On Tuesday, June 18 PBS39 News Tonight featured a Community Corner segment on Estate Planning with our own Laurie Siebert and Attorney Charles Stopp. The segment starts at 18:41 in the recording available online at wlvt.org.

On Tuesday, June 18 PBS39 News Tonight featured a Community Corner segment on Estate Planning with our own Laurie Siebert and Attorney Charles Stopp. The segment starts at 18:41 in the recording available online at wlvt.org.

Monthly Archives: June 2019

Did You Know…?

You can access the

latest from our VNFA video collection online at valleynationalgroup.com/video.

You can access the

latest from our VNFA video collection online at valleynationalgroup.com/video.

You can also watch and follow us on our Valley National Financial Advisors YouTube and VNFAsince1985 Vimeo channels. Click the links here to visit those video websites.

If you know someone who might find the insights valuable, please feel free to share the links.

CALL TO ACTION: Reply to this e-mail with topics or questions that you would like to see our PROS address!

The Numbers & “Heat Map”

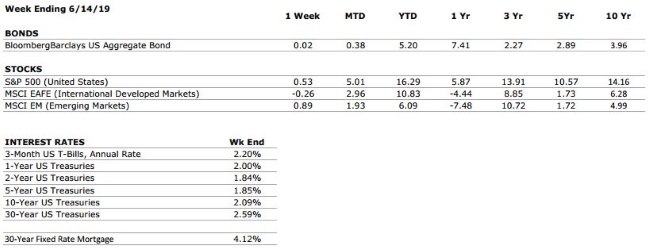

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A. Surveys of US consumers continue to indicate that the consumer is in a strong position. |

|

FED POLICIES |

B+ |

There were several central bank meetings around the world last week, and most of them were followed by dovish comments from policy setters. We have increased our Fed Policies grade to a B+ after Jerome Powell commented that “a number” of Fed decision makers believe that the case for a rate cut in the near future has strengthened. |

|

BUSINESS PROFITABILITY |

B- |

As was anticipated, first quarter earnings revealed a tapering of growth. According to Facset, the blended earnings decline for Q1 2019 is -0.4% (with 98% of S&P 500 companies having reported). However, more than 75% of these companies have reported earnings that were higher than consensus estimates. |

|

EMPLOYMENT |

A |

The US economy added just 75,000 new jobs in May, well below the consensus estimates as well as recent trends. However, monthly jobs data tends to be volatile, and it is certainly possible that there is a significant rebound in June (as there was between February and March). We continue to view the jobs market as very healthy. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but as the economic cycle continues to mature, this metric will deserve our ongoing attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

We have raised our international risks rating to a 7 as a result of rising tensions between the US and Iran, as well as the recent decision by the Trump administration to impose a sales ban on Chinese tech company Huawei. The ban is representative of the risks associated with the growing technology rivalry between the US and China. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

What We’re Reading

A collection of links to articles and ideas our VNFA staff found interesting and informative recently.

Five Retirement-Planning Myths (schwab.com)

The average employer 401(k) match is at an all-time high – see how yours compares (cnbc.com)

SALT deduction cap rules finalized; safe harbor proposed (Journal of Accountancy)

12 Strategies for Keeping Lifestyle Inflation in Check (thesimpledollar.com)

The Markets This Week

by Connor Darrell

CFA, Assistant Vice President – Head of Investments

The

equity and bond markets continued to send different signals last week after

comments from Federal Reserve Chairman Jerome Powell helped propel the S&P

500 to new all-time highs but put further downward pressure on bond yields. The

equity market also benefitted from an announcement by President Trump that he

will hold an “extended meeting” with Chinese President Xi Jinping during the

G20 Summit in Japan this week. The ongoing trade dispute between the United

States and China continues to be a major factor for both equity markets and the

Federal Reserve, as the slowdown in trade activity is likely to be a hindrance

to economic growth. The total impact of

trade policy on economic activity over the long-term is not easily quantified,

making the Federal Reserve’s job even more difficult.

