“Vision is the art of seeing what is invisible to others.” – Jonathan Swift

Monthly Archives: January 2019

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

Global equity markets climbed higher for the second consecutive week despite mixed economic data and a significant reduction in forward revenue guidance by Apple, which blamed economic weakness in China for its slumping smartphone sales. The Apple announcement combined with a decline in manufacturing activity to push stocks lower on Thursday before a Friday rally was fueled by a blowout December jobs report and dovish comments made by Federal Reserve Chairman Jerome Powell. Friday’s jobs report showed that the U.S. economy added 312,000 new jobs during the month of December and revised estimates from previous months upward. Fears of an economic slowdown have been a major contributing factor to the volatility in markets over the past few months, but Friday’s employment report provided evidence that the US economy continues to add new jobs at a healthy clip, with new workers joining the labor force and real wages increasing. All of these factors should continue to support consumer spending and keep the risk of recession low in the near term.

Our Q4 Quarterly Commentary Is Now Available

Each quarter, we recap the important events that drove markets and identify key themes that will impact the forward outlook. Our Q4 2018 recap can be found at valleynationalgroup.com.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®. This week, Laurie will discuss Social Security, Medicare and Working – what you need to know.

Laurie will take your calls on this or other topics at 610-758-8810 during the live show, or via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VIDEO: Your Financial Choices December Recap

Spend a few minutes with Laurie Siebert to review her top takeaways from December and a preview of the January 2019 show topics lined up for Your Financial Choices. WATCH NOW

Quarterly Commentary – Q4 2018

Equities:

What a difference three months can make. Global equity markets sold off considerably throughout the 4th quarter, with sentiment turning negative as investors pondered the consequences of further monetary policy normalization in the wake of lower expectations for economic growth and inflation. The S&P 500 briefly entered “bear market” territory (defined as a 20% decline from previous highs) on Christmas Eve before bouncing off of lows, but the selloff was large enough to push markets into negative territory (as measured by total return, including dividends) on the year for the first time since the 2008 financial crisis. However, while there are indeed some signs of a moderation of economic growth (slowing housing market and fading impact of recent tax reform), the probability of recession in the near-term remains low. History suggests that non-recessionary bear markets tend to be short-lived.

Bonds:

The Federal Reserve was a major area of focus for bond investors throughout 2018, and that continued into Q4. The Fed implemented its 4th rate hike of the year following its December meeting, but acknowledged that its previous estimate of 4 further hikes during 2019 may be too aggressive. The shift in posture from the Fed reflected a sense of restraint that was already being priced into bond markets and represented a significant change in expectations from just three months prior. In our experience, sentiment tends to shift much faster than economic data, and the data still suggests that the U.S. economy is healthy. However, the Fed will face a difficult balancing act as it continues its normalization process even as markets have begun to show signs of fragility.

The “risk-off” sentiment that dominated the 4th quarter made its way into the corporate bond market, as credit spreads (the difference in yield between corporate and government bonds) widened to their highest level since 2016. However, overall bond market performance was positive during the 4th quarter as the volatility in equity markets caused investors to seek the relative safety of fixed income. It should be noted that despite what many pundits have deemed an unhealthy environment for bond investors, the overall bond market finished the year flat. To us, this is evidence that fixed income remains an important component of a properly diversified portfolio, and that a “bad” year for bonds looks very different from a “bad” year for equities.

Outlook:

After nearly a decade of healthy returns, it is unsurprising that markets have paused to digest the changing economic environment in which we currently find ourselves. Markets managed to squeeze three-years’ worth of gains into just 12 months during 2017, and ultimately, it has been an incredibly impressive run for U.S. equities over the past 10 years. Despite the negative sentiment that has dominated markets over the past three months, it is not unreasonable to suggest that stocks can generate positive returns in 2019.

