Happy Anniversary WDIY!

WDIY celebrated 24 years

on the air with the volunteers, staff, community and listener supporters at the

Ice House in Bethlehem. Valley National Financial Advisors is proud to support Lehigh

Valley public radio, and to bring listeners “Your Financial Choices” on WDIY, Wednesdays

from 6-7p.m. with Laurie Siebert.

Daily Archives: March 5, 2019

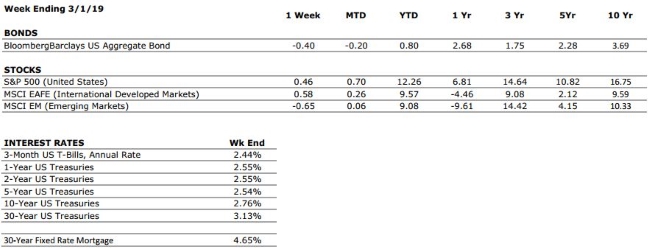

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

We have downgraded our consumer spending grade to A from A+ following weaker than expected December retail sales data and some declines in consumer confidence surveys. However, monthly data can be volatile and we still believe that the US consumer is in a healthy position. |

|

FED POLICIES |

C- |

The Federal Reserve implemented four interest rate hikes during 2018, and while the rate hike cycle appears to be on pause for now, rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

B+ |

Corporate earnings remain strong, but we anticipate earnings growth will taper off in 2019. We are also beginning to see a higher number of companies reducing forward earnings guidance, a sign that earnings growth may have reached its peak in 2018. |

|

EMPLOYMENT |

A+ |

The US economy added 304,000 new jobs in January, soundly beating estimates for the second straight month. The labor market is one of the strongest components of the economic backdrop at this time. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

FROM THE PROS… VIDEO

Vice President Timothy G. Roof, CFP® explains the basics of Qualified Charitable Distributions (QCDs). WATCH NOW

Quote of the Week

“Time you enjoy wasting, was not wasted.’” – John Lennon

The Markets This Week

by Connor Darrell

CFA, Assistant Vice President – Head of Investments

Perceived

progress in the ongoing trade negotiations between the U.S. and China seemed to

keep an aura of optimism around equity trading last week, with developed

markets equities (as measured by the S&P 500 and the MSCI EAFE indexes)

inching higher. Bond yields also moved higher, with the 10-Year Treasury yield

reaching its highest level in a month.

After a long delay related to the government shutdown, Q4 U.S. GDP was reported last week. The data showed that the U.S. economy grew 2.6%, which was above expectations but still below the trend rate that had been in place for the past two quarters. On the whole, the economy grew at a rate of 2.9% during 2018, up from 2.2% in 2017.

Market

Performance Diverging from Economic Data

The

S&P 500 has posted its best two-month start to a year since 1991, even as

economic data and corporate earnings have begun to taper off. While not

necessarily poor in absolute terms, recently released economic data has been

disappointing, with housing starts falling to their lowest level in two years

and consumer spending declining precipitously. In the near-term, it is

difficult to evaluate to what extent the uncertainty stemming from the

government shutdown can be blamed, but thus far the Fed’s reaction (which has

been to suggest that patience may be warranted in determining the path of

future policy) has been celebrated by markets.

It is likely not a coincidence that the market’s strong start to the year has coincided with a change in tone from the Fed. The expectation in the market is now for the Fed to hold pat for the entirety of 2019, which if recent trends are to be believed, would likely bode well for stocks. But as we observed during the latter half of 2018, sentiment can change very quickly.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie will discuss: “Strategies for managing the income on your tax return and why it is important.”

Laurie will take your calls on this or other topics at 610-758-8810 during the live show, or via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.