by Connor Darrell, Head of Investments

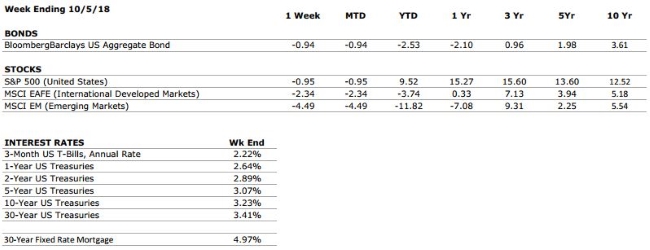

Equity markets ended a bumpy week relatively flat after a strong rally on Tuesday was offset by Thursday’s selloff. A variety of geopolitical concerns – including the disappearance of journalist Jamal Khashoggi while in Saudi custody – weighed on investors’ minds. Bonds trended lower after the release of the minutes from the Federal Reserve’s September meeting, which suggested that policymakers expect to continue raising interest rates and would consider pushing them into “restrictive” territory in an effort to keep the economy from overheating.

The Fed Isn’t Going “Loco”

President Trump has made it no secret that he disapproves of the Federal Reserve’s decision to carry on with a steady pace of interest rate increases. It’s not surprising that a sitting president, who’s legacy is likely to be closely tied to the performance of the economy under his watch, would be opposed to monetary policy decisions designed to slow the growth of the U.S. economy. What is surprising however, is that he would express that opinion so publicly. In an interview this month, the President stated that he believes the Fed is “going loco” and is “out of control”.

There are a couple of things to keep in mind about the Fed’s job. The Fed’s primary function is to keep the economy from reaching extremes. That involves stepping in to reduce the pain during recession as well as keeping the economy from overheating during periods of expansion. The latter task is arguably even more important, because the worst economic periods throughout history have all been preceded by excessive risk taking and asset bubbles, which typically form during the latter stages of a bull market. Looking through the lens of history, the current interest rate environment can still be reasonably considered to be accommodative for economic growth, and the Fed will likely continue its pace of gradual rate hikes. All of this should be well understood by financial markets and should not lead to a sharp fall in stock or bond prices on its own.