We Are Hiring! Our team is looking for an experienced CPA to lead our tax team as Director of Tax Services. Please review and share the job posting on our website at valleynationalgroup.com/join-our-team.

We Are Hiring! Our team is looking for an experienced CPA to lead our tax team as Director of Tax Services. Please review and share the job posting on our website at valleynationalgroup.com/join-our-team.

Daily Archives: July 16, 2018

Did You Know…?

by Roxie Munoz, CLU, FLMI, Assistant Vice President / Manager, Insurance Services

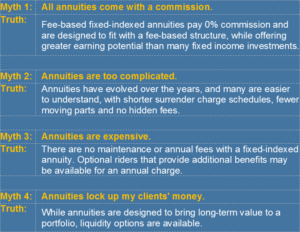

Unique Benefits of Fixed Index Annuities

A sound retirement plan can resemble a relay race. Each phase, or leg, has its own needs that demand their own strategy or product strengths to best build, sustain and deliver financial solutions. Fixed index annuities offer unique benefits that work in concert to help you reach your retirement goals.

Protection: A central benefit of fixed index annuities is a level of protection that underpins the product’s guarantees. When you purchase a fixed index annuity, not only is your principal protected, so is any interest credited to your contract. No matter what the index does, your return will never be less than zero due to index volatility.

Tax Deferral: Throughout the accumulation phase, money can grow tax-deferred. This means, while your principal and any interest credited are protected from volatility, the tax-deferral benefit provides the opportunity for compounded growth over time—further bolstering your resources for when you choose to take an income.

Liquidity Options: As a component of a strategic income plan, a fixed index annuity provides added income flexibility through a variety of liquidity options. They offer liquidity features that give access to the contract value. Typically, 10 percent of the annuity’s value annually is available for free withdrawal during the surrender charge period. Many products also have increased or full access to the contract value for qualified care needs.

Liquidity Options: As a component of a strategic income plan, a fixed index annuity provides added income flexibility through a variety of liquidity options. They offer liquidity features that give access to the contract value. Typically, 10 percent of the annuity’s value annually is available for free withdrawal during the surrender charge period. Many products also have increased or full access to the contract value for qualified care needs.

Guaranteed Income: A study found 78% of workers are looking for lifetime income in retirement. This goal is followed closely behind by 76% who are looking for stability of income.1 Once the accumulation period ends, you can begin receiving distributions from the guaranteed income sources you generated. You can choose to receive a lump-sum payment, fixed amount payments over time, or annuitized payments for life. With an income rider option, you have additional flexibility for guaranteed lifelong income payments. These fail-safe measures can be added to a fixed index annuity contract, securing payments that cannot be outlived, with joint payout options for a spouse.

Take Care of Loved Ones: In addition to helping generate and sustain a stable income throughout your life, with fixed index annuities you can also establish a clear transition of assets to a named beneficiary. Whether death occurs during the accumulation or distribution phase of the annuity, the annuity guarantees direct payment to the named beneficiary. Depending on the contract, these payments may be in the form of a lump-sum, series of payments or lifetime payments. The contract may also help bypass probate, saving time and expense in the process.

Benefits You Can Rely On.

Any of these benefits on their own are important in retirement. But, it is their interdependent strengths that can help fund retirement from start to finish. Contact our office today to determine if an annuity should be part of your financial plan.

Sources: Indexed Annuity Leadership Council, The State of America’s Workforce: The Reality of Retirement Readiness. White Paper, 2018

Quote of the Week

“Geeks are people who love something so much that all the details matter.” – Marissa Mayer