“They always say time changes things, but you actually have to change them yourself.” – Andy Warhol

Monthly Archives: July 2018

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®. On this week’s show – July 25 – guest hosts Rodman Young, CPA/PFS, CFP® and Jaclyn Cornelius, CFP®, EA from Valley National Financial Advisors, will discuss: “Company transitions and your job.”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®. On this week’s show – July 25 – guest hosts Rodman Young, CPA/PFS, CFP® and Jaclyn Cornelius, CFP®, EA from Valley National Financial Advisors, will discuss: “Company transitions and your job.”

For more information, including how to listen to the show online, check the show’s website yourfinancialchoices.com and visit wdiy.org.

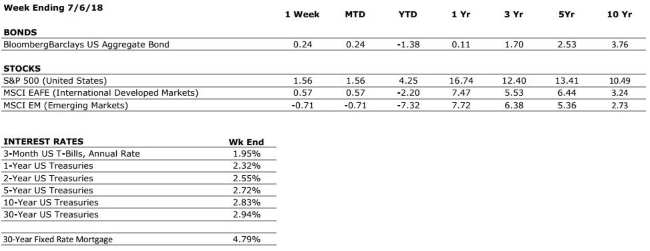

The Number & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer spending is expected to remain healthy as individuals with lower tax rates spend their windfalls. |

|

FED POLICIES |

C- |

Following its June meeting, the Federal Reserve implemented the second rate hike of 2018, and suggested that two more hikes should be expected before year-end. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

A |

Q1 Earnings were very strong, with US companies reporting YoY earnings growth of 25%. Q2 earnings season kick into gear this month. |

|

EMPLOYMENT |

A+ |

The US economy added 213,000 new jobs in June, and the labor force participation rate is now on the rise. Jobs are available for those who want them. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

The Markets This Week

by Connor Darrell, Head of Investments

The last few weeks have finally brought some stability back to markets, with the S&P 500 now up 5.86% year to date. Q2 earnings season begins this week, and investors are expecting more strong growth in corporate profits amid a strong economic backdrop. On the bond side, yields remained relatively stable last week, though the trend of yield curve flattening remains firmly intact.

Now May Be a Great Time to Rebalance

Since emerging from the depths of the financial crisis in early 2009, the S&P 500 has produced a total return of over 360%. Disciplined investors who stuck through the turmoil of the great recession and were able to maintain exposure to equities have been richly rewarded for their patience. However, while the US economy remains on firm footing and the risk of recession in the near future remains relatively low, the next 10 years for investors are likely to look very different from the last 10 years. Investing is about achieving goals, and it is likely that the market’s strength over the past several years has put many investors ahead of schedule in terms of their long-term plan. Additionally, that strength in equity markets has likely pushed equity allocations toward the upper end of many investors’ target range, which can lead to a riskier portfolio. Nobody will ring a bell announcing when the current market cycle finally comes to an end, and the official “top” of the market may not be officially identified for quite some time after it occurs. But we can say with a reasonably high degree of confidence that we are much closer to the top than the bottom.

All of the above suggests that it may be prudent for investors to take a step back, evaluate their long-term asset allocation targets, and rebalance to ensure that their portfolio is properly tuned for the road ahead. 2018 has already presented investors with a number of new risks to consider and managing these risks will become increasingly difficult as the environment becomes less accommodating to the complacent investor.

Valley National News

We Are Hiring! Our team is looking for an experienced CPA to lead our tax team as Director of Tax Services. Please review and share the job posting on our website at valleynationalgroup.com/join-our-team.

We Are Hiring! Our team is looking for an experienced CPA to lead our tax team as Director of Tax Services. Please review and share the job posting on our website at valleynationalgroup.com/join-our-team.

Did You Know…?

by Roxie Munoz, CLU, FLMI, Assistant Vice President / Manager, Insurance Services

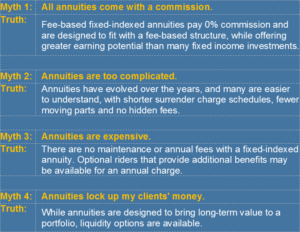

Unique Benefits of Fixed Index Annuities

A sound retirement plan can resemble a relay race. Each phase, or leg, has its own needs that demand their own strategy or product strengths to best build, sustain and deliver financial solutions. Fixed index annuities offer unique benefits that work in concert to help you reach your retirement goals.

