“All great changes are preceded by chaos.” – Deepak Chopra

Monthly Archives: June 2019

The Markets This Week

by Connor Darrell

CFA, Assistant Vice President – Head of Investments

Markets

were largely unchanged last week as investors weighed mounting geopolitical

concerns against the potential for an easing of monetary policy. Technology

stocks were under pressure for a majority of the week as the ongoing trade

dispute between the U.S. and China has hurt global microchip sales.

Economic data released throughout the week did little to increase optimism that the global economy can stave off a slowdown in economic growth rates. Retail sales grew 0.5% month-over-month, slightly below the consensus forecast of 0.6%, and the University of Michigan Consumer Sentiment Index ticked down to 97.9 from May’s reading of 100. Elsewhere, a survey of businesses revealed a decrease in confidence among large multinational corporations; the fifth such decline in as many quarters. Most key metrics remain healthy in absolute terms, but the rate of change has certainly tilted lower in recent months.

Watching the Federal Reserve (Again)

Last week’s inflation data revealed a month-over-month increase in consumer prices of just 0.1%, a far cry from the Federal Reserve’s annual target. The Federal Reserve will meet this week to discuss monetary policy and markets will be paying close attention to the committee’s decision on interest rates, as well as its commentary on the economy. The bond market is continuing to price in expectations of forthcoming rate cuts, and the weakening in inflation expectations has only bolstered those expectations. The Federal Reserve has consistently communicated that its decisions are “data-dependent”, and the data has become increasingly difficult to interpret as a result of last year’s tax cuts and this year’s escalation in trade tensions. Ultimately however, investors should not concern themselves too much with the level of interest rates or the Fed’s next policy move. The fact that inflation remains so low is actually a positive sign that the economy has more room to expand, since inflation is often a key sign of tightening in the economy that precedes key inflection points in the economic cycle.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie will discuss: “Resources in the community – financial and otherwise.”

Questions can be submitted live on air by calling 610-755-8810 or sent in online anytime at yourfinancialchoices.com/contact-laurie Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

The Numbers & “Heat Map”

THE NUMBERS

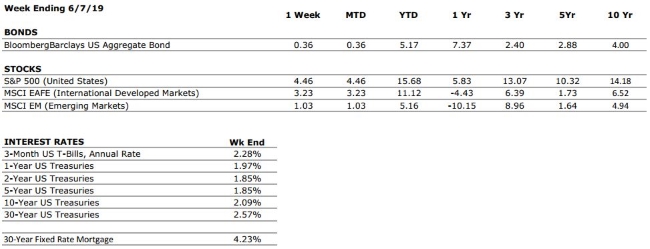

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A. Surveys of US consumers continue to indicate that the consumer is in a strong position. |

|

FED POLICIES |

C+ |

Following its March meeting, the Federal Reserve signaled to markets that it may not hike interest rates during 2019, and plans to halt its balance sheet reductions. The Fed’s future actions will remain data dependent, but the contractionary policies that have dominated the last two years appear to be on pause. |

|

BUSINESS PROFITABILITY |

B- |

As was anticipated, first quarter earnings revealed a tapering of growth. According to Facset, the blended earnings decline for Q1 2019 is -0.4% (with 98% of S&P 500 companies having reported). However, more than 75% of these companies have reported earnings that were higher than consensus estimates. |

|

EMPLOYMENT |

A |

The US economy added just 75,000 new jobs in May, well below the consensus estimates as well as recent trends. However, monthly jobs data tends to be volatile, and it is certainly possible that there is a significant rebound in June (as there was between February and March). We continue to view the jobs market as very healthy. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

We have raised our international risks rating to a 7 as a result of rising tensions between the US and Iran, as well as the recent decision by the Trump administration to impose a sales ban on Chinese tech company Huawei. The ban is representative of the risks associated with the growing technology rivalry between the US and China. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

Was your 2018 tax refund not as large as you were originally anticipating, or did you end up owing? With the changes from the 2016 Tax Cuts and Jobs Act, the IRS is still trying to perfect the Form W-4 for the proper amount of tax withholding.

If you are expecting any life changes this year — marital status, number of dependents, or a substantial change in income or deductions — contact us so we can help you avoid the surprise next year.

READ MORE: The IRS releases its new tax withholding form. Here’s what you need to know.

Quote of the Week

“You leave home to seek your fortune and, when you get it, you go home to share it with your family.” – Anita Baker

The Markets This Week

by

Connor

Darrell CFA, Assistant Vice President – Head

of Investments

A

weaker than expected jobs report fed rising speculation that the Federal

Reserve will opt to lower interest rates in the coming months, leading to a

rally in equities that saw the S&P 500 rise by more than 4% last week.

Global manufacturing data also released during the week seemed to lend further

credence to this sentiment as trade tensions pushed global manufacturing

activity into contraction and down to its lowest reading since October of 2012.

It is becoming increasingly clear that the uncertainty related to global trade

is having an impact on business investment, and with the tensions likely to

persist in the near-term, investors should be prepared for additional

volatility in markets.

Don’t

Rely on the “Powell Put”

With

the sudden escalation of global geopolitical uncertainty threatening to slow

business investment and reduce economic growth, Federal Reserve policymakers

have found themselves in a very difficult (und unique) environment in which to

operate. Perhaps in response to the very high levels of uncertainty coming from

other areas of the financial world, it seems that Fed officials have made a

concerted effort to be extra communicative in recent months. For example,

during the last week of May (which included a market holiday), there were 13

separate speeches given by Fed officials; a staggering number when you consider

that the Federal reserve already meets two times per quarter and releases

detailed notes for public consumption after each meeting. It seems that the

Federal Reserve has felt the need to address the shorter-term shocks to markets

that have resulted from setbacks in trade negotiations and other geopolitical

concerns by constantly reminding investors that it is watching things very closely.

The timing of many of these statements has coincided with rising levels of volatility in markets, leading some to refer to current Fed policy as the “Powell Put.” With the Fed under the microscope, it is easy overestimate its power and lose focus on all of the other factors that drive markets over the long-term. In the context of a $20 trillion economy, one or two 25-basis-point adjustments to short-term interest rates are unlikely to have a profound impact on the trajectory of economic growth, and investors would be well-served by broadening their focus. In fact, we would argue that the most important thing for investors to focus on is portfolio construction, and that this is the case no matter what stage of the economic cycle we find ourselves in. The interaction of monetary policy, the economy, and the stock market has become a defining characteristic of the current economic cycle, but it shouldn’t be the key input to determining the composition of one’s portfolio.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie will discuss: “What are we teaching our children about finances?”

Questions can be submitted live on air by calling 610-755-8810 or sent in online anytime at yourfinancialchoices.com/contact-laurie Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Valley National News

Last week, we celebrated with and bid a fond farewell to our Assistant Vice President of Insurance Services, Roxie Munoz. Roxie has retired after 19 years of service to our VNFA clients. She has spent the past year transitioning her role and responsibilities across our team. We look forward to hearing about her wonderful adventures living in retirement. Congratulations, Roxie!

VNFA IN THE NEWS

Get to know our CEO Matt Petrozelli in a candid interview with Ashley Russo – Unscripted with Russo, Episode 21. LISTEN to the podcast recording or WATCH the video interview.