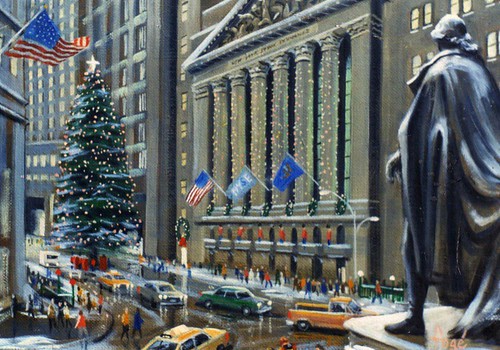

(Photo courtesy artist Bill Foge)

Stocks kept their winning streak alive last week, even if in the muted fashion typical of the stretch before Christmas.

The Standard & Poor’s 500 Index gained 3.51 points, or 0.28%, on the week, closing at 1243.91. That was its highest closing since Sept. 19, 2008, just days after the Lehman Brothers collapse. If it moves above its “pre-Lehman level,” as one market watcher called it, of around 1250, there would be some good reason for optimism about 2011.

Small-cap stocks, as measured by the Russell 2000, climbed 0.34%, to 779.51—the benchmark’s fifth consecutive weekly gain. The blue-chip Dow Jones Industrial Average was up 81.59 points, closing at 11491.91, its third straight week of gains. And the tech-heavy Nasdaq Composite notched its fourth week of gains, climbing 0.21% to 2642.97. That marked its fourth straight week of appreciation.

Behind the uniform gains, however, some pros saw an important shift taking place. “You’re seeing people de-risk, to some extent,” says Mike O’Rourke, chief market strategist at BTIG. In other words, they’re starting to take profits from small caps and plow the money into more stable large caps, reversing a big trend of 2010.

FedEx (ticker: FDX) was perhaps the most interesting of the big stocks last week. The shipping giant, considered a proxy for the economy, said its profits fell by 19% in its most recent quarter. Investors, however, didn’t punish the stock, taking comfort in the company’s raised outlook for the rest of the year. FedEx closed Friday down only slightly for the week, at about 93.

The week also brought some good economic news, helping the climate for stocks, including an uptick in sentiment among small businesses. And in Washington, the Republicans and Democrats worked out a deal on extending the Bush tax cuts, long popular on Wall Street. President Obama signed the bill on Friday.

Interest rates backed up early last week, and the dollar strengthened. The 10-year Treasury’s yield climbed to 3.568% last Thursday, the highest it’s been since May, before finishing the week at 3.329% as more buyers emerged. Still, yields have moved up steadily as 2010 has wound down. The U.S. Dollar Index, which measures the greenback against a basket of currencies, was around 80.4, versus 75 and change in early November.

Several weeks do not make a trend. There is considerable debate on whether rates will continue to rise and how much strength the dollar actually has. But no matter how they play out, these two issues are sure to be central to the stock market’s performance in 2011 (Source: Barrons Online).

The Weekly Commentary

Observations of the current state of the stock and bond markets