TAX SEASON OFFICE HOURS

Our offices will be open on President’s Day (February 18) and Good Friday (April 19), despite the market holidays. Additionally, our Bethlehem and New Jersey offices will be open on Saturdays from 9 a.m. to Noon, February 9 – April 13 for tax preparation document delivery and pick-up. Meetings are by appointment only.

Monthly Archives: January 2019

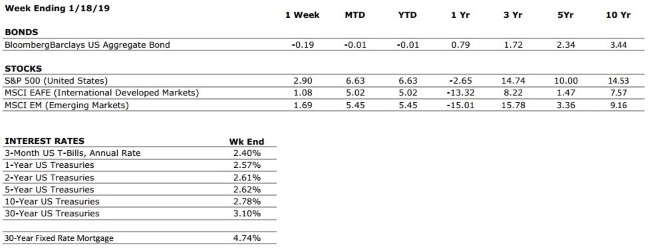

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer confidence was hindered somewhat by the market volatility experienced during December. We are awaiting further data from the US Depertment of Commerce (which has been delayed due to the government shutdown) in order to make an assessment regarding whether this merits a new grade. |

|

FED POLICIES |

C- |

The Federal Reserve implemented its fourth interest rate hike of the year in December. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

B+ |

Corporate earnings remain strong, but we anticipate earnings growth will taper off in 2019. We are also beginning to see a higher number of companies reducing forward earnings guidance, a sign that earnings growth may have reached its peak in 2018. |

|

EMPLOYMENT |

A+ |

The US economy added 312,000 new jobs in December, blowing estimates out of the water. The unemployment rate rose to 3.9% as a result of new workers entering the labor force. Growth in the size of the labor force is a sign of a healthy labor market. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

After a strong start to the new year, the major equity market benchmarks ended the holiday-shortened week flat. Stocks struggled to gain momentum throughout the week after Commerce Secretary Wilbur Ross stated during an interview on CNBC that the US and China were “miles and miles” away from a potential trade agreement. Q4 2018 earnings reports continued to indicate healthy corporate profits, though well below the growth rates observed during the earlier parts of the year. Over the long-term, stock market performance tends to closely track corporate earnings, and analysts are still expecting double digit earnings growth for the current reporting period.

The week ended on a positive note when it was announced on Friday afternoon that policymakers had reached an agreement to temporarily reopen the government for a minimum of three weeks. The key focus of markets continued to be directed elsewhere, and there was very little reaction to the news in terms of price movement in the major indices. This is likely due in part to the temporary nature of the “deal.”

Did You Know? ESG: A Different Approach to Investing

As issues like climate change, corporate governance, and consumer privacy have become increasingly important to consumers, this has led to significant growth in what is known as ESG Investing. ESG stands for Environmental, Social, and Governance, and refers to three of the key areas of focus for evaluating and measuring the sustainability and ethical standards of an investment in a corporation.

Today, more and more investors are striving to enact changes to the role that large corporations play in society and are seeking to exert their influence via the capital markets. An ESG approach to investing uses a combination of exclusionary screens (avoiding companies that do not meet the minimum standards of sustainability and corporate governance practices of the investor) and active shareholder engagement to address key areas of concern. These include things like environmental sustainability, community engagement/impact, equal pay, and ethical business practices among others. Capital markets play a vital role in our economic system and are one of the most powerful means of influencing the behavior of large corporations because share prices and shareholder engagements directly impact the decisions of company leadership.

In response to the growing interest in ESG investing, our team has invested a considerable amount of time and resources into constructing portfolios that meet these standards. If this is something you would be interested in learning more about, please reach out to your financial advisor to begin a conversation.

Did You Know…? TAX TIP

The IRS just published final guidance on one of the new provisions in the Tax Cuts and Jobs Act is the 20% pass-through deduction. In simple terms, individual business owners may claim a deduction equal to 20% of their qualified business income. However, limitations are in place that that will limit or eliminate the deduction for certain high-income earners.

The new guidance specifically addresses when a rental activity will rise to the level of trade or business and will qualify for this deduction. If an individual spends at least 250 hours of “rental services” throughout the year and maintain contemporaneous records for each location, including dates of all services performed by the taxpayer or somebody else, you may qualify for this deduction. READ MORE at IRS.gov

Quote of the Week

“Write to be understood, speak to be heard, read to grow.” – Lawrence Clark Powell

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie and her guest Loretta M. Tubiello-Harr CPA/ABV, CVA, will discuss: “What are business advisory services and how can they help your business?”

This week, Laurie and her guest Loretta M. Tubiello-Harr CPA/ABV, CVA, will discuss: “What are business advisory services and how can they help your business?”

Laurie will take your calls on this or other topics at 610-758-8810 during the live show, or via yourfinancialchoices.com.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Valley National News

They will be assisting our tax preparation team with document intake and digital set up as well as providing support on special projects.

All four students were selected for Valley National’s tax season internship program, which is in its fifth year. The program is designed to provide real-world experience for individuals interested in a career that may include tax planning. Tax interns are exposed

to and participate in every part of the process, working alongside seasoned CPAs and financial planners in a professional office environment.

Interns from past years have gone on to have successful careers in a variety of different fields, including finance & accounting – most notably, our own Brinda Vyas, Junior Accountant at Valley National Financial Advisors joined the team after her internship and subsequent graduation from DeSales University in 2016.

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer confidence was hindered somewhat by the market volatility experienced during December. We are awaiting further data from the US Depertment of Commerce (which has been delayed due to the government shutdown) in order to make an assessment regarding whether this merits a new grade. |

|

FED POLICIES |

C- |

The Federal Reserve implemented its fourth interest rate hike of the year in December. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

B+ |

Corporate earnings remain strong, but we anticipate earnings growth will taper off in 2019. We are also beginning to see a higher number of companies reducing forward earnings guidance, a sign that earnings growth may have reached its peak in 2018. |

|

EMPLOYMENT |

A+ |

The US economy added 312,000 new jobs in December, blowing estimates out of the water. The unemployment rate rose to 3.9% as a result of new workers entering the labor force. Growth in the size of the labor force is a sign of a healthy labor market. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

FROM THE PROS… VIDEO

Our tax team created three videos about tax preparation, offering instructions, CPA tips, and answers to frequently asked questions. Visit valleynationalgroup.com/tax to access them all and get more resources.

Frequently Asked Questions WATCH NOW

Welcome New Tax Clients WATCH NOW

Tax Preparation “Preparation” WATCH NOW

Quote of the Week

“Happiness often sneaks in through a door you didn’t know you left open.” – John Barrymore