April 2019 – Valley National Financial Advisors welcomes Vance Szabo to the full-time position of Operations Associate, managing wealth management fee billing as part of the back-office operations team based in Bethlehem.

Daily Archives: April 9, 2019

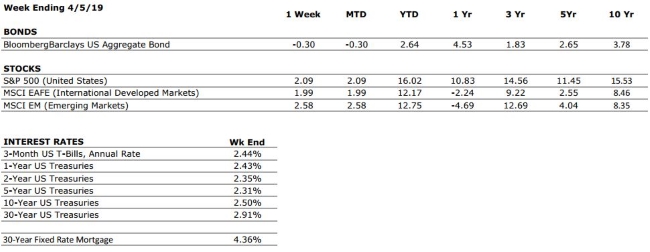

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A. Surveys of US consumers continue to indicate that the consumer is in a strong position, and a recent bounceback in existing home sales suggests that households are still willing to make large purchases, which bodes well for the economy and for markets. |

|

FED POLICIES |

C+ |

(Upgraded from C-) Following its March meeting, the Federal Reserve signaled to markets that it may not hike interest rates during 2019, and plans to halt its balance sheet reductions. The Fed’s future actions will remain data dependent, but the contractionary policies that have dominated the last two years appear to be on pause. |

|

BUSINESS PROFITABILITY |

B- |

(Downgraded from B+) Corporate earnings remain strong, but we anticipate earnings growth will taper off in 2019. According toFacset, the expected earnings growth rate for S&P 500 companies during 2019 is around 4%. This is below the long-term average for the current cycle. |

|

EMPLOYMENT |

A |

The US economy added 196,000 new jobs in March, helping to alleviate concerns from an unexpectedly weak February report. Encouragingly, we have also observed some healthy wage growth, which is currently above the rate of inflation. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

Final Tax Return Reminders!

Monday is the filing deadline, and our team is busy making sure that our clients’ tax returns are completed.

If you have requested a paper copy of your return, our office will notify you when it is ready for pickup. If you requested a digital copy, you will receive a notification e-mail from tax@valleynationalgroup.com to let you know that your returns are ready for review and your signatures.

Please be sure to return your signed 8879 and state filing forms to us as quickly as possible. You can deliver them in person, post a scan or image of the signed paper document to your eVault Client Portal, or e-mail them to our team at tax@valleynationalgroup.com.

Remember, local tax returns and any related payments are your responsibility to submit directly. We include instructions in your personal tax packet to help you get these submitted.

Quote of the Week

“Change is never painful, only the resistance to change is painful.’” – Buddha

The Markets This Week

by Connor Darrell

CFA, Assistant Vice President – Head of Investments

U.S.

stocks posted another week of solid gains, and the S&P 500 now sits within

2% of its all-time high (previously established in September 2018). Much of the

market’s gains appeared to be influenced by some better than expected economic

data from the Chinese manufacturing sector, as well as a strong March U.S. jobs

report which revealed a significant recovery from a disappointing February

figure. Interestingly, what many might expect to be one of the more significant

sources of uncertainty – the Brexit negotiations – have largely had little

impact on markets so far in 2019. Having already extended the deadline for a

deal, British Parliament still appears to be no closer to a resolution than it

was a few weeks ago.

In the bond market, the reassuring economic data helped to restore the yield curve to a more traditional upward slope over the three-month to 10-year range. Yields in the middle range of the curve crept higher, but remain well below their highs.

Retirement Bill Passes in U.S. House of Representatives

In a rare (and perhaps surprising) display of bipartisanship, the Ways and Means committee of the U.S. House of Representatives voted in support of the SECURE Act, a bill which will provide some positive new changes for those currently in the process of saving for retirement. The bill seeks to provide enhancements to the available tax breaks for retirement savers, as well as increase the incentive for more people to participate in employer sponsored retirement plans such as 401(k)s. If eventually passed into law, the bill would repeal the maximum age for traditional IRA contributions (currently age 70 ½) and increase the age for required minimum distributions from 70 ½ to 72. Additionally, long-term part-time workers would be allowed to participate in 401(k) plans, and small employers would receive expanded tax credits for creating retirement savings plans for their employees.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week,

Laurie welcomes Connor Darrell, CFA, Head of Investments at Valley National

Financial Advisors to discuss: “First

Quarter Market Review.”

This week,

Laurie welcomes Connor Darrell, CFA, Head of Investments at Valley National

Financial Advisors to discuss: “First

Quarter Market Review.”

Laurie will take your calls on this or other topics at 610-758-8810 during the live show, or via yourfinancialchoices.com.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.