The rally in equities this month has come despite signals from global bond markets that global growth is slowing and that inflation is nowhere to be found. Equity markets are betting that central banks will have enough ammunition to stave off a meaningful decline in economic activity. Elsewhere, tensions in the Middle East have continued to push oil prices higher. On Thursday, President Trump authorized and then cancelled airstrikes against Iranian assets in response to the series of attacks that left several oil assets damaged in and around the Strait of Hormuz.

Geopolitics Not A Major Factor for Investors

In response to crippling economic sanctions that have led to a 90% reduction in the nation’s oil exports, Iranian-backed forces have begun lashing out at U.S.-allied interests in the region. The American response has been firm, leading many to speculate that the potential for a military conflict has increased. While the recent developments are concerning for a global economy that is struggling to maintain momentum (and of course even more so for the human lives that may be put in danger should tensions continue to intensify), history tells us that these types of events tend to only impact markets for a short period of time. Given the location of the risk (along a major oil trade route), we could continue to see volatility in the price of crude, but investors should avoid overreacting to geopolitical developments and maintain a disciplined, balanced allocation within their portfolios.

Quote of the Week

“Knowledge alone is not power. The sharing of our knowledge is when knowledge becomes powerful.” – Rich Simmonds

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie will discuss: “Charitable Giving.”

Questions can be submitted live on air by calling 610-755-8810 or sent in online anytime at yourfinancialchoices.com/contact-laurie Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

The Numbers & “Heat Map”

THE NUMBERS

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A. Surveys of US consumers continue to indicate that the consumer is in a strong position. |

|

FED POLICIES |

C+ |

Following its March meeting, the Federal Reserve signaled to markets that it may not hike interest rates during 2019, and plans to halt its balance sheet reductions. The Fed’s future actions will remain data dependent, but the contractionary policies that have dominated the last two years appear to be on pause. |

|

BUSINESS PROFITABILITY |

B- |

As was anticipated, first quarter earnings revealed a tapering of growth. According to Facset, the blended earnings decline for Q1 2019 is -0.4% (with 98% of S&P 500 companies having reported). However, more than 75% of these companies have reported earnings that were higher than consensus estimates. |

|

EMPLOYMENT |

A |

The US economy added just 75,000 new jobs in May, well below the consensus estimates as well as recent trends. However, monthly jobs data tends to be volatile, and it is certainly possible that there is a significant rebound in June (as there was between February and March). We continue to view the jobs market as very healthy. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but as the economic cycle continues to mature, this metric will deserve our ongoing attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

We have raised our international risks rating to a 7 as a result of rising tensions between the US and Iran, as well as the recent decision by the Trump administration to impose a sales ban on Chinese tech company Huawei. The ban is representative of the risks associated with the growing technology rivalry between the US and China. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Valley National News

Tom Riddle, our Founder & Chairman, participated in a panel discussion last week on the topic of succession planning. He was invited to share his example based on the successful implementation of our organizational plans. Tom and his co-panelists from Gross McGinley and Concannon Miller responded to questions about best practices and offered insights based on their experiences to an audience of business leaders at the first Business Growth Symposium hosted by Lehigh Valley Business. Visit lvb.com for photos and a recap of the symposium.

Did You Know…?

by Frank Stettner, CPA, CFP ®, Senior Vice President

New Jersey allows seniors who are 62 or older to exclude all or part of their pension income, plus other income, from their state income tax return. This exclusion is going up between 2017 and 2020 as long as your gross income – not taxable income – is not more than $100,000. The exclusion was $40,000 in 2017, $60,000 in 2018 and is $80,000 in 2019. In 2020, it reaches $100,000. If your gross income is one dollar more than $100,000, you get zero pension exclusion. It is not phased out – it is simply gone .The instructions for calculating the “Pension Exclusion and Other Retirement Income Exclusion” state that the $100,000 limit is based on line 26, Total Income.

So what income is not included on line 26? There are three types of income that don’t show up: Social Security benefits, New Jersey municipal bond interest and federal government bond interest. Everything else is included as income on your New Jersey tax return.

If you are close to the $100,000 threshold, is there any way you can reduce your gross income to come in below the allowable amount? If you have interest income, consider putting some money in New Jersey municipal bonds. If you have dividend income, consider moving some money into non dividend paying stocks or mutual funds. Evaluate this with your advisor to see if it makes sense for you.