“Planning is bringing the future into the present so that you can do something about it now.”

– Alan Lakein

Monthly Archives: April 2018

The Markets This Week

by Connor Darrell, Head of Investments

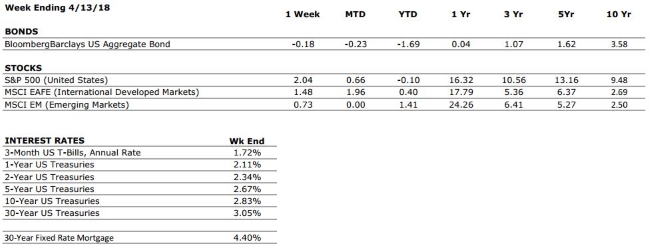

Earnings season is now in full gear and the initial data has been quite strong. According to Factset, a little less than 20% of S&P 500 companies have reported earnings thus far, and the blended earnings growth rate for these companies has been 18.3%. The healthy earnings growth pushed equity markets higher for the second straight week, while bonds finished down as the ten year Treasury note pushed close to 3%. The 3% threshold will be an important milestone in the normalization of interest rates. Rising interest rates have been discussed ad nauseam in financial news outlets, but are a natural part of the economic cycle and should be expected to continue as the economy strengthens. The Bureau of Economic Analysis will release its first estimate of Q1 2018 GDP growth this week, and investors will likely be focusing on the year over year numbers as they look for further evidence of an improving economy.

What Happened To the Infrastructure Bill?

Following the passage of tax reform at the end of last year, it was widely expected that lawmakers would quickly shift their attention to infrastructure. For the time being, scandals, international tensions, and unrest within the Trump Administration seem to have slowed the legislative momentum established following the tax victory, and it now looks unlikely that an infrastructure spending bill will be introduced in Congress until after the mid-term elections in November. From a market perspective, the delay is unlikely to have major implications, but from an economic growth standpoint, an infrastructure bill could be an interesting wild card.

In terms of economic impact, infrastructure spending has similar effects to tax cuts. The increased spending on projects should have a positive impact on labor markets and create new jobs. In theory, those workers then have more money in their pockets to spend on goods and services, which should be a tailwind for economic growth. Many observers have been quick to point out that some aspects of the tax bill are “front loaded”, in that their effects phase out over time. An infrastructure bill passed during 2019 could potentially pick up some of the slack and help to carry growth momentum a little bit further, essentially allowing us to squeeze even more juice out of this long expansion. Given that outlook, it is entirely possible that this becomes the longest economic expansion in history, exceeding the period from 1991 to 2001 when the US experienced 120 straight months of economic growth. Given that the current expansion is already over 105 months old, there isn’t a lot further to go.

Of course all of this is incredibly difficult to project with any real degree of confidence, especially when considering the myriad of external factors and the possibility of significant changes to the composition of congress following the mid-term elections. But even without further stimulus in the form of infrastructure spending, the economy remains on firm footing and the risks of recession remain relatively low in the immediate future.

Heads Up!

by Thomas M. Riddle, CPA, CFP®, Founder & Chairman of the Board

Here is another big PLUS for Americans’ wealth. Home prices are trending up nicely and that trend could last for years and maybe decades. The reason: the U.S. is facing a housing shortage. And, what happens when demand outpaces supply? Prices rise! Home prices nationally rose 6.2% in the year that ended in January, roughly twice the rate of incomes and three times the rate of inflation, according to the S&P CoreLogic Case-Shiller National Home Price Index.

America’s housing shortage is more wide-ranging than simply the coastal states. The shortage stretches from pricey locales such as California and Massachusetts to more surprising places, such as Arizona and Utah. According to Barrons, some 22 states and the District of Columbia have built too little housing to keep up with economic growth in the 15 years since 2000, resulting in a total shortage of 7.3 million units. Home construction per household remains near the lowest level in 60 years of record-keeping, according to Jordan Rappaport, an economist at the Federal Reserve Bank of Kansas City.

At the same time, it is becoming more difficult to build all across America due to shortages of land, labor and materials – trends which will takes years, or maybe decades, to resolve.

Now is a good time for renters to reconsider how home ownership can significantly add to long term wealth.

Valley National News

Our team is competing in the Volunteer Challenge for the third year in a row! Our entire staff participates in these projects to assist local non-profits and ultimately support the Volunteer Center of the Lehigh Valley. This year many of our clients and friends in the community assisted with our project by donating to our food drive. We were able to deliver 241 pounds of food. In addition, our team sponsored a monetary donation that will provide 12,000 meals. Last but not least, our staff split up and took the time to volunteer at the Second Harvest warehouse to package food boxes for seniors and food backpack for children. We are looking forward to the final event on Tuesday, May 15 – https://www.volunteerlv.org/volunteer-challenge

Our team is competing in the Volunteer Challenge for the third year in a row! Our entire staff participates in these projects to assist local non-profits and ultimately support the Volunteer Center of the Lehigh Valley. This year many of our clients and friends in the community assisted with our project by donating to our food drive. We were able to deliver 241 pounds of food. In addition, our team sponsored a monetary donation that will provide 12,000 meals. Last but not least, our staff split up and took the time to volunteer at the Second Harvest warehouse to package food boxes for seniors and food backpack for children. We are looking forward to the final event on Tuesday, May 15 – https://www.volunteerlv.org/volunteer-challenge

