Happy Thanksgiving!

In observance of Thanksgiving, our offices will be closed on Thursday, November 22. We will be open on Friday morning, but our office will close again at 1 p.m. with the markets on November 23.

Daily Archives: November 20, 2018

VNFA In The Community

Help Us Create Holiday Hope Chests!

Help Us Create Holiday Hope Chests!

Join in our effort to support local children this holiday season through the efforts of the Volunteer Center of the Lehigh Valley. WHAT ARE HOLIDAY HOPE CHESTS?

We’re reaching out to our clients and friend to help us. WHAT CAN I CONTRIBUTE?

Plus, we’re having a WRAPPING PARTY on November 27, 11 a.m. to 1 p.m. at our Bethlehem headquarters. You’re invited to join us!

If you cannot stop by, you can still support the cause by donating to the #GivingTuesday campaign. Click here for details.

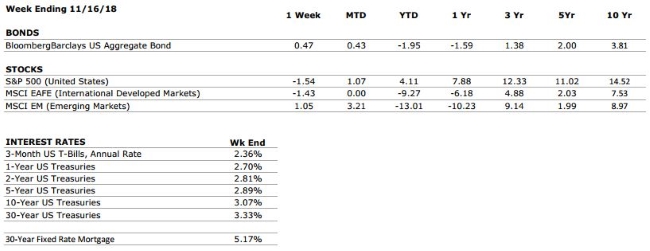

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer confidence is near all time highs with recent tax reform providing further support. We are anticipating a strong holiday shopping season. |

|

FED POLICIES |

C- |

The Federal Reserve is expected to raise interest rates one more time before the end of the year. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

A |

With over 90% of S&P 500 companies having reported Q3 earnings, Factset is reporting a blended earnings growth rate of 25.7% YoY. Tax reform has played a major role, but the strength of the US consumer is boosting corporate profits as well. |

|

EMPLOYMENT |

A+ |

The US economy added 255,000 new jobs in October, significantly more than the consensus forecast. For six months now, there have been more job openings available in the economy than there are unemployed workers to fill them. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know… TAX TIP

by Jessica Goedtel, Associate Financial Advisor

The IRS recently released their cost of living adjustments for 2019.

A few items to note:

- The maximum 401(k) contribution has increased to $19,000, from $18,500. The catch-up contribution for those ages 50 and over remains at $6,000.

- The annual IRA contribution amount has increased to $6,000 from $5,500. The catch-up contribution remains the same at $1,000. This is the first time since 2013 that this limit has increased.

- The overall limitation for defined contribution plans increased by $1,000 to $56,000.

In addition, the income brackets that determine eligibility for certain types of IRA contributions, such as Roth IRAs, have been increased for inflation. More information can be found at the official IRS release. READ MORE

This is a great time to review your current retirement savings strategies to make sure you are taking full advantage of your tax deferral options.

Quote of the Week

“What if today, we were grateful for everything?” – Charlie Brown

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

After a brief bump following the mid-term elections, markets have struggled to maintain their footing over the past couple of weeks. That trend continued last week with the S&P 500 sliding down 1.54%. International developed markets followed suit, although the much-maligned emerging markets equity index managed a positive gain. The bond market benefitted from the volatility in equity markets as well as some dovish comments from Atlanta Fed President Raphael Bostic (a member of the interest rate setting FOMC chaired by Jerome Powell), who stated at a conference in Madrid that he does not think “we are too far from a neutral policy.” The comment suggested that fewer rate hikes may be necessary and was somewhat contradictory to the statement Jerome Powell made back in October that prompted a surge in bond yields. Ultimately, investors should continue to expect that the Federal Reserve will remain “data dependent” and will be very clear in communicating its intentions to markets.

Corporate Earnings Have Been Strong, But May be Poised to Taper Off

On a year-over-year basis, Q3 earnings growth among S&P 500 companies is poised to reach its highest level since 2010. About half of that growth can be credited to tax reform, which decreased the tax burden on corporations and enabled them to report higher profits, but the other major contributing factor has been the strength of the U.S. consumer. However, despite the robust earnings growth that has been reported by U.S. companies, the equity market has failed to push meaningfully higher in 2018. This can be partially explained by the tendency for markets to be more concerned with the future rate of change of earnings, rather than the absolute numbers themselves. As the year-over-year benefits of tax reform disappear in Q1 of next year, consumers will take on the bulk of the burden in carrying earnings growth forward, and the bottom line is that earnings growth is likely to decelerate. The uncertainty surrounding how much earnings may decelerate is likely a contributing factor to some of the volatility we are observing in equity markets. We continue to believe that the economic environment is conducive to further gains, but caution that returns moving forward will be far less exciting than what investors have experienced over the past several years.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®. This week, Laurie will not be live on the air. Instead WDIY will air a recorded “Your Financial Choices” show. Questions submitted via yourfinancialchoices.com will be addressed on the next lives show – November 28.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.