Our offices will be closed this Friday starting at 11:30 a.m. for our summer team building event.

Daily Archives: July 9, 2019

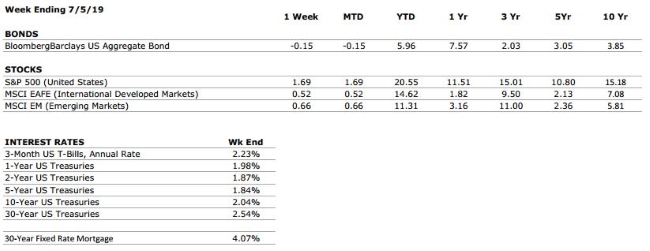

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A. Surveys of US consumers continue to indicate that the consumer is in a strong position. |

|

FED POLICIES |

B+ |

We have increased our Fed Policies grade to a B+ after Jerome Powell commented that “a number” of Fed decision makers believe that the case for a rate cut in the near future has strengthened. |

|

BUSINESS PROFITABILITY |

B- |

As was anticipated, first quarter earnings revealed a tapering of growth. According to Facset, the blended earnings decline for Q1 2019 is -0.4% (with 98% of S&P 500 companies having reported). However, more than 75% of these companies have reported earnings that were higher than consensus estimates. |

|

EMPLOYMENT |

A |

The US economy added 224,000 new jobs in June, beating consensus estimates by a wide margin. We continue to view the jobs market as very healthy. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but as the economic cycle continues to mature, this metric will deserve our ongoing attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

We have raised our international risks rating to a 7 as a result of rising tensions between the US and Iran, as well as the recent decision by the Trump administration to impose a sales ban on Chinese tech company Huawei. The ban is representative of the risks associated with the growing technology rivalry between the US and China. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

by

Mae Gerhart, CPA – Tax Accountant / Financial Planning Professional

When

you leave a job, you can often leave your 401(k) in your prior employer’s plan.

Some 401(k) plans require immediate distributions if the balance is $5,000 or

less.

If you receive a distribution check from your 401(k) there may be significant tax consequences, such as including it in income and an additional 10% early withdrawal penalty! One way to avoid this penalty is to perform a direct IRA rollover which transfers the money directly from your 401(k) to an IRA.

Some benefits of a self-directed IRA rollover include:

- Such a transfer can be accomplished tax-free

- You can increase the investment flexibility and choices in your Rollover IRA

- A rollover IRA gives you the most distribution features and flexibility in retirement

Distributions from IRAs may qualify for an exception to a 10% early withdrawal penalty before age 59 ½ if used for a first-time home purchase ($10,000 lifetime maximum), qualified higher education expenses for yourself, your spouse, child, or grandchild, or for health insurance premiums for certain unemployed individuals. But it’s all in the name–these exceptions do not work if the money was pulled out of a 401(k)!

It doesn’t always make sense to rollover your 401(k) to an IRA. For example, if you are separating from service in or after the year you reach 55 (50 for qualified public safety employees) or if you hold employer stock in your 401(k), there might be other strategies available.

Please reach out to your financial advisor to help you

determine the best course of action for your 401(k) at an old employer.

RELATED ARTICLE: Switching

jobs? Don’t make these mistakes with your retirement plan

(cnbc.com)

What We’re Reading

Tax planning is a year-round consideration for our clients and our team is diligent about staying informed.

Property Acquire by Gift of Through an Estate

Record Keeping for Individuals – Personal Residence Tips

Tax Breaks for Charitable Giving

Visit our website at valleynationalgroup.com/tax for recent articles.

Quote of the Week

“When all else fails, take a vacation.” – Betty Williams

The Markets This Week

by Connor Darrell CFA, Assistant Vice

President – Head of Investments

Equities continued to

push higher during the holiday shortened week after the U.S. and China agreed

to a temporary trading truce as the two nations continue to try and negotiate a

long-term deal. On Friday, the U.S. Department of Labor reported stronger than expected

job growth during the month of June, and that news caused stocks to pull back a

bit from their highs as it was perceived that the news might decrease the

probability of an interest rate cut during July. Bond investors are still

pricing in a full quarter point cut at the July 31 Federal Reserve meeting. As

we discussed in our quarterly commentary, equity and bond markets continue to

project different levels of optimism about the global economy. Equity markets

seem to anticipate that new economic stimulus will be enough to keep the

economy firing on all cylinders over the next couple of years, while bond

markets seem less enthusiastic.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Timothy G. Roof, CFP® and Connor Darrell, CFA from Valley National joins Laurie to discuss: “2nd Quarter 2019 Market Review”

Questions can be submitted live on air by calling 610-755-8810 or sent in online anytime. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.