by Connor Darrell CFA, Assistant

Vice President – Head of Investments

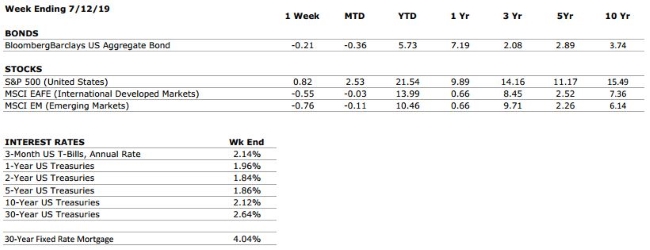

Global

equities shed some of their recent gains last week as lukewarm economic and

earnings data combined with increasing geopolitical tensions to put some

pressure on stocks. Bonds generated positive returns following comments from

multiple Federal Reserve policymakers which seemed to lend support for

potentially larger rate cuts in the realm of 50 basis points.

There was little to report on from a conference call held last week between U.S. and Chinese trade representatives. The two sides continue to appear far apart on certain key issues. In comments made last week, President Trump stated that there is still a long way to go before a final deal can be reached and left the door open to the possibility of additional tariffs on $325 billion of Chinese exports.

Earnings Update

With 15% of S&P 500 companies having reported Q2 earnings, the blended earnings growth rate is -1.9% on a one-year basis. The relatively weak results so far were largely expected by the analyst community as the initial accounting boost from 2017’s tax reform begins to wane. The good news is that while corporate earnings have been somewhat disappointing on an absolute basis, they have actually largely exceeded consensus estimates. According to data from Factset, the percentage of companies reporting earnings above consensus estimates has been close to 80%; well above the historical average. Often times, market performance is driven by the difference between expectations and reality, and Q2 earnings season has thus far brought an above average level of positive surprises. Furthermore, the beginning of earnings season has seen a large number of companies from the financial services sector report, and many of these companies’ earnings have been hindered by the decline in interest rates that has played out over much of the first half of 2019.