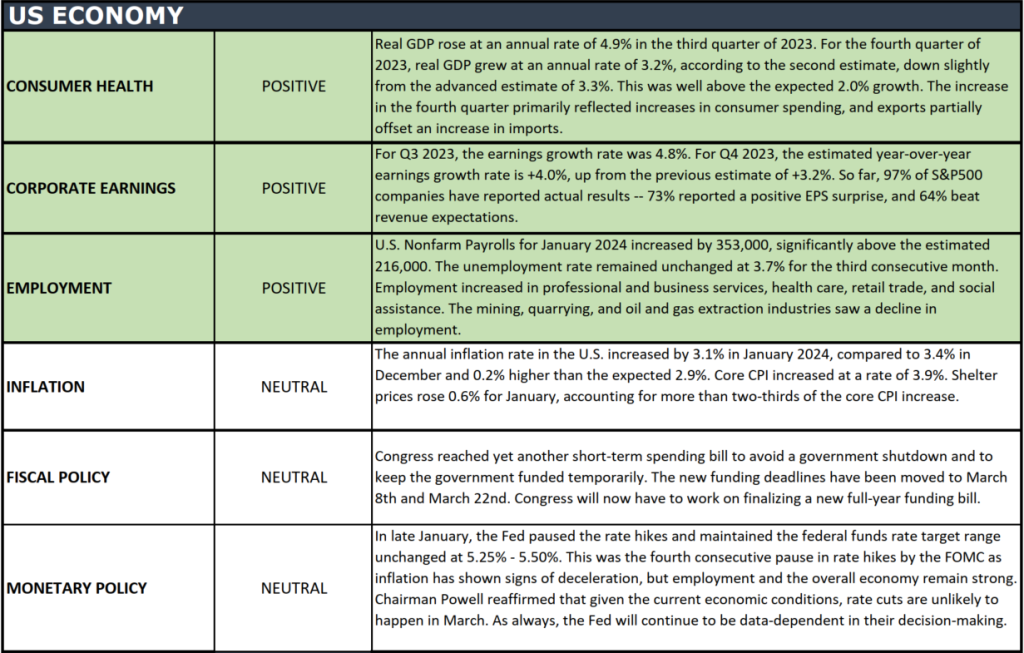

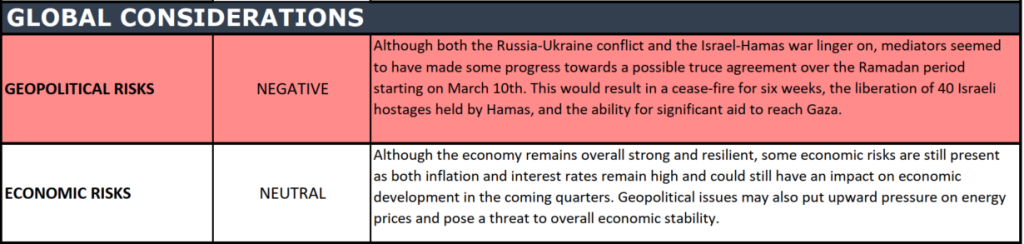

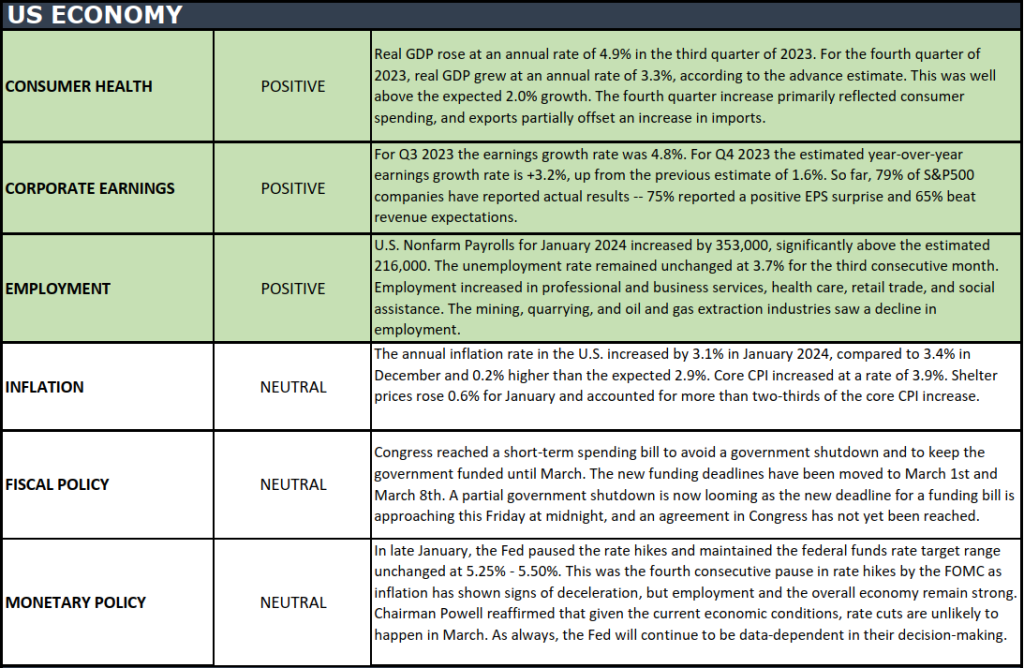

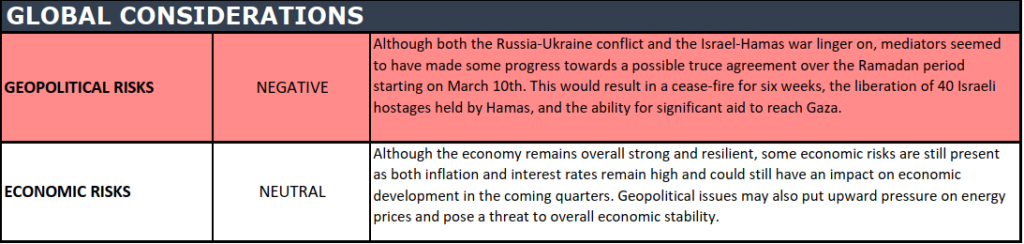

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade key economic conditions that we believe are of particular importance to investors.

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“It was one of those March days when the sun shines hot and the wind blows cold: when it is summer in the light, and winter in the shade” -Charles Dickens

Did You Know…? Why we have Leap Years?

In a typical year, tallying up the days from January to December in a calendar would sum up to 365 days. However, about every four years, February extends to 29 days instead of the usual 28. According to NASA, the Earth requires approximately 365.242 days to complete one orbit around the sun. It’s important to note the .242 part, an extra quarter of a day, around six hours each year, but for the sake of simplicity, this fractional day is conventionally rounded down to 365 days.

Those leftover six hours might not seem like a lot, but after four years, they pile up to a whole extra day, 24 hours! This accumulation prompts compensating for the surplus day to ensure chronological accuracy. Neglecting this adjustment could lead to a shift in seasons. Following 2024, February will have 29 days in 2028 and 2032.

To learn more about why leap year, visit NASA- Doing the Math on Why We Have Leap Day.

Current Market Observations

By: Chief Investment Officer, William Henderson

The shortened President’s Day Holiday week, with few economic news releases, allowed for one story to dominate the news and, therefore, market returns for the week. That story was AI (Artificial Intelligence) chip maker Nvidia’s (NVDA) 4th quarter EPS release, which showed the “Magnificent 7” member besting Wall Street analysts’ expectations for revenues and earnings. NVDA stock increased by +8.5%, adding $277 billion in market cap and notching a one-day Wall Street record. All major market indexes followed suit and ended the week higher: Dow Jones Industrial Average +0.9%, the S&P 500 Index +1.2%, and the NASDAQ +0.6%. An area of weakness in the stock market continues to be small capitalization stocks, which continue to lag the overall market. Fixed-income markets continue to push off any thoughts of rate cuts by the Federal Reserve before the second half of 2024. The 10-year U.S. Treasury bond yield fell four basis points to close the week at 4.26%.

