by Connor Darrell CFA, Assistant

Vice President – Head of Investments

U.S.

equities posted small gains for the week, but they were enough to enable the

S&P 500 to reach new all-time highs on Tuesday and again on Friday. Markets

were bolstered by a stronger than expected first quarter GDP reading, which

indicated that the U.S. economy grew at an annual rate of 3.2% despite the

government shutdown and harsh winter weather. However, many economists have

noted that the strong reading got a big boost from very favorable net export

numbers, which can be quite volatile. It would be unsurprising to see a

material shift downward during Q2 if import/export activity exhibits a

reversion to the mean. However, at the very least, investors should take the Q1

GDP data as a signal that growth is not stalling, which is a far cry from the

concerns that dominated sentiment in 2018.

The Market Recovery Is Complete

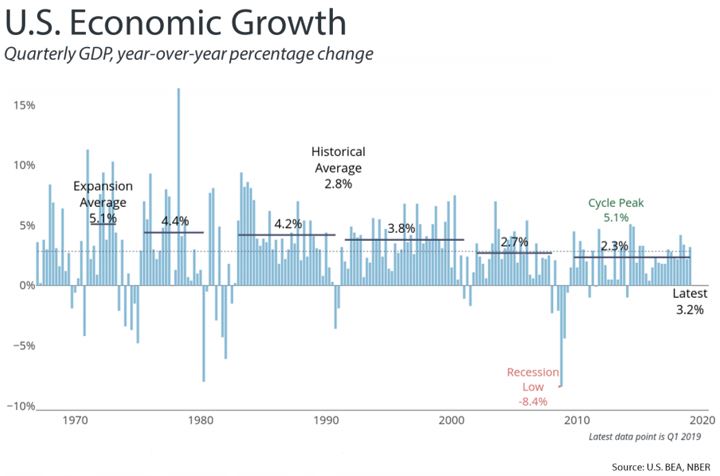

After reaching new all-time highs last week, the market has completed its recovery from the volatility experienced during the end of 2018. While there are a variety of factors that helped to push markets back to all-time highs, the most significant was that the economy remained resilient. The fears of a protracted slow-down that dominated Q4 2018 never truly manifested in the way that many anticipated, and the GDP data from last week has helped to confirm that these fears may have been overblown. The chart below shows the quarterly US GDP readings dating back to the 1960’s. Recent economic growth in the U.S. has remained robust and has now pushed beyond the historical average rate of 2.8%. While growth in the U.S. is unlikely to remain at the current level forever (for reasons touched upon above), we are not yet seeing signs of the recession many had feared was on the horizon just a quarter ago.