We continue to express that we believe the forward outlook for investment returns across asset classes looks very different than it did even five years ago, but that is more a product of starting point than anything else. The key areas of focus for markets moving into 2019 will continue to be trade, the Fed, and global economic growth (with a particular emphasis on China, which has showed signs of slowing). We continue to believe that the possibility of “surprises” remains skewed to the upside with respect to trade (potential deal being reached with China) and future Fed policy (slower pace of rate hikes) but believe that the Chinese economy will be important to watch moving forward. It used to be that when the U.S. sneezed, the world caught a cold. But eventually, China’s economy will be large enough that the same could be said for the world’s most populous nation.

VIDEO: Q4 Market Commentary – Connor Darrell CFA, Head of Investments, shares Valley National Financial Advisors’ review of the fourth quarter, and a first quarter 2019 outlook. WATCH NOW

HAPPY NEW YEAR!

As we usher in 2019, our team reflects on the people who matter so much to us – our clients. Without you, we would not have the pleasure of living our purpose to help others. We thank you for your continuing trust in us.

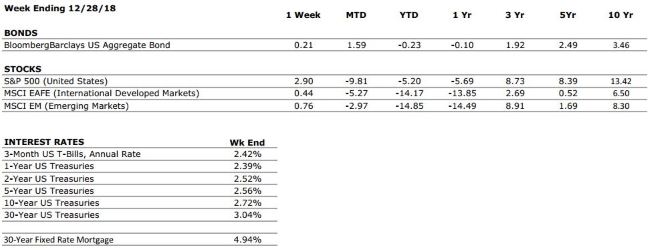

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer confidence is near all time highs with recent tax reform providing further support. The holiday shopping season was one of the strongest on record. |

|

FED POLICIES |

C- |

The Federal Reserve implemented its fourth interest rate hike of the year in December. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

B+ |

Corporate earnings remain strong, but we anticipate earnings growth will taper off in 2019. We are also beginning to see a higher number of companies reducing forward earnings guidance, a sign that earnings growth may have reached its peak in 2018. |

|

EMPLOYMENT |

A+ |

The US economy added 155,000 new jobs in November, which was below estimates. However, the unemployment rate remained at 3.7% and the data suggests that there have been more job openings available in the economy than there are unemployed workers to fill them for 6 consecutive months. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

FROM THE PROS… VIDEO

Matthew Petrozelli, CEO, reflects on the state of the markets moving into 2019. WATCH NOW

Did You Know…?

NJ Tax Amnesty Expires on January 15

For those taxpayers who have received a New Jersey Tax Amnesty notice, please be aware that the program ends January 15, 2019. The program offers a waiver of most penalties and reduced interest charges for those who have met the eligibility requirements. READ MORE at the State of New Jersey Department of Treasury website: nj.gov/treasury

Quote of the Week

“New Year – a new chapter, new verse, or just the same old story? Ultimately we write it. The choices is ours.” – Alex Morritt

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

It was another wild ride for investors despite the holiday-shortened week. Markets were sent tumbling throughout Monday’s abbreviated trading session after Treasury Secretary Steve Mnuchin released a curiously timed statement via Twitter, informing markets that he had spoken with executives from the nation’s six largest banks and had been assured that each were suffering from no liquidity issues. The statement was confounding to market participants as it seemed aimed at addressing a concern that had not been apparent to investors prior to its release.

After the holiday, markets seemed to conclude that this was nothing more than a poorly executed attempt by the White House to stabilize markets, and Wednesday’s trading session was one of the strongest in a decade. By the end of the week, U.S. equities managed to climb out of bear market territory to generate a gain of 2.90% (as measured by the S&P 500). Bonds have continued to play their traditional role as safe haven, generating positive returns as well.

Happy New Year from VNFA

Markets have been volatile in 2018, but as we have communicated previously, we do not believe that there is a need for drastic measures to be taken in portfolios at this time. CLICK HERE to access our recent market note (which summarizes our current thinking on markets).

We encourage investors to enjoy their New Year’s celebrations with friends and family and wish all TWC readers a happy and prosperous 2019!