U.S. Economy

It was a quiet week for economic releases. This week, we get the revised 4th quarter US GDP (Gross Domestic Product), which will be closely watched for upward revisions from the current +3.3%. Further, the February 2024 Index for Consumer Sentiment will be released, and the question will be whether consumer confidence moves higher yet again. Minutes from the January 2024 FOMC (Federal Open Market Committee) meeting confirmed what we have been saying for quite some time, that interest rate policy will remain data-dependent. Policymakers further stated that they continue to see risks of continued price stability.

Policy and Politics

Of course, 2024 is a US presidential election year, and Saturday showed former President Trump beating former South Carolina Governor Nikki Haley in the South Carolina GOP primary. While the race for the GOP candidate is not over, it is getting narrowed down, but we will know who the GOP candidate is on Super Tuesday (March 5).

Globally, politics and policy remain troubled as there is no end in sight for either Ukraine/Russia or Israel/Hamas.

What to Watch This Week

- U.S. Real GDP (Quarter over Quarter) for Q4 2023, released 2/28/24, prior 3.30%

- U.S. Core PCE (Personal Consumption Expenditures) Price Index for January ‘24, released 2/29/24, prior 2.93%

- U.S. Initial Claims for Unemployment Insurance for week of Feb 24, 2024, released 2/29/24, prior 201,000.

- U.S. Index of Consumer Sentiment for Feb 2024, released 3/1/24, prior 79.60.

Anytime a single stock’s action moves the markets, such as Nvidia did last week, we realize how thin the markets are and how starved for news and events Wall Street traders are. Certainly, the NVDA news was big, and adding a $277 billion market cap was a new record, but shouldn’t the real story be the economy? The U.S. economy continues to confound all the experts as it grows and adds employees each week. After 90% of S&P 500 companies have reported 4th quarter earnings, we see a healthy 7.5% earnings growth. We will be intrigued this week as new 4th Q GDP data and the important measure of consumer confidence will be released. Market focus will soon move to the March FOMC meeting and whether there will be any change in monetary policy. Reach out to your advisor at Valley National Financial Advisors for help or questions.

“Your Financial Choices”

Tune in Wednesday, 6 PM, “Your Financial Choices” on WDIY 88.1 FM. Laurie and her guest, Attorney Peter Iorio, from Fitzpatrick Lentz and Bubba, will be discussing: Avoiding Estate Planning Mistakes.

Questions can be submitted to yourfinancialchoices.com before the live show. Recordings of past shows are available to listen to or download at yourfinancialchoices.com and wdiy.org.

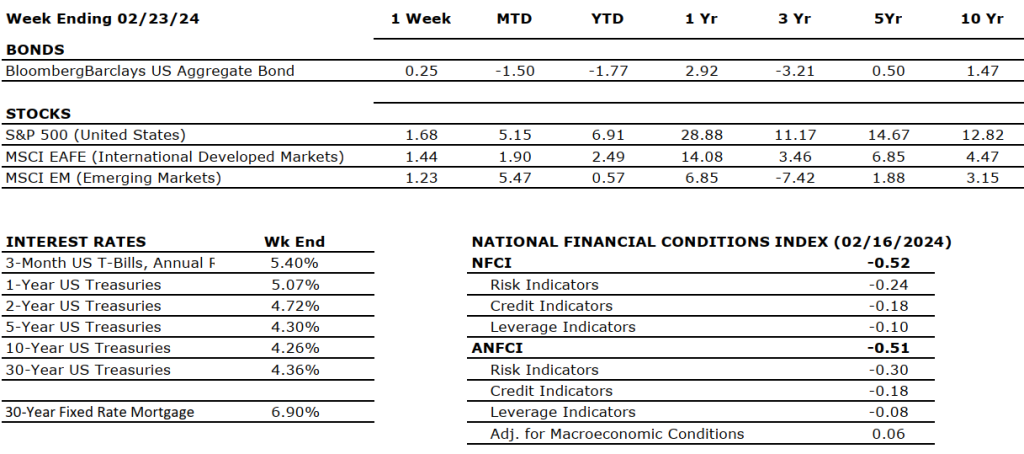

The Numbers & “Heat Map”

MARKET HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade key economic conditions that we believe are of particular importance to investors.

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Arriving at one goal is the starting point to another.” -John Dewey