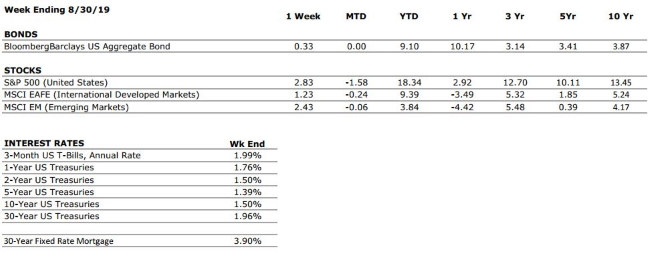

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A. Surveys of US consumers continue to indicate that the consumer is in a strong position, and recent GDP data provided further evidence of healthy consumer spending. |

|

FED POLICIES |

B+ |

Our Fed Policies grade remains a B+ after the Federal Reserve opted to cut its interest rate target by 25 bps following last month’s meeting. The cut was widely anticipated by markets, and if history is any representation, it is unlikely to be the last. |

|

BUSINESS PROFITABILITY |

B- |

With most S&P 500 companies having reported Q2 earnings, the EPS growth rate for the second quarter is close to zero. Despite the weak growth rate, almost 75% of companies have beaten consensus estimates this quarter. |

|

EMPLOYMENT |

A |

The US economy added 164,000 new jobs in July, right on target with consensus expectations. July’s report also showed that the size of the labor force (defined as those who are either working or actively seeking employment) grew to its highest level ever. The labor market remains one of the strongest components of the US economy. |

|

INFLATION |

A |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. Despite a tight labor market, we continue to see no signs of an increase in inflation. This bodes well for the extension of the economic cycle. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

Following a re-escalation of the US/China trade dispute, we have raised our “international risks” metric back to a 7. Other key areas of focus for markets include the ongoing Brexit negotiations, rising economic nationalism around the globe, and escalating tensions in the Middle East. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.