by Connor Darrell, Head of Investments

It was a busy week for financial markets, with a mixed bag of positive economic news and disruptive political developments. On the positive side, the US unemployment rate continued to track lower, reaching 3.8% in May. Unfortunately, that news was offset by two major developments in the global political landscape.

First, markets opened sharply lower on Tuesday as Italian political negotiations sparked fears that Eurosceptics (those who are opposed to European Union membership) were set to take control of the government. The political situation in Italy remains complex and the long-term outlook uncertain, but those fears were somewhat alleviated later in the week as a more favorable consensus was reached on the re-establishment of the government following March’s inconclusive election results.

Then on Thursday, the topic of tariffs once again dominated financial news headlines when the Trump Administration announced that it would allow the temporary tariff exemptions (Initially granted when the 25% steel and 10% aluminum tariffs first took effect in March) for Canada, Mexico, and the EU to expire. According to Goldman Sachs Investment Research, those countries accounted for approximately 40% and 48% of 2017 US imports of steel and aluminum respectively. Canada and Mexico immediately responded with retaliatory measures and stocks slid lower on the news.

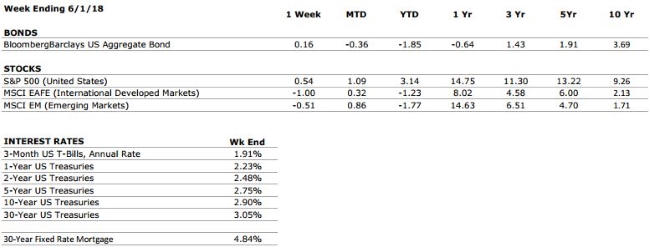

Amid the conflicting signals, US equities outperformed, and bonds generated small gains as investors sought refuge from some of the volatility.

Mike will work out of Valley National’s Bethlehem office as part of a service team supporting clients in the areas of wealth management and financial planning, as well as continuing professional development through the firm’s Entry Level Professional (ELP) program. The ELP program, now in its sixth year, is specifically designed to prepare the next generation of Financial Advisors at Valley National with key skills and knowledge.

Mike will work out of Valley National’s Bethlehem office as part of a service team supporting clients in the areas of wealth management and financial planning, as well as continuing professional development through the firm’s Entry Level Professional (ELP) program. The ELP program, now in its sixth year, is specifically designed to prepare the next generation of Financial Advisors at Valley National with key skills and knowledge.