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer spending is expected to strengthen as individuals with lower tax rates spend their windfalls. |

|

FED POLICIES |

C- |

The Federal Reserve increased the Fed Funds Rate by 0.25% in March, and is expected to implement at least 2 more hikes this year. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

A- |

4th quarter earnings season was stellar, with S&P profits growing at a fast pace. Q1 2018 earnings season kicks into full gear this week. |

|

EMPLOYMENT |

A+ |

The unemployment rate currently stands at 4.1%, the lowest reading since 2000. March’s headline jobs growth number was slightly below expectations, but there is substantial evidence that the prospects for those seeking work are very favorable. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

While you may not have watched all the hours of testimony from Mark Zuckerberg, you have probably heard a bit about Facebook in the news lately regarding data. Did you know that users can download a copy of the personal data that Facebook holds? https://www.facebook.com/help/302796099745838 Users can also access data from Google, LinkedIn and many other web-based communities.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®. Laurie will not host live shows for the next two weeks – April 18 & April 25. Instead you can tune in to WDIY at the normal time for a recorded show. Questions submitted online will be addressed on the next live show scheduled for May 2. For more information, including how to listen to the show online, check the show’s website www.yourfinancialchoices.com and visit www.wdiy.org.

Quote of the Week

“No winter lasts forever; no spring skips its turn.” – Hal Borland

The Markets This Week

by Connor Darrell, Head of Investments

Despite a busy week in Washington headlined by Speaker of the House Paul Ryan stepping down from his post, stocks managed to climb 2% higher last week. The market’s gains were bolstered by a rebound in technology and energy stocks. Facebook CEO Mark Zuckerberg endured two difficult days of Congressional testimony surrounding data security and privacy on the web. The testimony was well-received by the markets. Bonds were down slightly after the minutes from the most recent Federal Reserve meeting were released and suggested further rate hikes remain likely.

Now that the first quarter of 2018 is in the books, investors can shift their attention to the first earnings season under the new tax laws. Throughout Q1, the stock market was hampered by shifting inflation expectations, a selloff in technology stocks, and fears of an all-out trade war, but the steady flow of new corporate earnings data that is set to commence this week should provide investors with a (much needed) new area of focus. According to Factset, the market is expecting 17.1% growth in corporate earnings, which would be the highest growth rate since 2011. The strong estimates are a product of the reduced corporate tax rates under the new law, as well as increasing consumer confidence and economic growth.

Time to Follow Through

The optimism for earnings growth is in stark contrast to some of the nervousness that markets have exhibited over the past few months, where intra-day selloffs of more than 1% have been commonplace. That divergence is in many ways a microcosm of the increasingly conflicting signals that investors must grapple with moving forward. Shifting economic policies in the US and the potential for rising inflation and interest rates are offset by improving economic growth and consumer confidence around the world. But if Q1 taught us anything, it’s that expectations can only get us so far. At some point we need to see real tangible progress, and Q1 earnings season is the market’s first opportunity to prove to us that all the optimism surrounding tax reform’s impact on corporate profits was justified. If earnings live up to all the hype, stocks could find more stable footing and finally put some of these trade fears in the rear view mirror. If it doesn’t, we could all be left a little disappointed.

Heads Up!

by Thomas M. Riddle, CPA, CFP®, Founder & Chairman of the Board

CLICK HERE TO GET TO KNOW TOM

The next three decades hold extraordinary promise. Breakthroughs in robotics, healthcare & biomedical, 3D print manufacturing, artificial intelligence, and many other fields collectively hold the potential to spectacularly raise U.S. living standards. But, and there is a “but” unfortunately, the U.S. faces a significant obstacle to achieving this promise. That obstacle is high and quickly escalating U.S. debt levels and the annual interest payments on it.

Within 5 years the U.S. may enter a vicious spiral when debt is growing, interest payments are growing even faster and Treasury debt holders start to doubt our government’s ability to repay. At such a time interest rates could rise to compensate Treasury debt investors for taking the risk. Higher interest costs will be financed by even more debt – and the spiral continues.

When the spiral starts, Washington will face difficult choices to attempt to fix the problem: cut expenses (including Entitlements) or raise taxes. Based upon my 45 years of work experience, including 3 years with the U.S. Treasury Department, I believe it is highly likely Washington will raise taxes. The tax increase will have to be substantial to stop the spiral.

What will result when the U.S. dramatically raises taxes? Wealth, and the breakthroughs funded by it, may move to other countries with lower tax burden. You do not have to too look far to find examples of this phenomena on a local level. What caused the many corporate high rises in Conshohocken and City Line Avenue to be built instead of the highly taxed Philadelphia? Same for the incredible number of commercial buildings in Northampton and Lehigh counties instead of the higher taxed state of New Jersey. Or, southern Wisconsin instead of Illinois/Chicago. Or, Nevada instead of California. The bottom line is the debt spiral will probably continue.

In the near future we will report on the signs to look for when investors lose confidence in a country’s ability to repay its debts – history is full of examples.