Protection: A central benefit of fixed index annuities is a level of protection that underpins the product’s guarantees. When you purchase a fixed index annuity, not only is your principal protected, so is any interest credited to your contract. No matter what the index does, your return will never be less than zero due to index volatility.

Tax Deferral: Throughout the accumulation phase, money can grow tax-deferred. This means, while your principal and any interest credited are protected from volatility, the tax-deferral benefit provides the opportunity for compounded growth over time—further bolstering your resources for when you choose to take an income.

Liquidity Options: As a component of a strategic income plan, a fixed index annuity provides added income flexibility through a variety of liquidity options. They offer liquidity features that give access to the contract value. Typically, 10 percent of the annuity’s value annually is available for free withdrawal during the surrender charge period. Many products also have increased or full access to the contract value for qualified care needs.

Liquidity Options: As a component of a strategic income plan, a fixed index annuity provides added income flexibility through a variety of liquidity options. They offer liquidity features that give access to the contract value. Typically, 10 percent of the annuity’s value annually is available for free withdrawal during the surrender charge period. Many products also have increased or full access to the contract value for qualified care needs.

Guaranteed Income: A study found 78% of workers are looking for lifetime income in retirement. This goal is followed closely behind by 76% who are looking for stability of income.1 Once the accumulation period ends, you can begin receiving distributions from the guaranteed income sources you generated. You can choose to receive a lump-sum payment, fixed amount payments over time, or annuitized payments for life. With an income rider option, you have additional flexibility for guaranteed lifelong income payments. These fail-safe measures can be added to a fixed index annuity contract, securing payments that cannot be outlived, with joint payout options for a spouse.

Take Care of Loved Ones: In addition to helping generate and sustain a stable income throughout your life, with fixed index annuities you can also establish a clear transition of assets to a named beneficiary. Whether death occurs during the accumulation or distribution phase of the annuity, the annuity guarantees direct payment to the named beneficiary. Depending on the contract, these payments may be in the form of a lump-sum, series of payments or lifetime payments. The contract may also help bypass probate, saving time and expense in the process.

Benefits You Can Rely On.

Any of these benefits on their own are important in retirement. But, it is their interdependent strengths that can help fund retirement from start to finish. Contact our office today to determine if an annuity should be part of your financial plan.

Sources: Indexed Annuity Leadership Council, The State of America’s Workforce: The Reality of Retirement Readiness. White Paper, 2018

Quote of the Week

“Geeks are people who love something so much that all the details matter.” – Marissa Mayer

Valley National News

Introducing VNFA VIDEO!

Our CEO offers our first video message to you from our new Bethlehem studio. We are devoted to providing the communication and direction you want from the team that you trust in as many convenient formats as possible. Follow us on social media or visit our website at valleynationalgroup.com/video to follow our video features moving forward. Of course, we will also send you messages directly as part of the The Weekly Commentary e-mail newsletter.

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer spending is expected to remain healthy as individuals with lower tax rates spend their windfalls. |

|

FED POLICIES |

C- |

Following its June meeting, the Federal Reserve implemented the second rate hike of 2018, and suggested that two more hikes should be expected before year-end. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

A |

Q1 Earnings were very strong, with US companies reporting YoY earnings growth of 25%. |

|

EMPLOYMENT |

A+ |

The US economy added 213,000 new jobs in June, and the labor force participation rate is now on the rise. Jobs are available for those who want them. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

by Jessica Goedtel, Senior Associate

If you are on a high deductible health plan, you may have access to a Health Savings Account (HSA). Recently these have become very popular due to their “triple tax exempt” nature. First, if you contribute to your account via payroll, contributions will come out pre-tax. Alternatively, you can make after-tax contributions but receive a deduction on your tax return.

Second, you are not taxed on any investment growth in the account. Some plans offer a variety of investment options, others may work as a simple savings account. Check with your plan administrator to see what options are available to you.

Third, any distribution for qualified medical expenses is not taxable. And, unlike a Flex Savings Account (FSA), the balance can be carried over each year. If you are nearing retirement this could be an excellent strategy to save for medical expenses.

The contribution limits for HSAs for 2018 are $3,450 for a single person plan, and $6,900 for a family plan. If you are over the age of 55, you can increase your contribution by $1,000. One important item to consider is that once you become eligible for Medicare at age 65, you can no longer make contributions.

If used correctly, an HSA can be a very powerful tool in your financial plan.