by Connor Darrell, Head of Investments

Stocks posted their strongest weekly gain in over 2 months last week, with energy stocks leading the way amid further increases in the price of oil. It certainly won’t be celebrated by those of us traveling for summer vacations over the next couple of months, but oil prices are likely to remain elevated if the Trump Administration is able to reinstate economic sanctions on Iran. International markets also posted gains on the week.

Bonds had a relatively uneventful week, but remain under the microscope of many investors and media outlets as interest rates creep higher. We discuss some of our thoughts on what the market might be overlooking in our update below.

The Bigger Unknown in Monetary Policy “Normalization”

Likely due to their direct influence over the interest earned on savings and paid on loans, the Fed’s interest rate decisions seem to get all of the attention when it comes to discussions of monetary policy. However, faced with the unenviable task back in 2008 of combating the deepest recession in a generation, the Fed pulled out all the stops, using every tool in its arsenal to inject life back into the US economy. As a result, in addition to the traditional (and oft discussed) avenue of pulling interest rates down near zero, the Fed also implemented multiple rounds of Quantitative Easing, an unprecedented expansion of Reserve Bank Credit (the Fed Balance Sheet). This was accomplished by purchasing trillions of dollars’ worth of bonds in the open market in order to inject more money into the financial system and increase liquidity in markets. The ultimate purpose of the policy is largely the same as the reduction in interest rates, but it is widely considered to be a much more extreme approach.

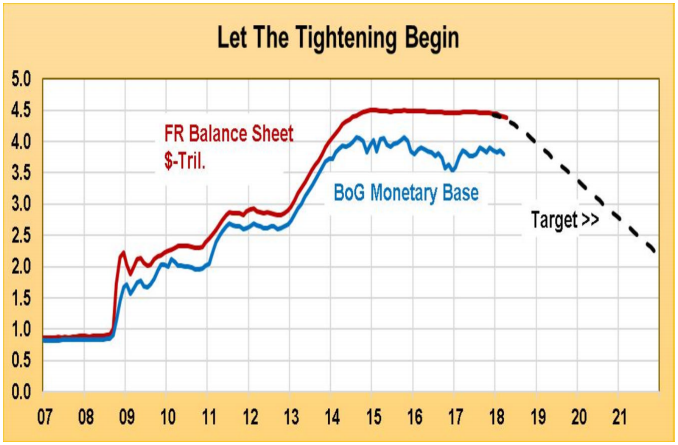

Between October of 2008 and December of 2014, the value of the Federal Reserve’s balance sheet swelled from $0.9 trillion to $4.5 trillion (see below chart from Argus Research) as it continued to purchase bonds. Since then, the balance sheet has remained largely untouched, but the Fed has made clear in its communications that this will soon change. The consensus among forecasters is that the Fed will begin the process of shrinking its balance sheet later this year by allowing maturing bonds to roll off and ceasing its reinvestment of coupon payments, to the tune of about $50 billion per month.

Like all markets, the bond market is driven primarily by supply and demand, and with the Fed reversing its policies, the underlying balance of supply and demand will undoubtedly be altered. What would this mean exactly? The ultimate results are very difficult to predict. If the Fed is able to effectively telegraph its moves (as it intends), then markets may be able to adjust gradually with no major impacts. But if the balance shifts more than anticipated, then a major dislocation could take place. Under such a scenario, the laws of supply and demand would dictate that the oversupply of bonds on the market would drive prices down, and yields up.

That short term rates will increase from here is highly likely and largely assumed by most investors, so in our view, the potential impact of the Fed’s balance sheet unwind, which would occur in addition to the trends already in place, is the bigger “unknown” as we move away from the accommodative monetary policies of the last decade. Given its current size, it may be appropriate to say that we consider the Fed’s balance sheet to be the “elephant” in the room.