Tomorrow is the Volunteer Challenge event, but there is still time to vote for your favorite project (before 6:30 p.m. tonight). Click here to see them all, plus available silent auction items. Click here to go direct to our project page. Thank you for helping us support awareness for the Volunteer Center of the Lehigh Valley.

Daily Archives: May 14, 2018

The Numbers & “Heat Map”

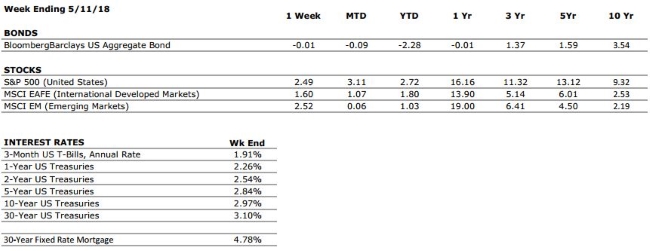

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer spending is expected to remain healthy as individuals with lower tax rates spend their windfalls. |

|

FED POLICIES |

C- |

The Federal Reserve increased the Fed Funds Rate by 0.25% in March, and is expected to implement at least 2 more hikes this year. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

A |

Q1 Earnings season is almost over, and it has been fantastic. US companies are reporting YoY earnings growth of almost 25%. |

|

EMPLOYMENT |

A+ |

The unemployment rate has dropped below 4% for the first time since 2000. Additionally, there are over 6 million unfilled job openings throughout the economy; close to an all-time record. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

by Jessica Goedtel, Senior Associate

If you are a Pennsylvania resident and are considering leasing a car, you should know that Pennsylvania imposes an additional 3% tax on the lease of motor vehicles, in addition to the state 6% sales tax. This special tax is collected and put into the Public Transportation Assistance (PTA) Fund, and is dedicated to funding mass transportation.

This tax is 3% of the total lease price, and applies to motor vehicles leased for 30 days or more. When deciding on whether to purchase or lease a new vehicle, make sure to factor in this additional cost.

Click here to read more about the PTA Fund and applicable fees and taxes on the PA Dept of Revenue website.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®. This week Laurie and her guest, Attorney Mark Aurand of Greater Good, LLC, will discuss:

“Accessible legal considerations for small business and nonprofit startups.”

Laurie will take your calls on this or other topics. This show will be broadcast at the regular time WDIY is broadcast on FM 88.1 for reception in most of the Lehigh Valley; and, it is broadcast on FM 93.9 in the Easton and Phillipsburg area– or listen to it online from anywhere on the internet. For more information, including how to listen to the show online, check the show’s website www.yourfinancialchoices.com and visit www.wdiy.org.

Quote of the Week

“Really great people make you feel that you, too, can become great.” – Mark Twain

The Markets This Week

by Connor Darrell, Head of Investments

Stocks posted their strongest weekly gain in over 2 months last week, with energy stocks leading the way amid further increases in the price of oil. It certainly won’t be celebrated by those of us traveling for summer vacations over the next couple of months, but oil prices are likely to remain elevated if the Trump Administration is able to reinstate economic sanctions on Iran. International markets also posted gains on the week.

Bonds had a relatively uneventful week, but remain under the microscope of many investors and media outlets as interest rates creep higher. We discuss some of our thoughts on what the market might be overlooking in our update below.

The Bigger Unknown in Monetary Policy “Normalization”

Likely due to their direct influence over the interest earned on savings and paid on loans, the Fed’s interest rate decisions seem to get all of the attention when it comes to discussions of monetary policy. However, faced with the unenviable task back in 2008 of combating the deepest recession in a generation, the Fed pulled out all the stops, using every tool in its arsenal to inject life back into the US economy. As a result, in addition to the traditional (and oft discussed) avenue of pulling interest rates down near zero, the Fed also implemented multiple rounds of Quantitative Easing, an unprecedented expansion of Reserve Bank Credit (the Fed Balance Sheet). This was accomplished by purchasing trillions of dollars’ worth of bonds in the open market in order to inject more money into the financial system and increase liquidity in markets. The ultimate purpose of the policy is largely the same as the reduction in interest rates, but it is widely considered to be a much more extreme approach.

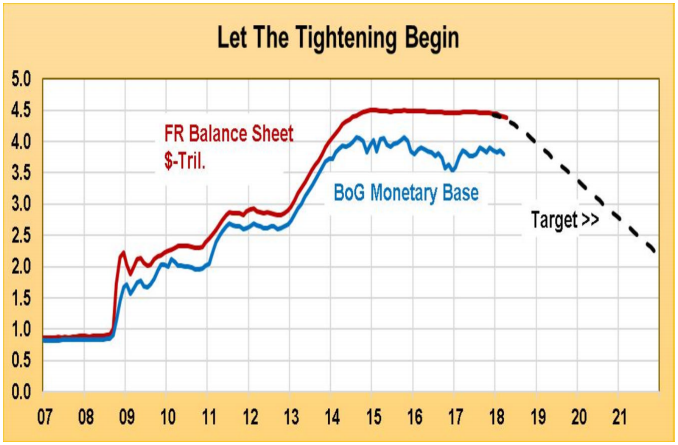

Between October of 2008 and December of 2014, the value of the Federal Reserve’s balance sheet swelled from $0.9 trillion to $4.5 trillion (see below chart from Argus Research) as it continued to purchase bonds. Since then, the balance sheet has remained largely untouched, but the Fed has made clear in its communications that this will soon change. The consensus among forecasters is that the Fed will begin the process of shrinking its balance sheet later this year by allowing maturing bonds to roll off and ceasing its reinvestment of coupon payments, to the tune of about $50 billion per month.

Like all markets, the bond market is driven primarily by supply and demand, and with the Fed reversing its policies, the underlying balance of supply and demand will undoubtedly be altered. What would this mean exactly? The ultimate results are very difficult to predict. If the Fed is able to effectively telegraph its moves (as it intends), then markets may be able to adjust gradually with no major impacts. But if the balance shifts more than anticipated, then a major dislocation could take place. Under such a scenario, the laws of supply and demand would dictate that the oversupply of bonds on the market would drive prices down, and yields up.

That short term rates will increase from here is highly likely and largely assumed by most investors, so in our view, the potential impact of the Fed’s balance sheet unwind, which would occur in addition to the trends already in place, is the bigger “unknown” as we move away from the accommodative monetary policies of the last decade. Given its current size, it may be appropriate to say that we consider the Fed’s balance sheet to be the “elephant” in the room.