Question: Due to my retirement, I have not been able to itemize. Do I still have to round up my real estate tax deductions to prepare my income tax return?

Answer: YES. Although homeowners can usually deduct property taxes only if they itemized their personal deductions, homeowners who did not itemize deductions can increase their standard deduction up to $1,000 ( $500 for single taxpayers) for real estate taxes paid in 2009 (this provision applies to 2010 also)

Daily Archives: January 13, 2010

The Big Picture

The combination of very low interest rates, massive federal deficits, and high stock market prices is unsustainable.

Interest rates will stay low only if growth remains slow. But, if economies grow slowly, then profits will not rise fast enough to justify current stock market share prices and incomes will not rise far enough to justify the prevailing level of house prices (see #5 in Facts That Make A Difference below for more info on home values).

If, on the other hand, the markets are right about the prospects for economic growth, and the current recovery is sustained, then governments (both U.S. and foreign) will react by cutting off the supply of cheap money later this year by raising interest rates among other maneuvers. Historically, the stock market has declined when interest rates started to rise.

In summary, government actions including the FED’s movements must be closely monitored. This is the best litmus test for the direction of the 2010 stock market.

Motivational Quote of the Week

“It’s wonderful what we can do if we’re always doing.”

–George Washington

Facts That Make A Difference

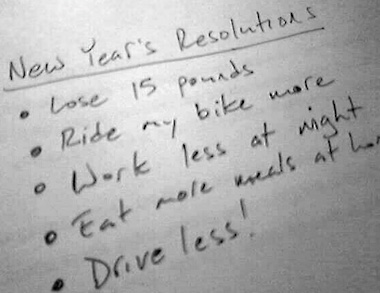

1. New Year’s Resolution?- the Dow industrials Index ended the first week of the new year up 190, or 1.8%, to 10,618, their highest level in more than 15 months. For what it’s worth, a strong five-day start has led to further gains three out of every four years in the Dow’s history. (source: Barrons).

2. Growing– online sales increased an impressive 15.5% this past holiday season (source: MasterCard Advisors Spending Pulse).

3. Out for a Movie – Americans shelled out $10,500,000,000 (that’s $10.5 Billion) at U.S. movie theaters in 2009, a record (source: Hollywood.com).

4. 58%– the percentage of parents who say they are not currently setting aside any money for their children’s college education (source: FINRA Investor Education Foundation).

5. Home, sweet, home – American homes are priced at around fair value on the basis of the long term relationship between current value and their market rental rate. Britain is still overvalued by 20%, and Australia, Spain and Hong Kong by 50% (The Economist magazine).

“Your Financial Choices” Airs on WDIY Wednesday Evenings, From 6-7 PM

The show is hosted by Valley National’s Laurie Siebert CPA, CFP®. This week Laurie will discuss Financial Planning: Putting The Pieces Together. Laurie will take your calls on this subject and other financial planning topics at 610-758-8810. WDIY is broadcast on FM 88.1 for reception in most of the Lehigh Valley; and, it is broadcast on FM 93.9 in the Easton/Phillipsburg area; and, it is broadcast on FM 93.7 in the Fogelsville/Macungie area – or listen to it online from anywhere on the internet. For more information, including how to listen to the show online, check the show’s website www.yourfinancialchoices.com

Personal Notes

Tea or coffee? I’ve been drinking mostly tea for the last few years. But, after reading about some medical benefits of coffee, I have been sharing cup-time with java. I have to admit, there’s something special about that first cup of coffee in the morning.

The Markets This Week

YOU might say 2010 began with a bang.

Stock indexes kicked off the new year’s first session with rare gains of more than 1%, and the opening number was backed by a rousing chorus: Auto sales are up, factories are buzzing with a hum unheard since the spring of 2006, and even Taser International (ticker: TASR) delivered a happy jolt with news of a big shipment of stun guns to Brazil — just in time for Carnaval.

Impressively, the vibe survived even after the market hit a discordant note. The government said Friday that employers had cut 85,000 jobs in December, disappointing those expecting hiring to begin anew (although officials revised November’s payrolls to show a marginal gain of 4,000 — the first job creation since the recession started). Yet stocks shrugged off the blow to inch higher Friday.

The Standard & Poor’s 500 rallied for the fifth time in seven weeks and the Nasdaq Composite Index added 48, or 2.1% to 2317 and is up 83% from its March low. The Russell 2000 jumped 19, or 3.1%, to 645.

Fresh highs were logged by sectors as disparate as financials, materials and semiconductors, and crude oil snaked higher on 11 of the past 12 trading days. In a potential break from 2009 patterns, commodity strength didn’t come at the dollar’s expense, and the buck fell less than 1% against both the euro and yen. Is this evidence investors are starting to look beyond the cost of government bailouts, toward the resulting, hard-won recovery?

Some 85% of S&P 500 stocks are now ahead of their 50-day averages. The median stock in the benchmark fetches 22.2 times earnings, and while many investment advisers are bracing for an inevitable but mild correction, a whopping 72% are bullish. A well known research firm warns the market is becoming “overvalued and over-believed,” but he is still tilting bullish, perhaps mindful of the danger of fighting market momentum too early.

So here we are, noses to the wind, straining to catch the first whiff of trouble. Our checklist of warning signs: A jump in the 10-year Treasury yield and long-term interest rates, a shunned Treasury auction that signals sated appetite for U.S. debt, and any hint of faltering global growth. Most important, if more good news fails to lift shares, that would suggest expectations have become too exacting. But there was no such failure amid last week’s celebration (Source: Barrons Online).

The Numbers This Week

In an unusual occurrence last week, U.S. Stocks, Foreign Stocks and bonds all increased. During the last 12 months, STOCKS have substantially outperformed bonds.

Returns through

1-08-2010 1-week Y-T-D 1-Year 3-Years 5-Years 10-Years

Bonds-

BarCap

Aggregate Index .4 .4 6.3 6.0 5.1 6.4

US Stocks-

Standard & Poor’s

500 2.7 2.7 28.9 – 4.7 1.4 -.5

Foreign Stocks-

MS EAFE

Developed Countries 2.3 2.3 27.3 -7.6 1.8 -.4

Source: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Assumes dividends are not reinvested.